SEC indicates that few tokens are securities and promises to protect cryptocurrencies

- SEC Views Few Cryptocurrency Tokens as Securities

- Paul Atkins advocates for innovation and fair regulatory protection in the sector

- Crypto Project seeks to modernize laws and support blockchain in the US

U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins reinforced his more flexible stance on cryptocurrencies this week, emphasizing that only a small portion of tokens should be considered securities. The statement marks a significant contrast with the previous administration, which classified much of the sector as securities.

In his speech at the Wyoming Blockchain Symposium Atkins explained that the SEC would "continue with this idea that just the token itself is not necessarily the security, and probably isn't." He added, "In my opinion, there are very few tokens that are securities, but it depends on the packaging and how they're being sold."

The stance follows the launch of "Project Crypto," an initiative introduced by the SEC last month to modernize securities laws and enable U.S. markets to adapt to blockchain solutions. The approach marks a departure from Gary Gensler's administration, which maintained that most cryptocurrencies qualified as securities.

During his speech, Atkins emphasized the need to support innovation in the sector. "It's a new day, especially for this [cryptocurrency] industry. We've been focused on innovation. Now, we want to embrace innovation," he declared. He also highlighted in a post on X that he intends to "develop a framework that protects cryptocurrency markets from regulatory distortions in the future," emphasizing his intention to work with Congress and other government agencies.

We must craft a framework that future proofs the crypto markets against regulatory mischief. I look forward to working with my counterparts across the Administration and Congress to get the job done.

— Paul Atkins (@SECPaulSAtkins) August 19, 2025

The market's reception was immediate. Analysts at Bernstein called Project Crypto the "boldest and most transformative cryptocurrency vision ever presented by an SEC chairman," highlighting its potential to "rewrite the rules of Wall Street." Matt Hougan, CIO of asset management firm Bitwise, assessed the initiative as a veritable investment roadmap for the next five years, indicating that Atkins envisions the tokenization of assets such as stocks, bonds, and even dollars in the long term.

This new SEC stance represents a milestone for the cryptocurrency market, which has faced regulatory disputes in the United States for years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What are Intent Based Architectures?

Bitcoin could face severe headwinds amid macroeconomic growth warnings, analyst says

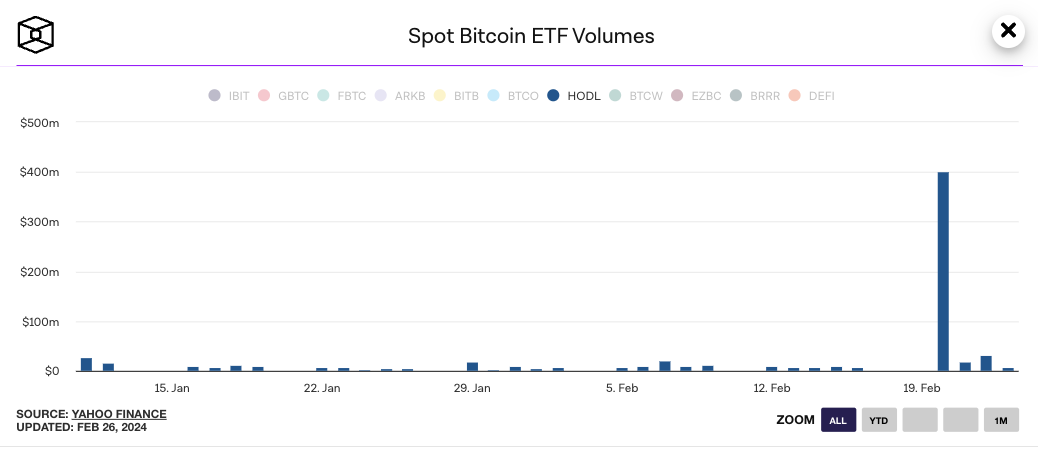

Spot bitcoin ETF volume spike may be due to high-frequency trading, CoinShares says

'Sloppy' US crypto mining survey put on pause by Texas judge