Dogecoin Bullish Traders Hit Hard as Long Liquidations Dominate

Dogecoin’s price has dropped 9%, with $10 million in long liquidations over the past 24 hours. The RSI below 50 indicates weakening buy-side momentum, suggesting a possible further decline toward $0.1758.

Dogecoin’s (DOGE) price has tapered downward since August 17, losing roughly 9% of its value over the past three days.

As the token slides, futures traders who had opened positions betting on a rally have plunged into losses. With new demand remaining muted, long traders of the meme coin may be at risk of further declines.

DOGE’s Decline Triggers Long Liquidations

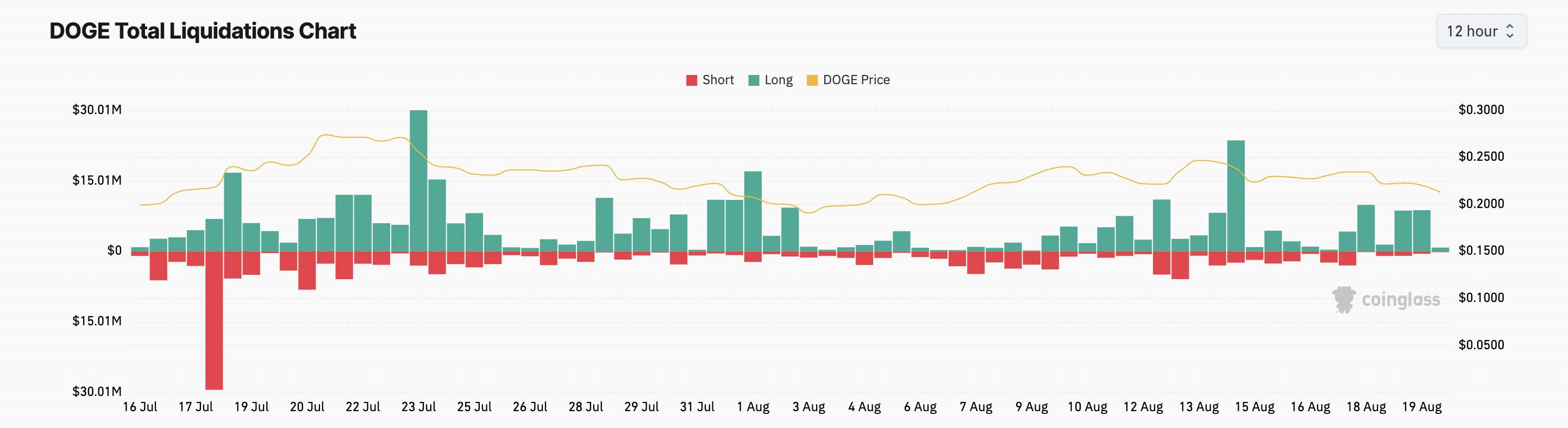

DOGE’s recent price decline, worsened by the broader market dip, has triggered a wave of long liquidations in its futures market. Per Coinglass, this has totaled $10 million in the past 24 hours as the meme coin extends its decline.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

DOGE Liquidations Chart. Source:

DOGE Liquidations Chart. Source:

DOGE Liquidations Chart. Source:

DOGE Liquidations Chart. Source:

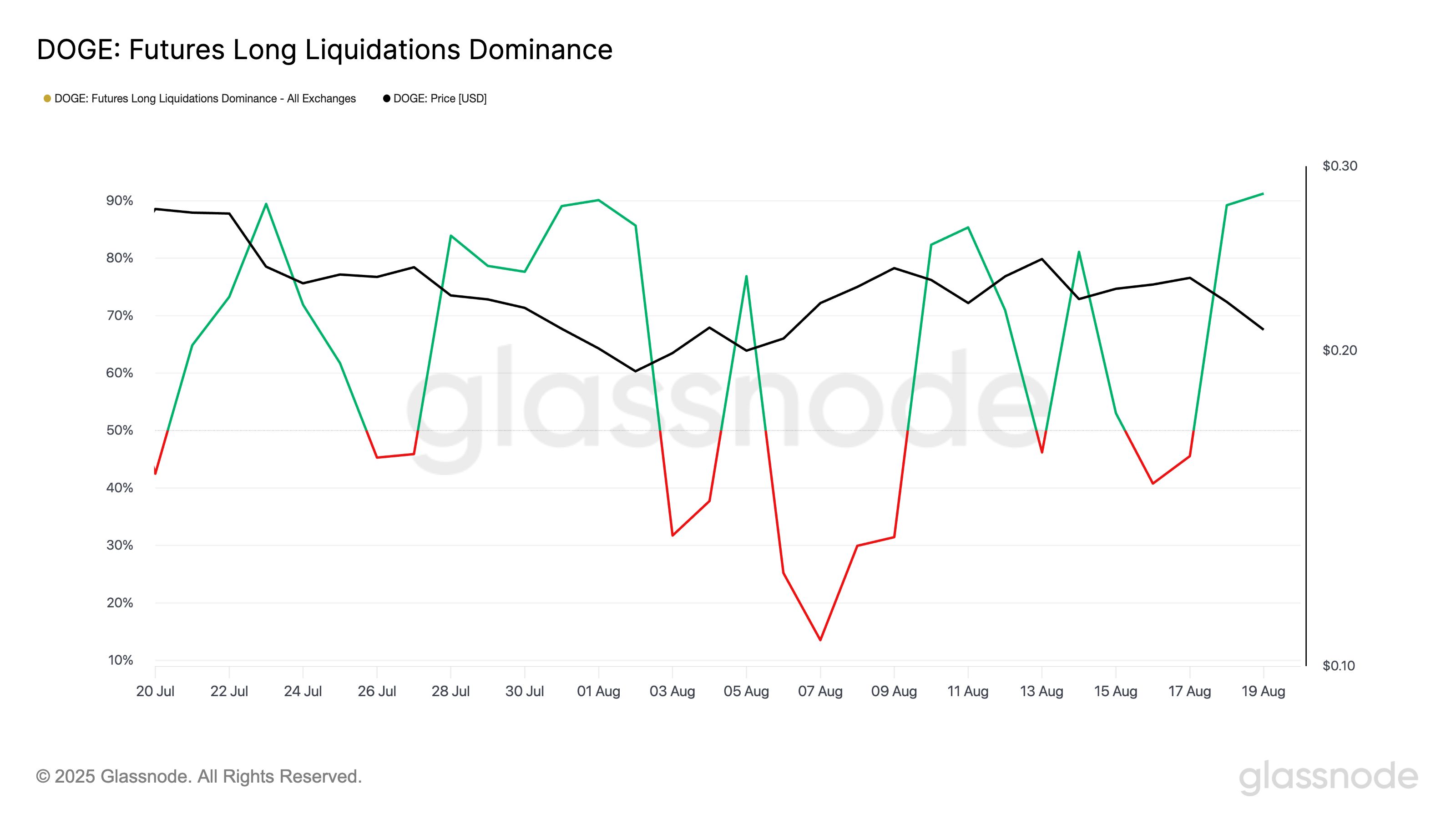

Moreso, yesterday, DOGE Futures Long Liquidations Dominance climbed to 98%, signaling that most liquidated positions were long bets.

DOGE Futures Long Liquidations Dominance. Source:

DOGE Futures Long Liquidations Dominance. Source:

DOGE Futures Long Liquidations Dominance. Source:

DOGE Futures Long Liquidations Dominance. Source:

Liquidations occur when an asset’s value moves against a trader’s position. In such cases, the trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations occur when an asset’s price falls past a threshold, making traders who bet on a price increase exit the market.

Excessive losses from these liquidations could dampen market sentiment among DOGE holders and futures traders alike, triggering further sell-offs. This may deepen the meme coin’s decline and extend its downward momentum in the near term.

DOGE Buyers Lose Steam

As of this writing, DOGE’s Relative Strength Index (RSI) struggles below the 50-neutral line, supporting this bearish outlook. It is at 46.36, reflecting the waning buy-side activity among market participants.

DOGE RSI. Source:

DOGE RSI. Source:

DOGE RSI. Source:

DOGE RSI. Source:

The RSI indicator measures an asset’s overbought and oversold market conditions. Typically, an RSI above 70 indicates an asset may be overbought (potentially overvalued) and due for a rebound. Conversely, values under 30 suggest it may be oversold (potentially undervalued) and is eyeing a bullish reversal.

At 46.36, DOGE’s RSI signals weakening bullish momentum. It suggests that buyers are struggling to maintain control amid the recent sell-off, and if this continues, the meme coin could fall toward $0.1758.

DOGE Price Analysis. Source:

DOGE Price Analysis. Source:

DOGE Price Analysis. Source:

DOGE Price Analysis. Source:

On the other hand, a rebound in buying pressure could push its price past $0.2347.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ’rallies are for selling‘: Top 3 arguments from BTC market bears

XRP bulls grow louder: What will spark the breakout toward $2.65?

Bitcoin gives up $90K at US open as two-week exchange outflows near 35K BTC

Refuting the AI bubble theory! UBS: Data centers show no signs of cooling down, raises next year's market growth forecast to 20-25%

The structural changes in the cost of building AI data centers mean that high-intensity investment will continue at least until 2027, and AI monetization has already begun to show signs.