Bitcoin Sluggish Demand Blamed for $10K Plunge In a Week

Bitcoin's price plunged over $10K within a week, driven by reduced market demand, ETF outflows, and expectations for Fed rate cuts, signaling potential future corrections if demand doesn't recover.

After hitting a new all-time high just last Thursday, Bitcoin’s price has plummeted by over $10,000 in a week.

A new analysis suggests the sharp correction stems from a key factor: a slowdown in demand across the Bitcoin market.

Bitcoin Demand Slowing Down

Julio Moreno, head of research at on-chain platform CryptoQuant, shared this view in an X post on Wednesday. He stated, “Bitcoin’s overall demand growth slowdown, including purchases from ETFs and Strategy, is behind the current price pause/correction.”

Bitcoin’s price had briefly bottomed out on August 1st, when concerns about a recession flared up after a weak US non-farm payrolls report. That same day, US spot Bitcoin ETFs saw $812 million in net outflows, according to Soso Value data.

Daily Net Inflows/Outflows of U.S. Spot Bitcoin ETFs. Source: SoSo Value

Daily Net Inflows/Outflows of U.S. Spot Bitcoin ETFs. Source: SoSo Value

However, from August 6, when the price rally began, the ETFs recorded seven consecutive days of net inflows. This trend reversed last Thursday with the July Producer Price Index’s release, returning to net outflows. The outflow volume wasn’t very large, yet Bitcoin’s price dropped sharply in comparison.

Moreno explained that on-chain demand metrics mirror this exact pattern. He argues that this correction isn’t due to the sudden actions of a single entity like an ETF or MicroStrategy, but rather a widespread decline in demand among most market participants.

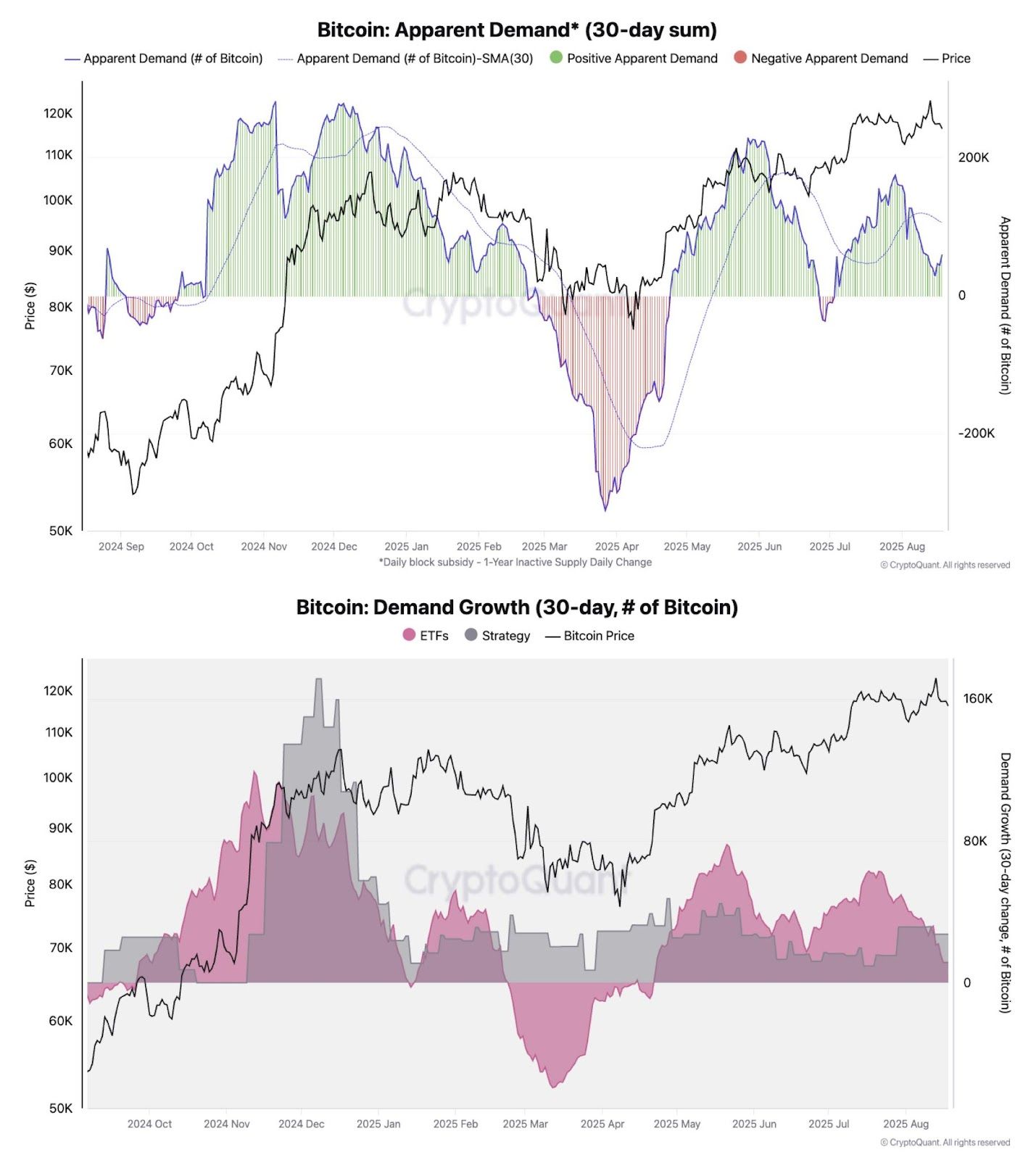

For example, CryptoQuant’s Apparent Demand metric showed a reading of 147.3703K on August 1, a similar price level. However, on August 20, the same metric had nearly halved to 64.787K.

Bitcoin: Apparent Demand & Bitcoin: Demand Growth. Source: CryptoQuant

Bitcoin: Apparent Demand & Bitcoin: Demand Growth. Source: CryptoQuant

While Bitcoin’s price surged and then returned to its starting point over the past 15 days, market demand essentially dropped by half. This suggests that if market sentiment doesn’t recover, Bitcoin could face further corrections.

The market likely needs a macroeconomic catalyst to boost overall demand, such as renewed expectations of a Fed rate cut. According to CME’s FedWatch data, market participants anticipate two rate cuts this year, with an 86% probability of a 25 basis point cut at the September FOMC meeting.

For comparison, last Thursday, when Bitcoin’s price approached $124,000, the market priced in three rate cuts this year and a 98% chance of a cut in September.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Full statement from the Reserve Bank of Australia: Interest rates remain unchanged, inflation expectations raised

The committee believes that caution should be maintained, and that outlook assessments should be continuously updated as data changes. There remains a high level of concern regarding the uncertainty of the outlook, regardless of its direction.

Solana ETF attracts 200 millions in its first week; as Wall Street battles intensify, Western Union announces a strategic bet

The approval of the Solana ETF is not an end point, but the starting gun for a new era.