Why Shiba Inu’s 11% Weekly Loss Could Be the Setup for a Bullish Breakout

Despite an 11% weekly loss, Shiba Inu’s rising weighted sentiment and Chaikin Money Flow (CMF) indicate growing market confidence, hinting at a possible rebound toward $0.00001295.

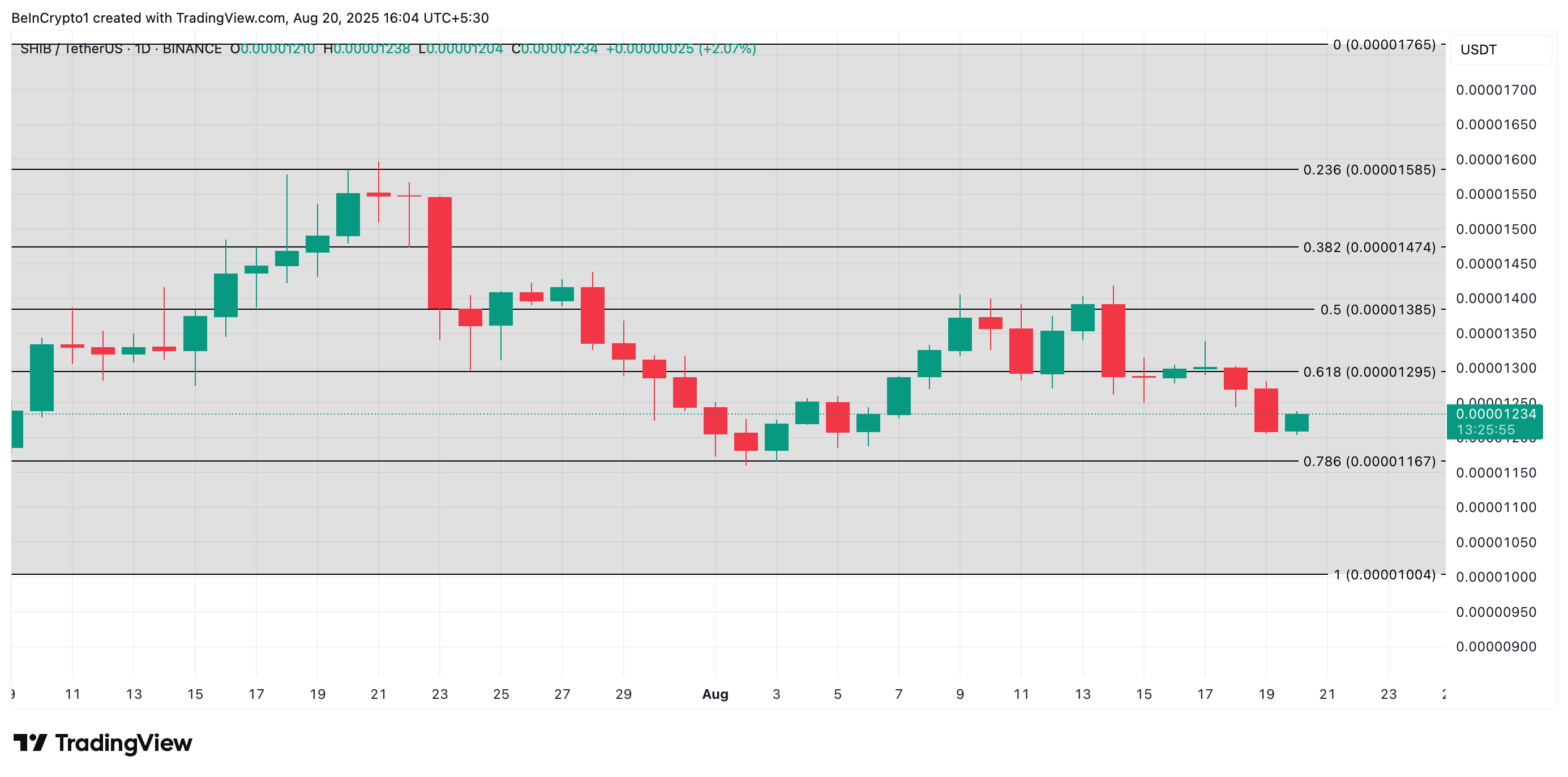

The slowdown across the meme coin market has dragged Shiba Inu (SHIB) down 11% in the past week. At press time, the leading meme coin trades at $0.00001234.

However, despite the price decline, two key on-chain indicators are flashing bullish divergences, raising the possibility of a near-term turnaround.

Traders Grow Optimistic on SHIB Despite Price Drop

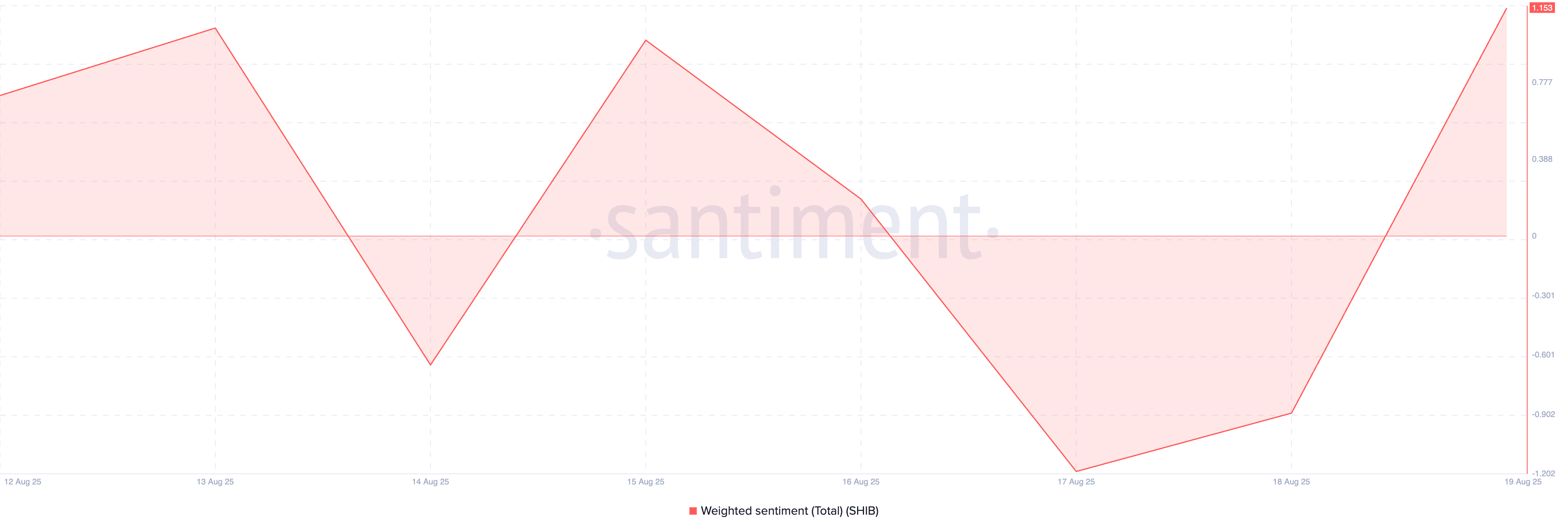

Despite its recent lackluster performance, SHIB has seen its weighted sentiment shift upward, showing that traders are growing increasingly optimistic about the meme coin. According to Santiment, this metric stands at a seven-day high of 1.153 at press time.

SHIB Weighted Sentiment. Source:

Santiment

SHIB Weighted Sentiment. Source:

Santiment

An asset’s weighted sentiment measures its overall positive or negative bias by combining the volume of social media mentions with the tone of those discussions.

When an asset’s weighted sentiment is positive, it signals rising confidence and renewed interest in the asset, even if prices are under pressure.

On the other hand, a negative weighted sentiment reflects bearish conditions. This means investors have become skeptical of the token’s short-term prospects, which may cause them to trade less.

SHIB’s falling price, alongside a rising weighted sentiment, creates bullish divergence, showing market confidence is climbing despite downward price action. This divergence is usually interpreted as a precursor to a potential reversal, suggesting that traders may be quietly positioning themselves for a rebound.

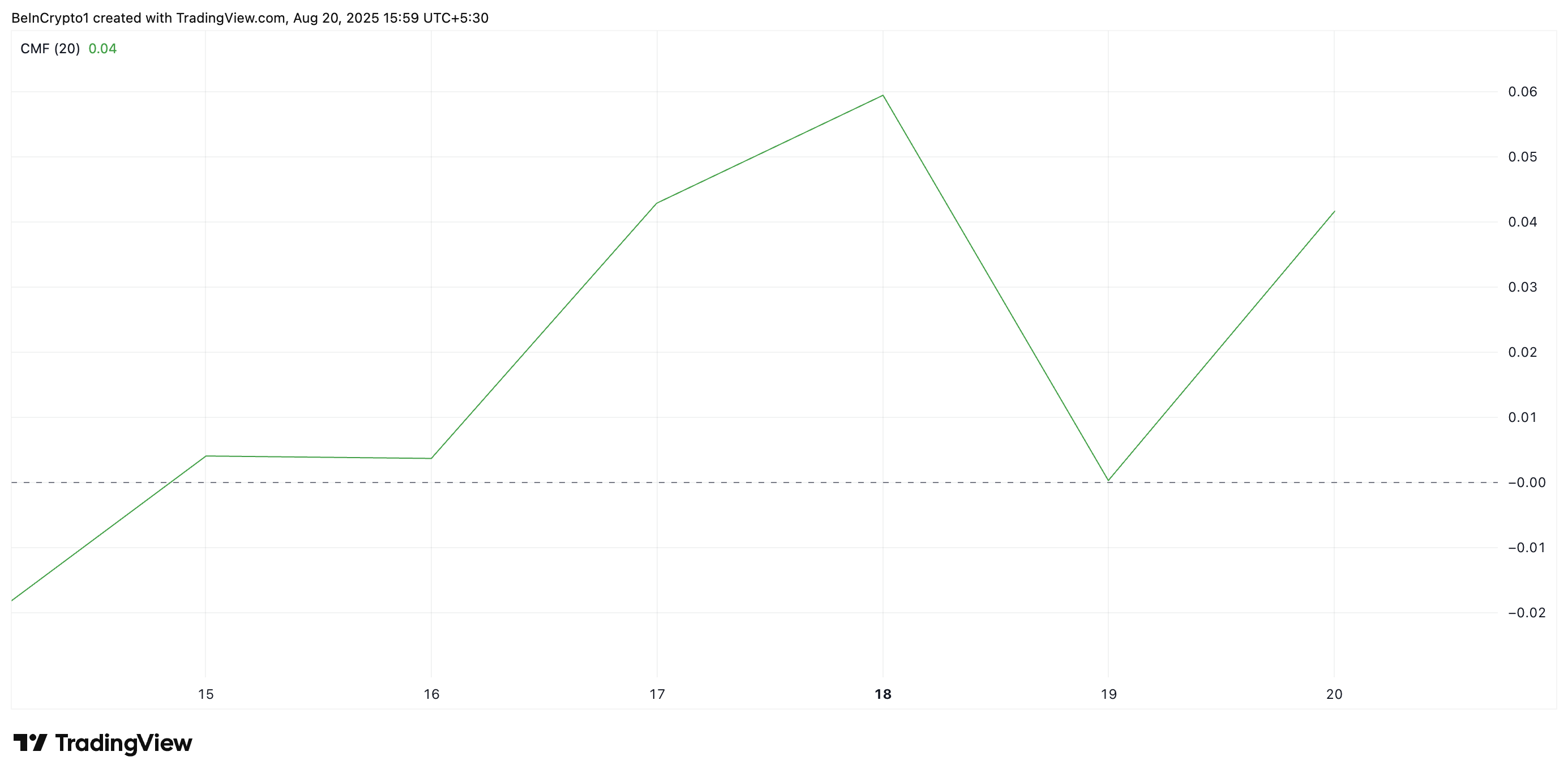

Furthermore, the setup of the altcoin’s Chaikin Money Flow (CMF) supports this bullish outlook. Readings from the meme coin’s daily chart show the CMF climbing steadily, even as SHIB’s price declined, forming another bullish divergence.

At press time, the CMF stands at 0.04, signaling that money is beginning to flow back into the asset.

SHIB CMF. Source:

TradingView

SHIB CMF. Source:

TradingView

The CMF measures buying and selling pressure based on price and trading volume. A positive CMF reading, such as the one SHIB currently holds, suggests that more capital is entering the market than leaving it.

When this occurs alongside a price drop, traders are quietly accumulating the token at lower levels, a sign of underlying strength.

Can Shiba Inu Turn Losses Into a Breakout?

When bullish divergences like these form, they often point to a potential trend reversal. For SHIB, these mean its buyers are gaining enough momentum to challenge the sell-side pressure and trigger a rebound toward $0.00001295.

SHIB Price Analysis. Source:

TradingView

SHIB Price Analysis. Source:

TradingView

On the other hand, if sellofs continue, SHIB risks falling to $0.00001167.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Full statement from the Reserve Bank of Australia: Interest rates remain unchanged, inflation expectations raised

The committee believes that caution should be maintained, and that outlook assessments should be continuously updated as data changes. There remains a high level of concern regarding the uncertainty of the outlook, regardless of its direction.

Solana ETF attracts 200 millions in its first week; as Wall Street battles intensify, Western Union announces a strategic bet

The approval of the Solana ETF is not an end point, but the starting gun for a new era.