Date: Thu, Aug 21, 2025 | 06:45 AM GMT

The cryptocurrency market is rebounding from the recent dip as Ethereum (ETH) reclaims $4,300, notching a 3% daily gain. This strength has carried into the broader altcoin market, with Phala Network (PHA) now showing early signs of a potential breakout.

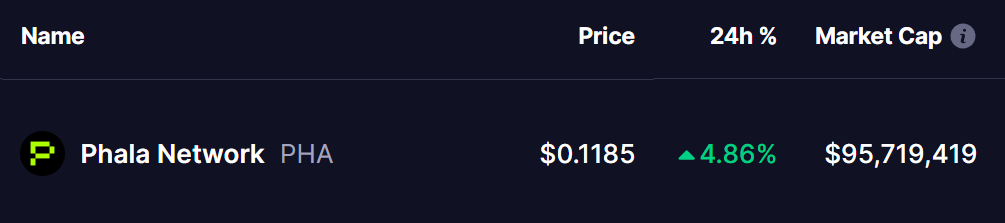

PHA climbed 4% in the last 24 hours, and its price structure is beginning to resemble a bullish fractal pattern recently confirmed in Bio Protocol (BIO).

Source: Coinmarketcap

Source: Coinmarketcap

PHA Mirrors BIO’s Breakout Structure

BIO’s chart has become a valuable reference point for traders. Earlier this year, BIO broke out of a classic falling wedge pattern—a bullish reversal formation. After consolidating beneath a red-marked resistance zone, the token powered higher, reclaiming multiple resistance levels and ultimately rallying by an impressive 124%.

BIO and PHA Fractal Chart/Coinsprobe (Source: Tradingview)

BIO and PHA Fractal Chart/Coinsprobe (Source: Tradingview)

PHA appears to be walking the same path.

It has also completed a breakout from a falling wedge structure and is now trading just below its immediate red resistance zone at $0.13, currently priced around $0.1186.

What’s Next for PHA?

If the fractal continues to play out, a successful breakout above $0.13 could serve as the trigger for a stronger rally. From there, PHA could target the next resistance levels at $0.1625 and $0.2058, which would represent a potential 72% upside from current prices.