Insider Buys YZY for $450,000, Reaps $3.4M Profit

- $450K insider purchase of YZY influences the market significantly.

- Insider earns over $3.4M profit from volatility spike.

- Market volatility highlights strategic trading activity in crypto.

An insider executed a $450,000 transaction to acquire YZY at $0.24 using two wallets, paying a 129 SOL priority fee, before selling a majority at $2.12.

This activity highlights potential institutional interest in YZY, impacting market volatility and liquidity significantly, with on-chain monitoring suggesting a $3.4 million profit from the rapid asset price changes.

An insider recently spent $450,000 to purchase YZY at an average price of $0.24, including a 129 SOL priority fee. This move raised questions and attracted considerable attention from the cryptocurrency community and market analysts.

Tracking the insider’s actions revealed the involvement of two wallets to execute the purchase and a strategic selloff that followed. Over 1.59 million YZY were sold at an average price of $2.12, accumulating significant profit.

This strategic transaction yielded an estimated profit of over $3.4 million (+760%) and resulted in increased market attention. The purchase and sale have bolstered market discussions around trading strategies and crypto asset management.

Financial implications for YZY include potential liquidity shifts and market volatility. These actions amplify both market dynamics surrounding YZY and broader crypto investment strategies. Economic stakeholders closely track such maneuvers for underlying risk assessments.

The lack of official statements from YZY leaders adds an air of speculation. Market analysts continue to monitor developments, especially as wallet analytics and blockchain data provide deeper insights into possible further actions.

Currently, there are no qualifying primary-source statements, tweets, or blog posts found from YZY founders/leadership or influential Key Opinion Leaders (KOLs) regarding the insider trade event you outlined.

Potential financial, regulatory, and technological outcomes remain under scrutiny. This transaction shows how high-stakes trading activity can influence liquidity, volatility, and potentially the regulatory perspective on unregulated markets. Stakeholders evaluate historical parallels to anticipate future repercussions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

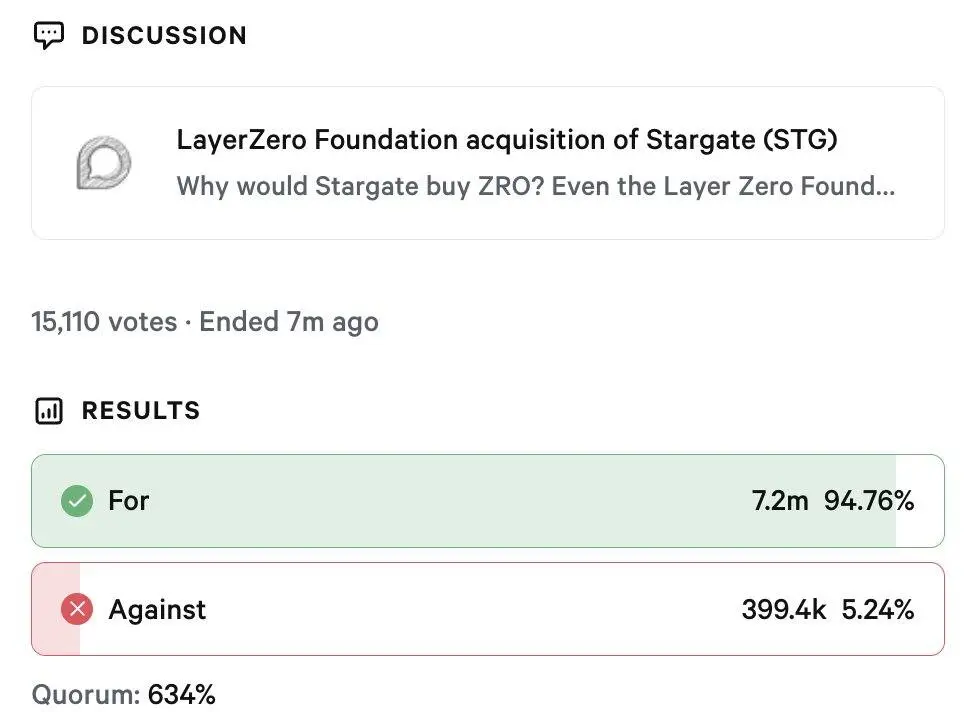

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

US Fed Signals Rate Cut: Crypto Shorts Liquidated

Jim Cramer Plans Ethereum Purchase for Family Hedge