Pi Network Fades From Crypto Conversations—Is a Return to All-Time Low Next?

Pi Network’s PI token struggles with minimal market interest, as its social dominance hits a weekly low and weighted sentiment remains negative. Without a surge in buying activity, PI could be headed toward an all-time low of $0.32.

Since the beginning of the week, Pi Network’s native token PI has traded sideways, facing new resistance at the former support floor formed at $0.37.

Traders and investors continue to show limited interest in the altcoin, as its lackluster price performance has failed to inspire confidence among holders.

Falling Interest Threatens Pi Network

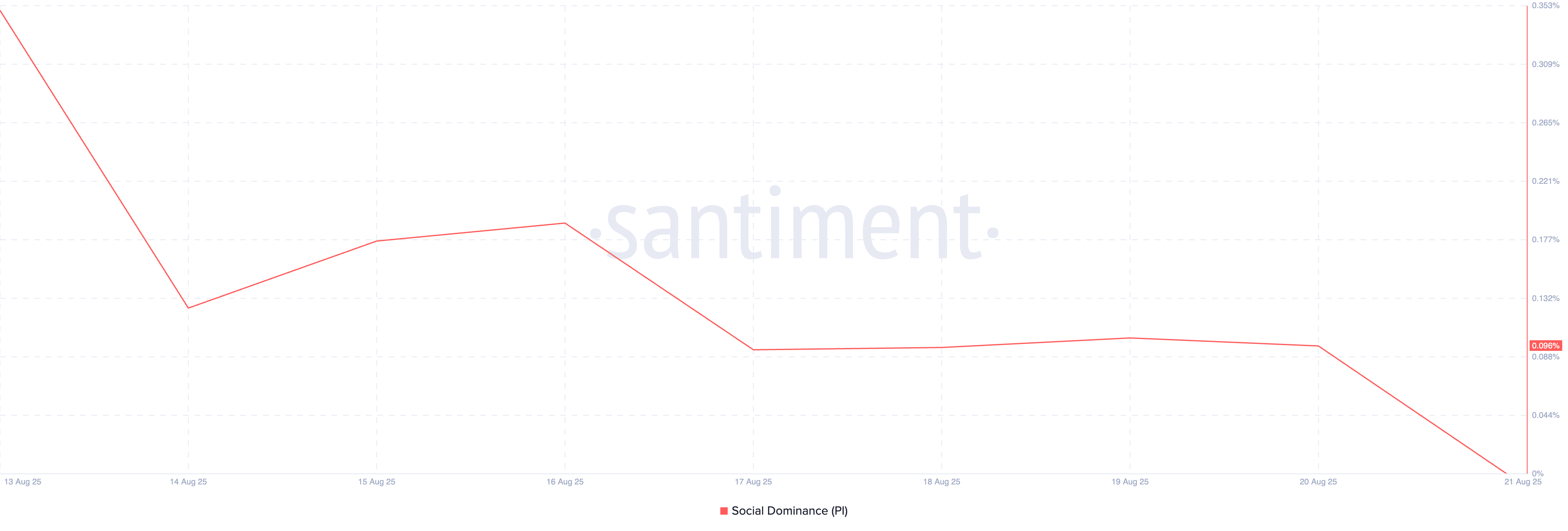

According to Santiment, PI’s social dominance has plunged to a weekly low of 0.096%, indicating a sharp decline in the altcoin’s relevance within crypto discussions during the review period.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

PI Social Dominance. Source:

Santiment

PI Social Dominance. Source:

Santiment

The social dominance metric measures how frequently an asset is mentioned across social platforms relative to the rest of the market. When its value falls, the asset is losing attention and engagement from the community.

PI’s falling social dominance is noteworthy because the lack of market buzz reduces the likelihood of new buying pressure entering the market, putting it at risk of a downside breakout.

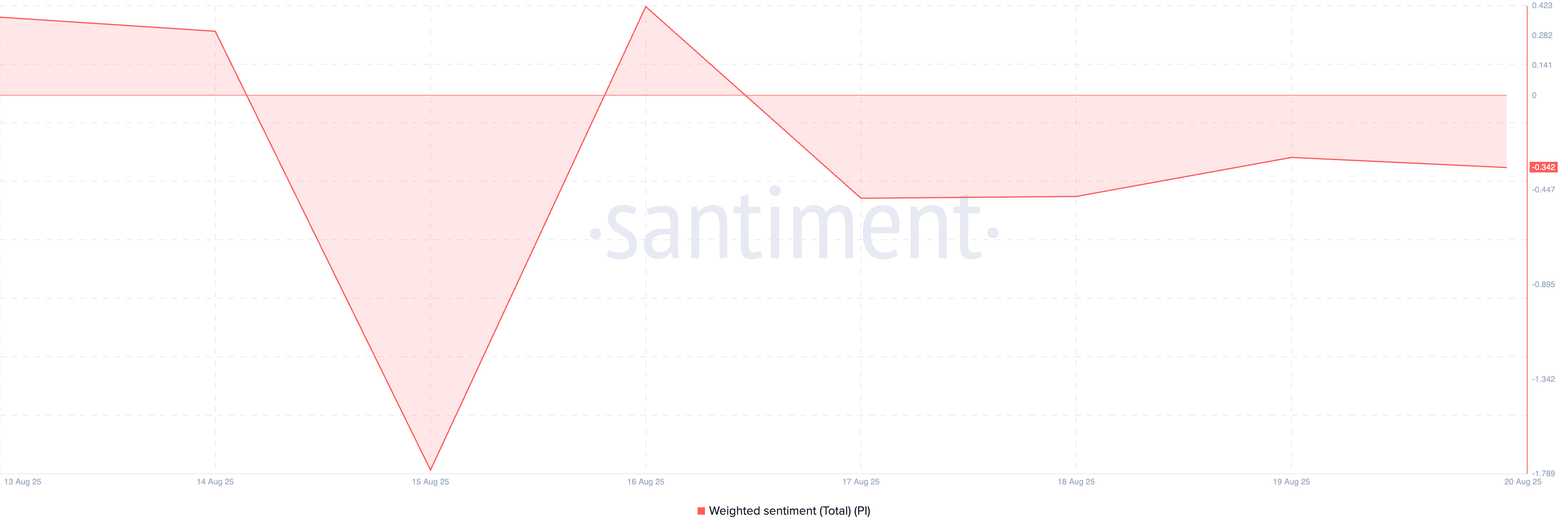

Furthermore, PI’s weighted sentiment has remained persistently negative since the beginning of the week, supporting this bearish outlook. As of this writing, this sits at -0.342.

PI Weighted Sentiment. Source:

Santiment

PI Weighted Sentiment. Source:

Santiment

The weighted sentiment metric analyzes social media platforms to gauge the overall tone (positive or negative) surrounding a cryptocurrency. It considers the volume of mentions and the ratio of positive to negative comments.

When an asset’s weighted sentiment is negative, the overall market sentiment, measured from social data, is bearish. This suggests that PI traders and investors remain pessimistic, which could weigh on the asset’s price performance in the near term.

PI’s All-Time Low Could Be Next

PI’s dwindling presence in online conversations, coupled with predominantly negative sentiment, points to one thing: a sustained price decline.

This combination heightens the risk of a further decline toward its all-time low of $0.32.

PI Price Analysis. Source:

TradingView

PI Price Analysis. Source:

TradingView

However, a spike in buying activity and renewed demand could help PI overcome resistance at $0.37 and push its price toward $0.40.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morning News | Infrared to conduct TGE on December 17; YO Labs completes $10 million Series A financing; US SEC issues crypto asset custody guidelines

A summary of major market events on December 14.

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net inflow of $286 million; US Ethereum spot ETFs saw a net inflow of $209 million

Bitwise's top ten crypto index fund has officially been listed and is now trading as an ETF on NYSE Arca.

Banding Together in the Bear Market to Embrace Investors! Crypto Tycoons Gather in Abu Dhabi, Calling the UAE the "New Wall Street of Crypto"

As the crypto market remains sluggish, industry leaders are pinning their hopes on investors from the UAE.

Behind the Pause in Increasing BTC Holdings: Metaplanet’s Multiple Considerations