Shiba Inu Circulation Spikes Again, Intensifying Price Downtrend

Shiba Inu faces price downtrend with rising circulation and selling pressure; support at $0.00001252 is key for potential bounce toward $0.00001393.

Shiba Inu has experienced significant price fluctuations recently, primarily driven by broader market conditions and investor sentiment.

The meme coin’s price has been caught in a downtrend, with its value showing signs of weakness. Increased circulation and selling pressure are contributing to this trend, causing concern for investors.

Shiba Inu Sees Bearish Cues

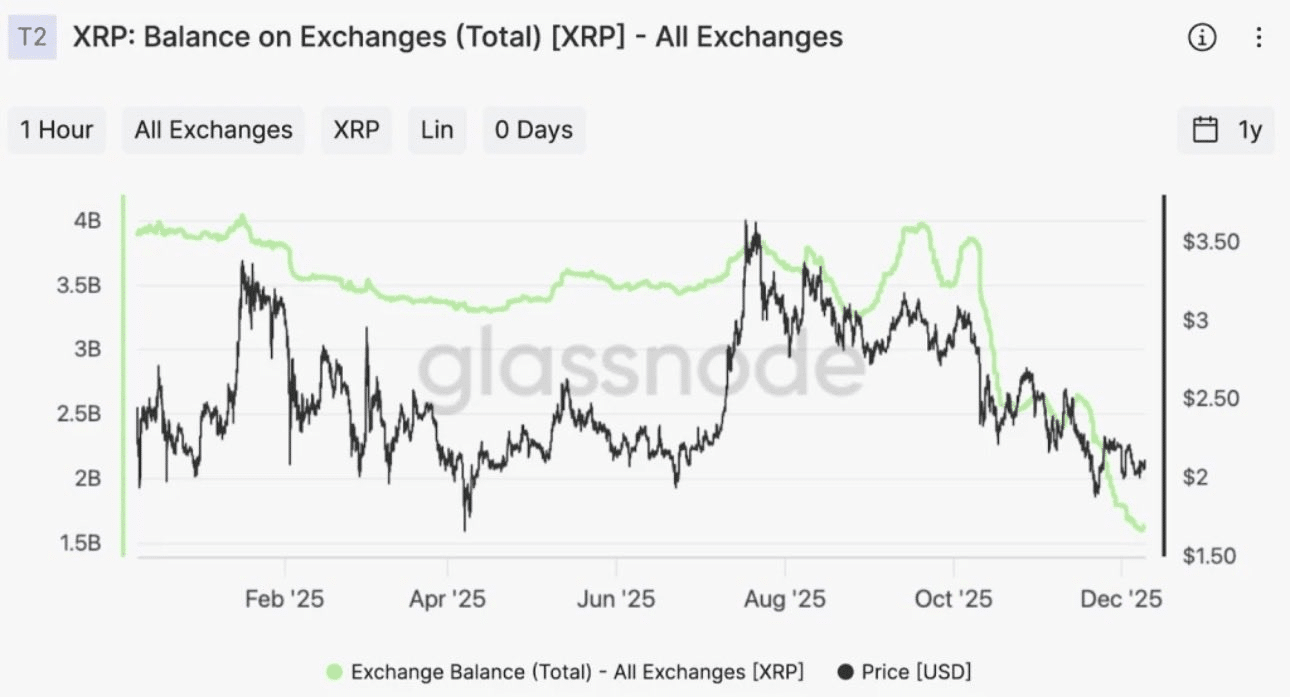

In recent days, Shiba Inu has seen a notable surge in the circulation of its supply. This is evidenced by a spike in velocity, which measures the movement of SHIB tokens across various addresses. The increased circulation is often indicative of selling behavior, as holders move their assets.

Historically, similar spikes in velocity have been followed by price declines, signaling that the same may occur with Shiba Inu’s current trend. The surge in velocity reflects growing uncertainty among investors, who may be reacting to the overall market downturn. With more tokens changing hands, the selling pressure increases, further driving down the price.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Shiba Inu Velocity. Source:

Glassnode

Shiba Inu Velocity. Source:

Glassnode

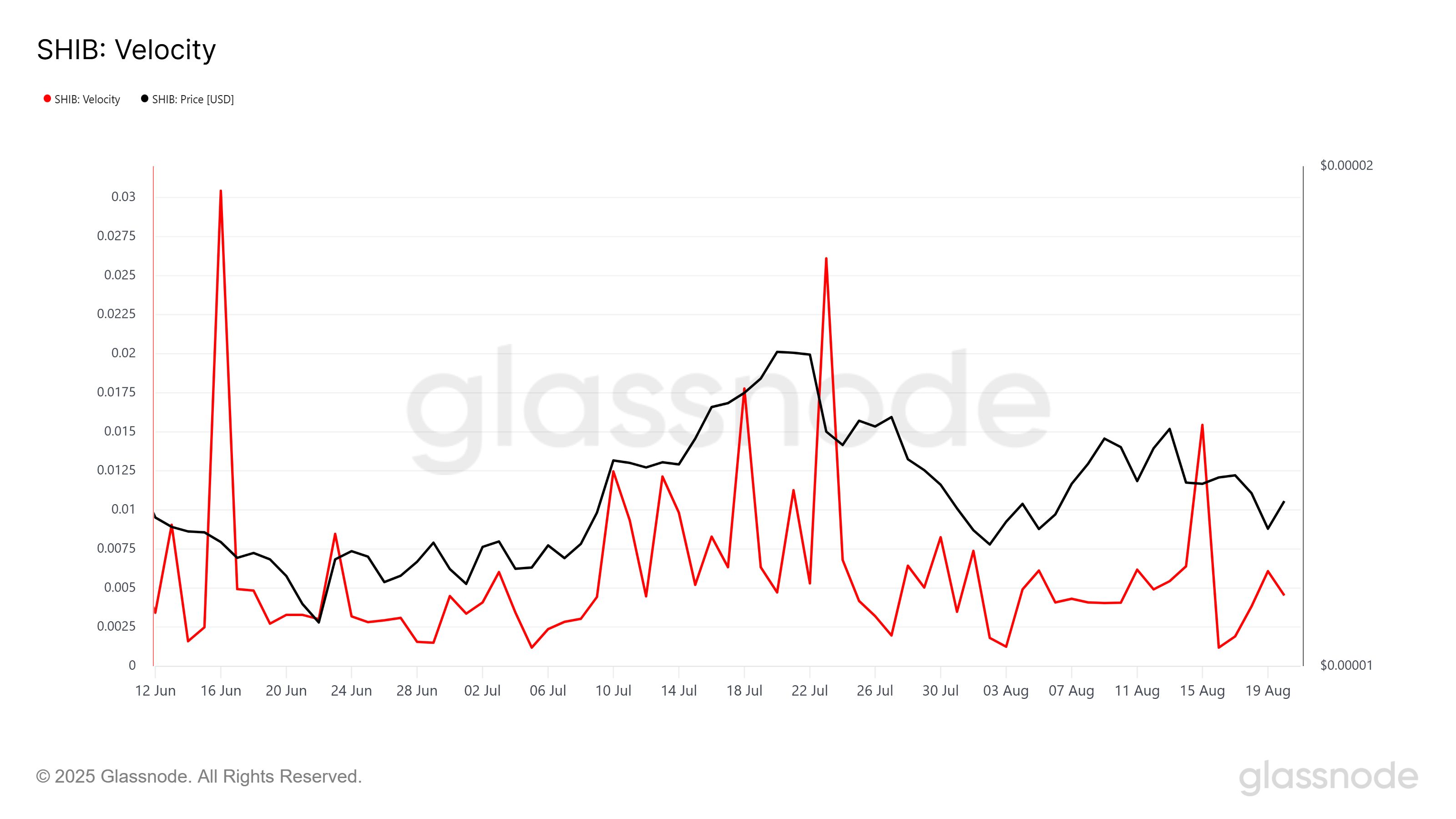

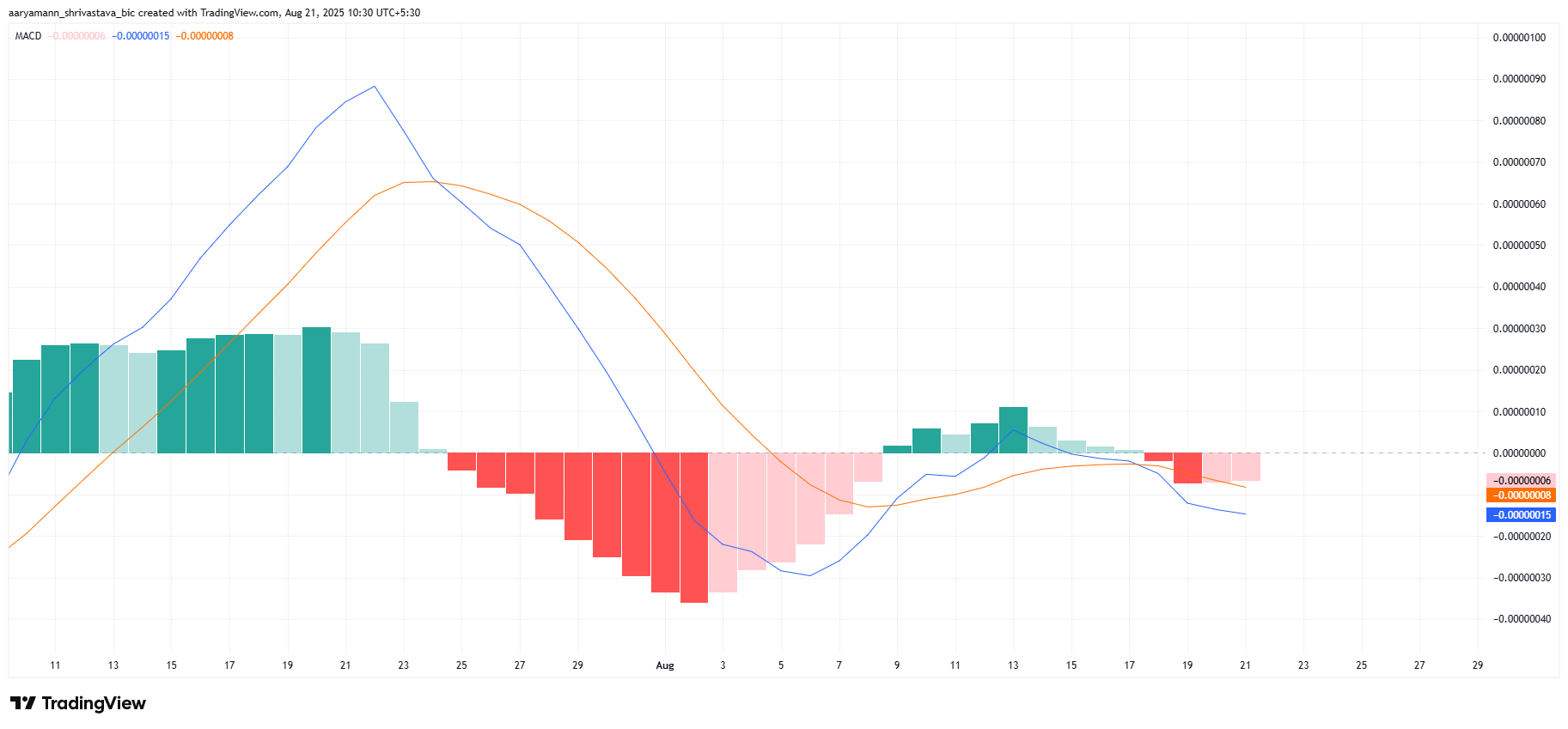

The broader macro momentum for Shiba Inu shows a bearish outlook, with the MACD currently indicating a bearish crossover. This technical signal suggests that momentum is shifting in favor of the bears, as selling pressure overtakes buying interest. However, the bearish crossover appears to be losing strength quickly, which suggests that the market is highly volatile.

The quickly changing momentum reflects the unpredictable nature of the current market. With the MACD losing strength, Shiba Inu’s price could find it difficult to establish a clear direction, leaving investors uncertain about the altcoin’s next move. This volatility adds to the overall risk for Shiba Inu in the near term.

Shiba Inu MACD. Source:

TradingView

Shiba Inu MACD. Source:

TradingView

SHIB Price Looks For Support

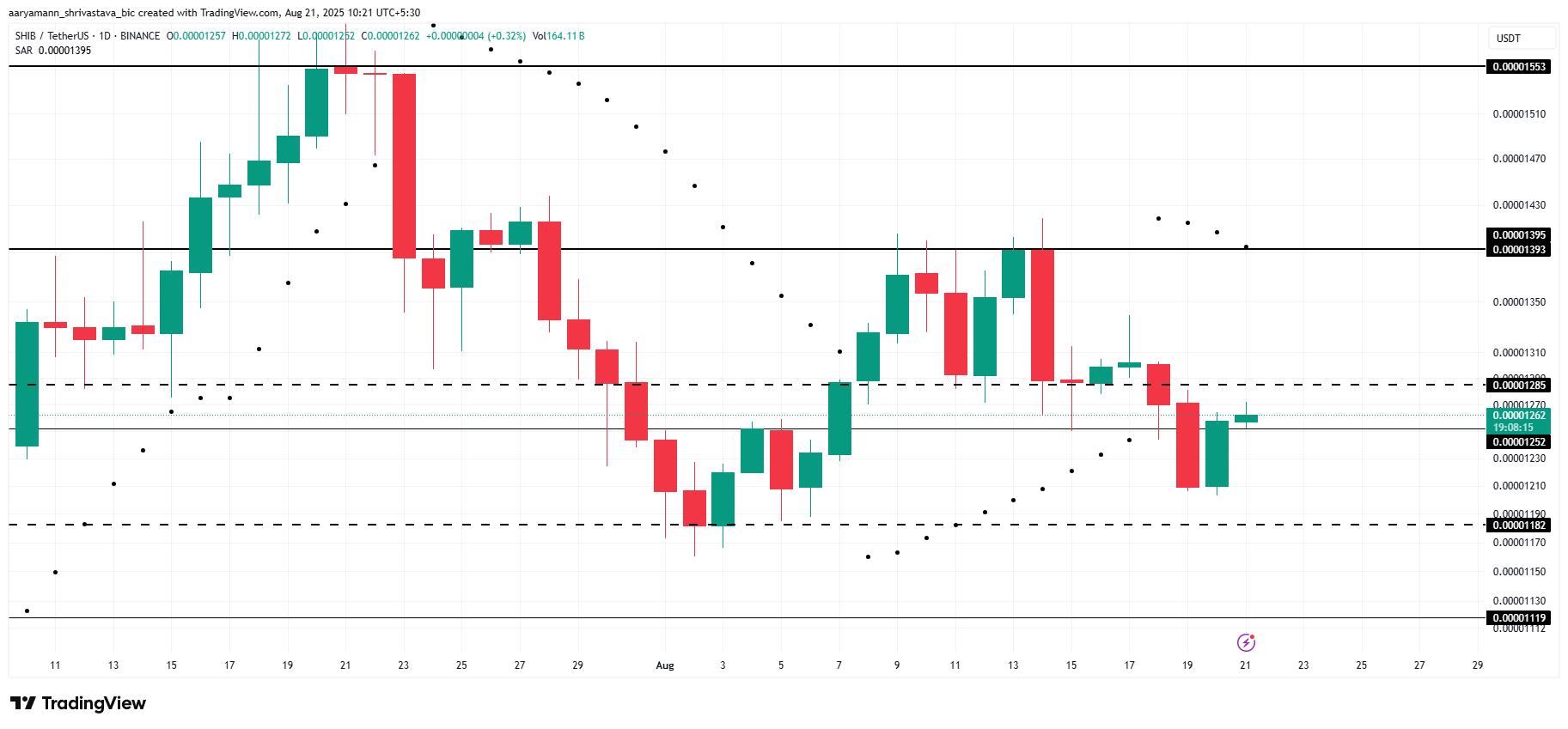

Shiba Inu’s price is currently at $0.00001262, and they are attempting to secure $0.00001252 as a support level. However, given the rising circulation and the overall bearish market conditions, maintaining this support may prove challenging for the meme coin. The ongoing selling pressure could keep Shiba Inu from bouncing back quickly.

The Parabolic SAR confirms that a downtrend is active at the moment, signaling further declines for Shiba Inu. If the price fails to hold at $0.00001252, it could drop to $0.00001182, entering a phase of consolidation. This would likely keep the altcoin in a bearish range, further discouraging potential investors.

Shiba Inu Price Analysis. Source:

TradingView

Shiba Inu Price Analysis. Source:

TradingView

However, if Shiba Inu manages to secure the $0.00001252 support level, it could see a potential bounce. A successful support reclaim could drive the price upward, potentially reaching $0.00001393. If this happens, it would invalidate the bearish thesis and offer some hope for a price recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

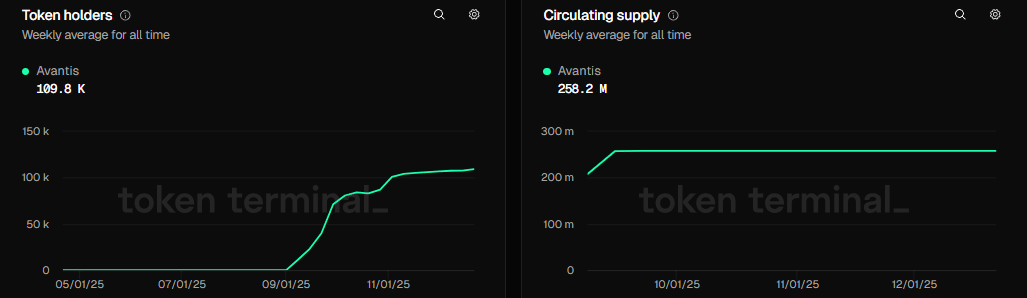

Avantis – Assessing key drivers of AVNT’s 62% weekly rally

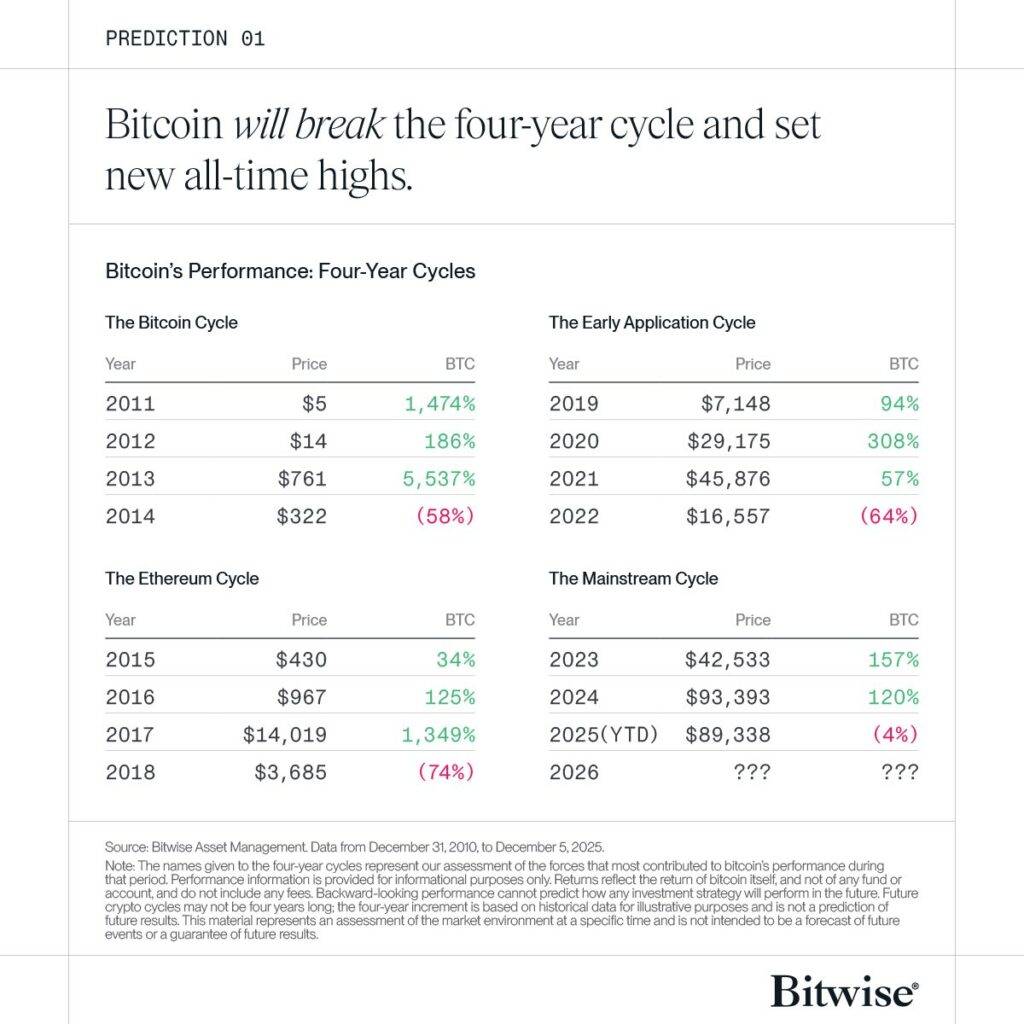

Bitcoin – Is it a case of ‘pain today, gains tomorrow’ for BTC’s price?

Are XRP and Cardano Losing Relevance? Mike Novogratz Explains Key Indicators as Crypto Investors Move Beyond Hype, Seek Real Utility

Reasons why XRP is poised to lead 2026 DESPITE drop below $2