Aave price shows renewed bullish momentum after rejecting a gap and bouncing off a rising trendline near $270. Technical indicators and fading exchange outflows support a short-term rally, though lighter spot volume warrants caution for traders monitoring confirmation and liquidity.

-

Aave bounced off trendline support at ~$270, up >5% in 24 hours.

-

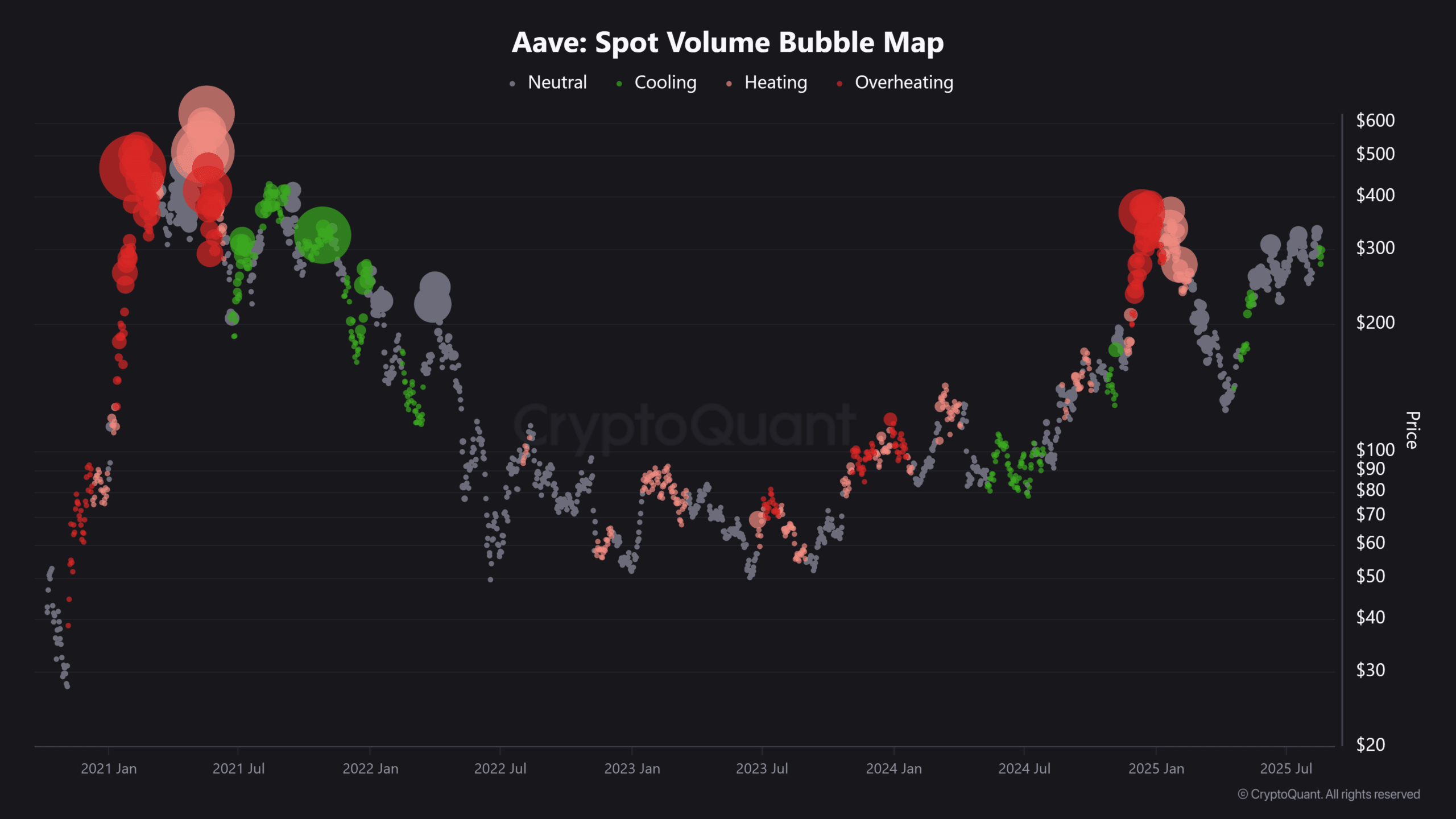

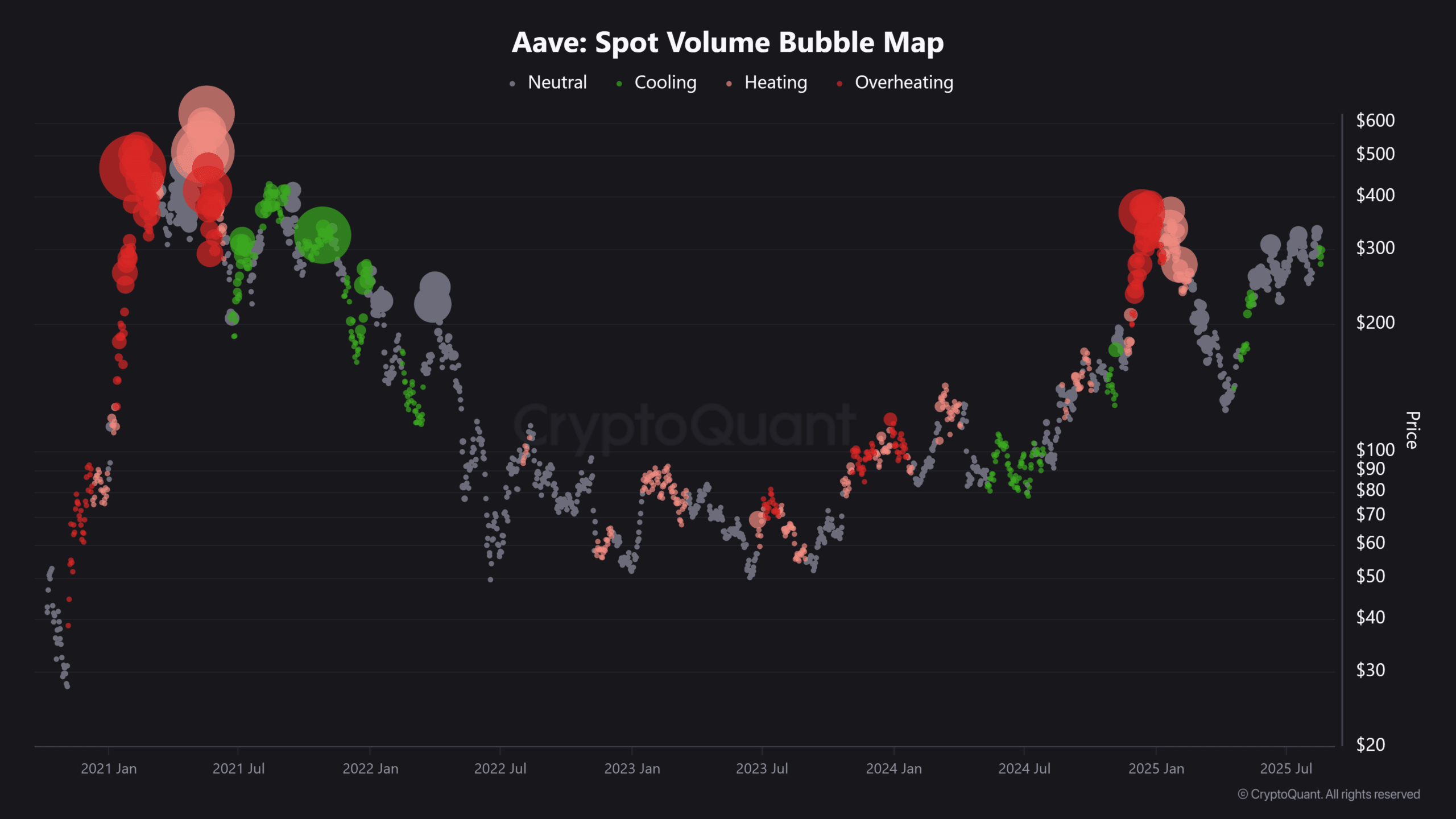

Exchange outflows have cooled, indicating fewer tokens leaving exchanges (CryptoQuant data).

-

Spot volume has dropped, suggesting consolidation rather than clear conviction from spot buyers.

Aave price rebounds from $270 trendline support; bullish technicals and waning outflows hint at a short-term rally — monitor spot volume for confirmation. Read the full analysis.

What is Aave price doing now?

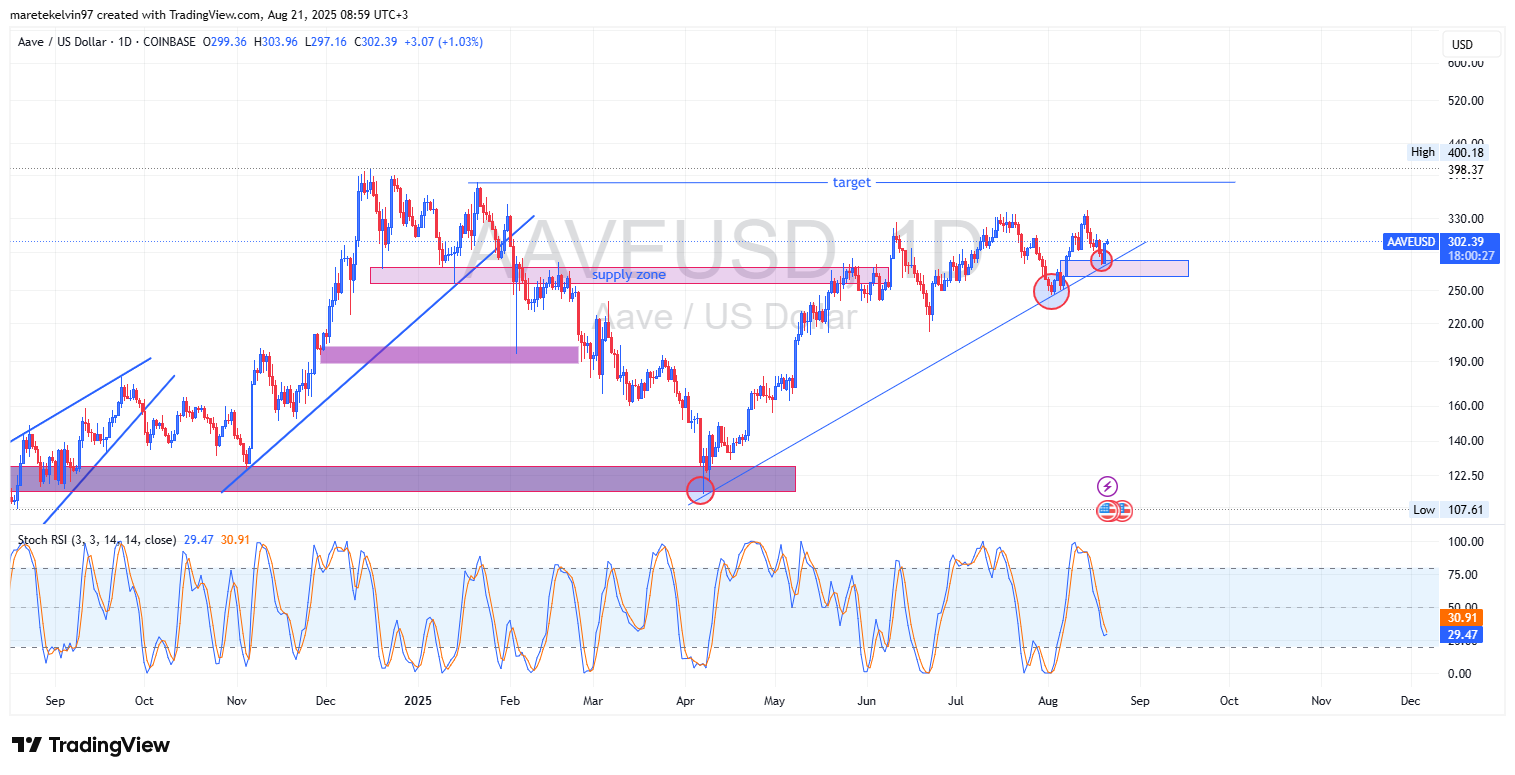

Aave price is staging a short-term rebound after a rejection at a filled gap near $270, gaining more than 5% in the last 24 hours. The move preserved a rising trendline, while momentum indicators and exchange outflow data point to a bullish tilt with caution from lighter spot activity.

How did support and trendline interplay influence Aave’s bounce?

Prices held a confluence zone where the rising trendline aligned with a previous gap-fill around $270. This level produced three solid bounces since April, signaling market respect for short-term structure.

Traders use such confluence to identify lower-risk entries; the repeated rejections at the same zone increase its significance as immediate support.

Source: TradingView

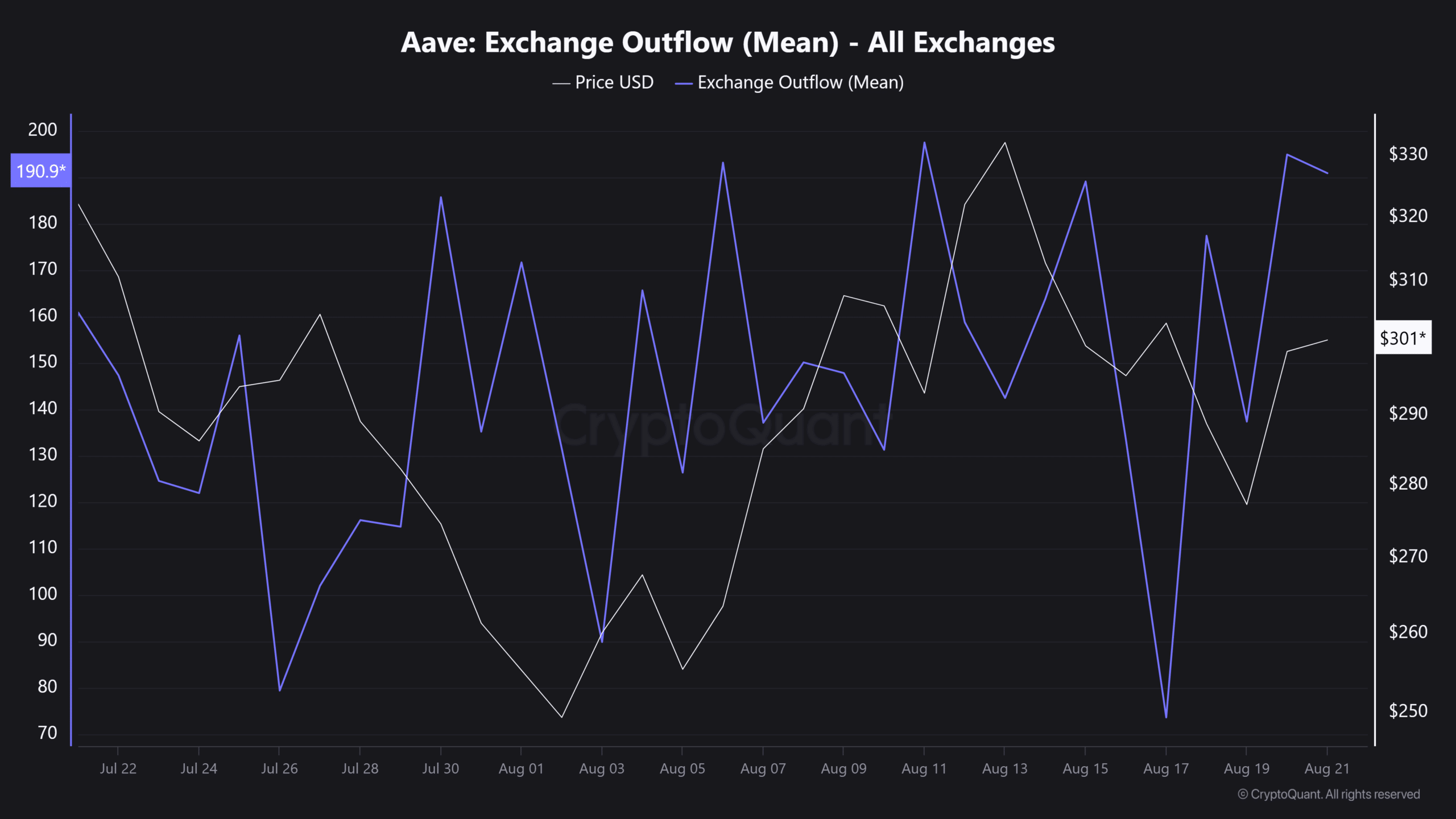

How do on-chain and exchange metrics affect the outlook?

Exchange outflows for AAVE have moderated, according to CryptoQuant data, which typically reduces immediate selling pressure and can support price stability or upward moves.

At the same time, spot market activity has cooled: bubble-map indicators show lower trading volume than earlier this month, signaling consolidation rather than broad-based accumulation.

Source: CryptoQuant

Why does spot volume matter for Aave price confirmation?

Spot volume provides conviction: higher spot volume on a breakout signals genuine buying demand, while a price move on low volume can be prone to failure. Current bubble-map readings show subdued spot trading, so traders should await stronger volume to confirm any extended rally.

Source: CryptoQuant

Frequently Asked Questions

Is Aave price likely to continue rising?

Short-term technicals favor a continued rally while the $270 trendline holds and outflows remain muted. Confirmation requires rising spot volume and sustained closes above recent highs.

How should traders manage risk on Aave positions?

Use tight stops below the $270 trendline, size positions for volatility, and monitor on-chain outflow and spot volume for signs of conviction or reversal.

Key Takeaways

- Support confirmed: Aave bounced off a $270 confluence of trendline and gap-fill, showing repeated support.

- On-chain signals: Exchange outflows have faded (CryptoQuant), lowering immediate selling pressure.

- Volume caution: Spot volume has cooled; traders should wait for stronger volume to confirm a sustained rally.

Conclusion

COINOTAG analysis shows Aave price recovering from a key confluence at $270 with bullish momentum supported by moderating exchange outflows. However, lighter spot activity means traders should seek volume confirmation before assuming a longer-term breakout. Monitor trendline integrity and on-chain metrics for next directional cues.

Published: 2025-08-21 | Updated: 2025-08-21