J.P. Morgan Deep Dive: Four Key Factors Behind Ethereum Outperforming Bitcoin

Ethereum's strength is built on the synergistic effect of four key factors: favorable policies, structural optimization, institutional adoption, and potential upside.

Original Title: "JPMorgan's Comprehensive Analysis: Four Factors Driving Ethereum Outperformance Against Bitcoin!"

Original Source: BitpushNews

Over the past few weeks, the crypto market has witnessed a notable trend: Ethereum (ETH) has significantly outperformed Bitcoin (BTC).

According to JPMorgan's latest research report, Wall Street analysts attribute this phenomenon to four core factors—ETF structural optimization, corporate treasury accumulation, regulatory attitude moderation, and the potential unlocking of future staking functionality. These factors not only explain Ethereum's recent strength but also indicate that it may have even greater upside potential in the future.

1. Market Background: Dual Drive of Policy and Capital Inflows

In July, the U.S. Congress passed the "GENIUS Act" stablecoin bill, bringing unprecedented institutional favorable conditions to the crypto market. Subsequently, Ethereum spot ETFs attracted a record-breaking $5.4 billion in inflows in a single month in July, nearly on par with Bitcoin ETF inflows.

However, as August rolled in, Bitcoin ETFs experienced minor outflows, while Ethereum ETFs continued their trend of net inflows. This divergence in capital flows became a direct catalyst for Ethereum to achieve superior performance against Bitcoin.

Meanwhile, the market is also awaiting the upcoming September vote on the "Crypto Market Structure Bill." Investors widely anticipate this to be another significant turning point similar to stablecoin legislation. With the dual effect of policy and market expectations, Ethereum's position in the capital markets has rapidly risen.

2. Analysis of Four Key Factors: Why is Ethereum Outperforming Bitcoin?

JPMorgan analyst Nikolaos Panigirtzoglou and his team clearly state in the report that Ethereum's strength stems from the following four core driving factors:

1. Potential Opening of Staking Functionality

Currently, a prominent feature in the Ethereum ecosystem is the PoS (Proof of Stake) staking mechanism. Users need at least 32 ETH to operate a validation node themselves, which is a relatively high barrier for most institutional investors and retail holders.

If the U.S. Securities and Exchange Commission (SEC) eventually approves spot Ethereum ETFs to allow staking, fund managers can directly generate additional returns for holders without requiring investors to run nodes themselves. This means that a spot ETH ETF will not only be a price-tracking tool but will also upgrade to a "yield-bearing passive investment product."

This is fundamentally different from a Bitcoin spot ETF: Bitcoin itself does not have a native yield mechanism, while an Ethereum ETF may potentially come with "interest" in the future, which clearly enhances its market appeal.

2. Corporate Treasury's Accumulation and Use Cases

JPMorgan pointed out that about 10 public companies have already added Ethereum to their balance sheets, accounting for approximately 2.3% of the circulating supply.

Of particular note, some companies are not just "buy and hold" but are further engaging with the ecosystem:

· Running Validation Nodes: Directly earning staking rewards.

· Utilizing Liquidity Staking or DeFi Strategies: Putting ETH into yield protocols to earn additional returns.

This means that Ethereum is gradually evolving from a "speculative asset" into an "enterprise sustainable asset allocation tool." And this trend is something that Bitcoin has not yet fully achieved.

Corporate treasury involvement represents longer-term, more stable capital inflows, also enhancing the market's valuation anchoring for Ethereum.

3. Regulatory Attitude Toward Liquidity Staking Tokens has Softened

Previously, there has been ongoing SEC scrutiny over the compliance of liquidity staking tokens (LSTs) such as Lido and Rocket Pool, with concerns that these tokens might be deemed securities, thereby affecting large-scale institutional participation.

However, the latest development is that at the level of SEC staff, a clarifying opinion has been given that they "may not be viewed as securities." While not officially legislated yet, this stance has greatly alleviated institutional concerns.

In this context, institutional funds that were previously cautious about compliance may enter Ethereum staking and related derivative markets more rapidly and on a larger scale.

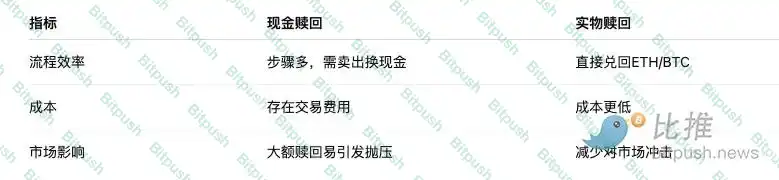

4. Optimization of ETF Redemption Mechanism: Physical Redemption Approved

The SEC recently approved a physical redemption mechanism for both spot Bitcoin and Ethereum ETFs. This means that institutional investors can now redeem ETF shares directly for an equivalent amount of Bitcoin or Ethereum, bypassing the cumbersome process of "selling ETF for cash first."

This mechanism brings three main benefits:

· Improved Efficiency: Saves time and cost.

· Enhanced Liquidity: ETF directly linked to the spot market.

· Reduced Selling Pressure: Avoids market sell-offs triggered by large-scale redemptions.

Compared to Bitcoin and Ethereum, this system is also advantageous, but since Ethereum's proportion in corporate and institutional holdings is relatively low, it means that there is more room for future growth, and the marginal effect is more significant.

Three, Future Outlook: Has Ethereum's Potential Surpassed Bitcoin?

JPMorgan Chase pointed out in its report that while Bitcoin is still the "value store" leader in the crypto market, Ethereum has more room for growth:

· ETF Adoption: The scale of ETH ETFs is currently lower than BTC, but with the unlocking of staking, it is expected to attract more long-term funds.

· Corporate Adoption: Bitcoin has long been held by many corporations and institutions, while Ethereum is still in the early stages, presenting a huge incremental space for the future.

· DeFi and Application Ecosystem: Ethereum is not just a digital asset but also hosts applications such as decentralized finance (DeFi), NFTs, stablecoins, AI + on-chain computing, thus having a more diverse range of use cases.

In other words, Bitcoin is more like "digital gold," while Ethereum is evolving into the "digital economy's infrastructure."

Four, Conclusion

JPMorgan Chase's analysis reveals a key logic: Ethereum's strength is not primarily speculation-driven in the short term but is built on the overlay effect of four major factors—policy favorability, structural optimization, institutional adoption, and potential returns.

With the further improvement of the ETF mechanism, continuous increase in corporate treasury holdings, and potential policy confirmations by the SEC in the future, Ethereum is expected to gradually narrow or even surpass Bitcoin's advantage in the future market landscape.

For investors, this trend is not only a signal of fund flows but also likely indicates a turning point for the entire crypto market from a "single value store" to a "multi-dimensional application ecosystem."

In a new chapter of crypto history, while Bitcoin may still be the “digital gold,” Ethereum is rapidly evolving into the “digital economy’s heart.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market in "Extreme Fear" as Market Braces for Bitcoin to Drop Towards $80,000

The cryptocurrency market is crowded with investors who have suffered such deep losses that they cannot continue buying in, yet are unwilling to cut their losses.

Arthur Hayes’ New Article: BTC May Drop to 80,000 Before Kicking Off a New Round of “Money Printing” Rally

The bulls are right; over time, the money printer will inevitably go “brrrr.”

Mars Morning News | Federal Reserve officials divided on December rate cut, at least three dissenting votes, Bitcoin's expected decline may extend to $80,000

Bitcoin and Ethereum prices have experienced significant declines, with disagreements over Federal Reserve interest rate policies increasing market uncertainty. The mainstream crypto treasury company mNAV fell below 1, and traders are showing strong bearish sentiment. Vitalik criticized FTX for violating Ethereum’s decentralization principles. The supply of PYUSD has surged, with PayPal continuing to strengthen its presence in the stablecoin market. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

"Sell-off" countdown: 61,000 BTC about to be dumped—why is it much scarier than "Mt. Gox"?

The UK government plans to sell 61,000 seized bitcoins to fill its fiscal gap, which will result in long-term selling pressure on the market.