Jack Dorsey’s Bitchat wants your neighborhood to run on Bitcoin

Is Jack Dorsey’s Bitchat really a chat app, or an experiment in how digital society might look without central authorities at all?

- Jack Dorsey’s experimental messenger Bitchat is expanding from short-range Bluetooth mesh into location-based chat, grouping users by geohashes and giving them temporary pseudonyms.

- Bitchat positions payments as part of messaging itself, offering potential use cases from spam control to neighborhood trade, while aligning with Bitcoin’s principles of privacy and resilience.

- Challenges remain around Apple’s in-app payment rules, privacy risks from repeated geohash use, Lightning’s shrinking capacity optics, and the sustainability of independent Nostr relays.

- Whether Bitchat evolves into a real neighborhood-level economy or remains a proof of concept will depend on usage, platform policies, and relay economics.

Table of Contents

- Bitchat moves from offline mesh to city-scale messaging

- A system held together by three independent layers

- What crypto adds that plain chat can’t

- The practical tests that will decide Bitchat’s future

Bitchat moves from offline mesh to city-scale messaging

On Aug. 21, Jack Dorsey announced that Bitchat, his experimental messenger, will add “location chat,” a feature that places people into local chat rooms based on their region.

The system uses geohashes, a way of turning GPS coordinates into grid squares that represent neighborhoods, cities, or larger areas. Each grid gives users a temporary pseudonym, so identity is not tied to phone numbers or accounts.

Messages are passed through Nostr relays, a decentralized protocol that Dorsey has supported for several years and that already enables Bitcoin payments. The update is currently under App Store review.

Bitchat itself had only been introduced a few weeks earlier. On Jul. 6, Dorsey released the app in beta through Apple’s TestFlight program along with a detailed white paper.

The first version allowed messages to be passed over Bluetooth within a range of about 300 meters, creating mesh networks that worked even without internet or cellular coverage.

The technical design included Curve25519 for key exchange, AES-GCM for encryption, and features such as file fragmentation, duplicate suppression, and a “panic mode” that deletes all data instantly.

On Jul. 9, Dorsey acknowledged that the code had not yet undergone an independent security audit, making clear that the project was still in an early stage.

With the new feature, Bitchat is shifting from short-range offline messaging to broader, location-based communication, reflecting the same principles that shape Bitcoin ( BTC ), including open participation, privacy as a baseline, and no dependence on a single company to keep the system running.

A system held together by three independent layers

To understand how Bitchat works, it helps to look at the three pieces that hold it together, including geohashes, Nostr relays, and Bitcoin payment rails. Each one does a different job, holding the system together.

A geohash is a simple idea . It takes your latitude and longitude and turns them into a short code made of numbers and letters.

Instead of pinpointing your exact GPS location, it places you inside a grid. The length of the code decides how big that grid is.

A six-character geohash, for example, covers roughly one square kilometer, enough to group people in the same neighborhood while keeping their exact positions private.

In Bitchat, that grid appears to become a chat room, and everyone in it may get a new pseudonym that resets when they move somewhere else. Once users are inside a room, their messages are carried over Nostr, an open protocol for decentralized communication.

Unlike WhatsApp or Telegram, which depend on company servers, Nostr relies on independent relays. Anyone can run one, and users are free to choose which relays to connect to.

If a relay goes down, the network keeps working because there is no central server to pull the plug. It is a model designed for resilience and open access.

Payments are already baked into this system. Nostr has defined standards called NIPs, and two of them matter most here. NIP-57 describes “zaps,” which are Lightning tips recorded as events on Nostr. NIP-47 covers “Nostr Wallet Connect,” which lets apps talk securely to a user’s Lightning wallet.

This means that if Bitchat enables payments, people could tip, pay small fees to post, or settle micro-transactions in real time using Bitcoin’s Lightning Network .

These layers, geohashes for location, Nostr relays for transport, and Lightning for payments, explain the foundation of Bitchat.

None of them is an untested idea. Geohashes are widely used in mapping. Nostr has been live since 2020, and Lightning processes millions of small payments every month. What Bitchat is trying to do seems to be combining them into a single, everyday tool.

What crypto adds that plain chat can’t

Bitchat could function as a normal messenger, but the reason it matters to the crypto world is that payments are already part of its underlying protocol.

Nostr, which Bitchat is reported to use to relay messages, supports Bitcoin’s Lightning Network natively, opening up use cases that ordinary chat apps cannot offer without bolting on external services.

One clear example is spam control. Most messaging platforms fight spam with phone number verification, identity checks, or moderation teams.

On Nostr, users often rely on “zaps”, Lightning tips as small as a single satoshi. Some communities already require a tiny payment to post, which costs almost nothing for genuine users but discourages bots and mass spam.

In Bitchat, this could potentially work at the level of local rooms, where a refundable micro-fee is enough to keep conversations clean without needing central moderators.

Another area is local commerce. In 2024, Nostr clients like Damus processed millions of Lightning zaps, showing that people are comfortable sending small payments inside apps.

Applied to location chat, that behavior could translate into tipping a street performer, paying a neighbor for a service, or posting a small bounty for quick help.

Since Lightning payments settle instantly and can be as small as a fraction of a cent, they are well-suited to casual exchanges that are too small for traditional banking systems.

The same model also might extend to resilience during outages. In places where internet access is restricted or unreliable, Bluetooth mesh could still carry messages short distances, while Lightning allows users to exchange value without waiting for banks to recover.

Past crises have shown the demand for this kind of tool. During the 2019 protests in Hong Kong, downloads of mesh apps like Bridgefy surged because they worked without cell service. A system like Bitchat could, in theory, offer the same benefit, but with money built in.

Payments on Nostr have also been getting more private. Some wallets now use Cashu, which creates anonymous Bitcoin-backed tokens. This could allow Bitchat users to pay each other inside location rooms in a way that is as untraceable as handing over physical cash.

The practical tests that will decide Bitchat’s future

For Bitchat to move from experiment to everyday tool, it will need to steer through several real-world challenges.

The first is the platform policy. In 2023, Apple required the Damus client, another Nostr-based app, to remove Lightning “zaps” from individual posts on iOS.

Apple only allowed tips to be sent at the profile level, arguing that payments linked directly to content could bypass its in-app purchase rules.

If Bitchat enables pay-to-post or tipping inside location rooms, it may run into the same restrictions. Unless there is a workaround, Apple’s policy could prevent the app from offering the very features that make it different.

The second issue is privacy and safety around location. Geohashes are designed to hide exact GPS points by grouping users into broader areas. But researchers have shown that repeated activity within the same grid can still reveal patterns over time.

Even if precise coordinates are hidden, consistent participation could expose where someone lives or works. Bitchat tries to address this by giving users a new pseudonym in each geohash, but at scale, protecting anonymity will be harder than it looks on paper.

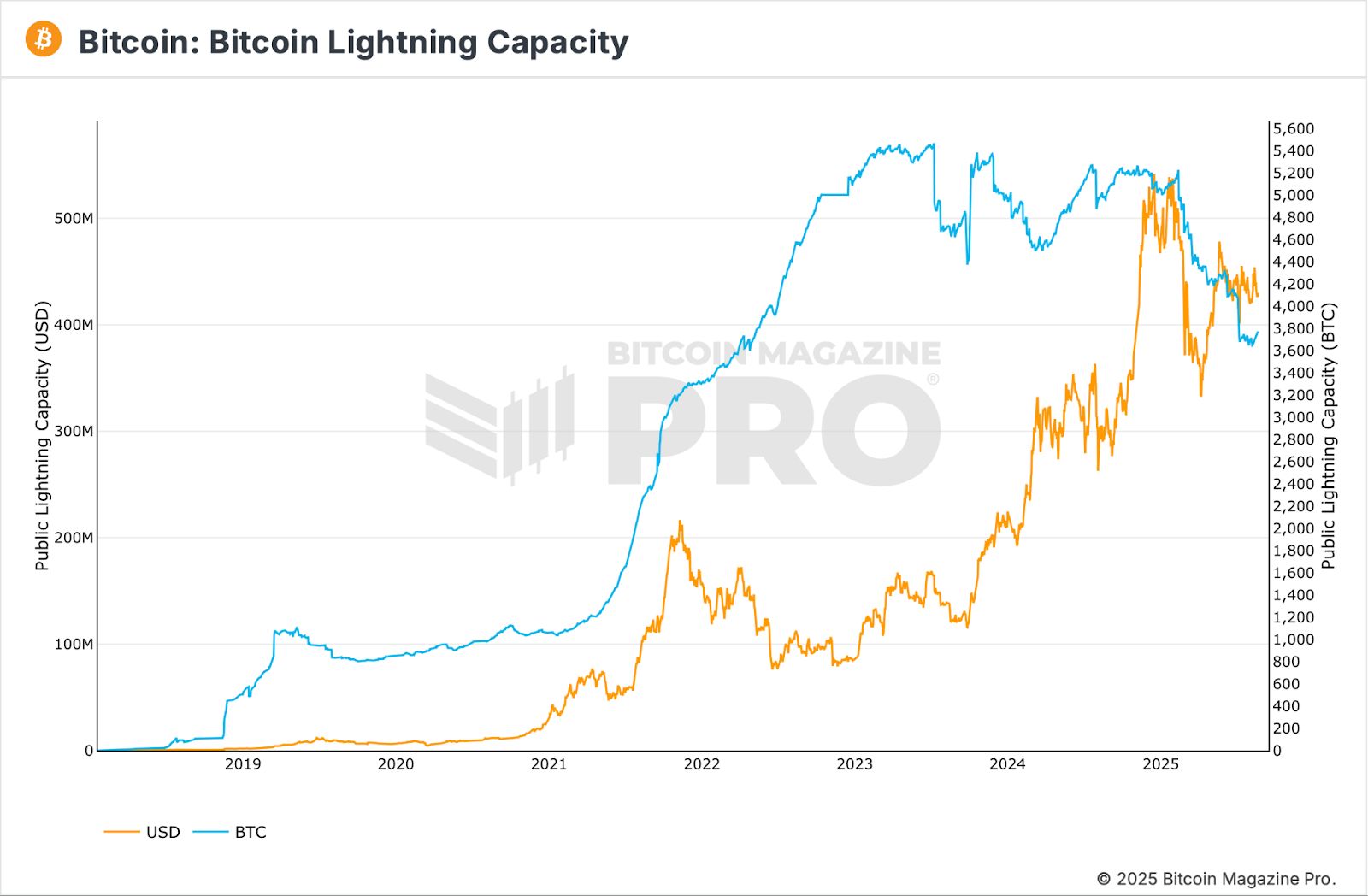

There is also the question of Lightning’s current optics. Public channel capacity has dropped from around 5,400 BTC in 2023 to about 3,800 BTC as of August 2025.

Bitcoin Lightning Network capacity chart | Source: Bitcoin Magazine Pro

Bitcoin Lightning Network capacity chart | Source: Bitcoin Magazine Pro

Critics argue that this signals weakening usage. Developers counter that capacity is not the best measure, since modern wallets route payments more efficiently, and success rates remain above 98%.

Both realities matter. The network is working in practice, but headlines about shrinking capacity may influence how outsiders perceive the stability of payments on Bitchat.

A further challenge lies in relay economics. Nostr depends on independent servers, or relays, to carry messages. Ephemeral events, like those used for geohash chat, reduce storage needs but still require bandwidth and uptime.

If only a handful of well-funded relays end up dominating city-level traffic, the system could drift back toward centralization. How these relays sustain themselves, whether through fees, donations, or integration with Lightning payments, remains unresolved.

Hence, the app will need to find ways to comply with platform rules, protect user privacy, maintain confidence in payments, and ensure that relay operators have incentives to keep the system running.

Put together, these tests define the experiment in clear terms. Bitchat will show whether it is possible to merge local conversation with Bitcoin payments in a way that is private, resilient, and practical.

If usage grows, payments work reliably, and platform hurdles are managed, the app could stand as the first step toward a social layer built on the same foundations as Bitcoin.

If not, it will remain a proof of concept, valuable for what it teaches, but not yet ready for mainstream adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Quantum Computing Bitcoin: Michael Saylor’s Powerful Vision for an Unbreakable Future

1.18 Billion XRP In Four Weeks. Here’s What Whales Are Doing

PancakeSwap, YZi Labs Announce Zero-Fee Prediction Market on BNB Chain