Date: Sat, Aug 23, 2025 | 06:20 AM GMT

The cryptocurrency market turned bullish after Jerome Powell hinted at potential rate cuts in September during today’s Jackson Hole event. Following the remarks, Ethereum (ETH) surged over 10% past $4,750, sparking strong momentum across memecoins, including Dogwifhat (WIF).

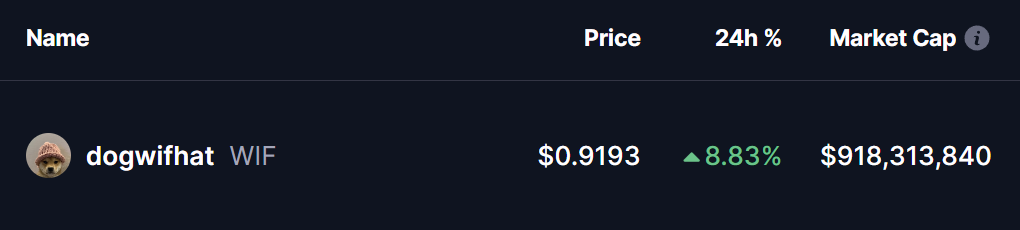

WIF has gained 9% in the past 24 hours, and its chart is now displaying a bullish technical structure that points to a potential continuation to the upside.

Source: Coinmarketcap

Source: Coinmarketcap

Holds Symmetrical Triangle Support

On the daily chart, WIF continues to consolidate within a symmetrical triangle formation, a classic pattern that often precedes a breakout.

After suffering a 40% correction from its descending resistance trendline rejection, WIF tested its ascending support trendline near $0.79, where buyers stepped in. From that level, the token staged a strong rebound and is now trading around $0.92.

Dogwifhat (WIF) Daily Chart/Coinsprobe (Source: Tradingview)

Dogwifhat (WIF) Daily Chart/Coinsprobe (Source: Tradingview)

Crucially, WIF is approaching its 100-day moving average at $0.9466, a resistance level that could serve as the launchpad for further upside if broken.

What’s Next for WIF?

If bulls manage to reclaim and hold above the 100-day MA, WIF could rally toward its descending resistance trendline near $1.24—a potential 35% move higher from current levels.