Liquidity Dilemma of RWAs: Why AMMs Can Only Be a "Convenience Layer" Rather Than the "Primary Market"

What RWA truly needs is a predictable, measurable, and settleable liquidity highway.

Original Title: "Where Should AMM Stand in RWA?"

Original Author: @sanqing_rx, Core Member of RealtyX DAO Community

Introduction: Bridging the Liquidity Gap in RWA

Real World Assets (RWA) are becoming a key narrative in Web3's journey to the mainstream. However, bringing trillions of real-world assets onto the blockchain, and merely tokenizing assets, is just the first step. The true challenge lies in building efficient and robust secondary market liquidity for them. Automated Market Makers (AMMs), as a cornerstone of DeFi, are naturally highly anticipated, but can they be directly applied to the world of RWA?

Summary (Three-Sentence Overview)

· Conclusion: Current mainstream AMMs (Centralized Liquidity, Stablecoin Curve, etc.) are not suitable to serve as the "primary market" for RWA. The biggest obstacle is not the curve model but rather the liquidity providers (LPs) whose economic model is not sustainable in the low turnover, heavy compliance, and slow pricing RWA environment.

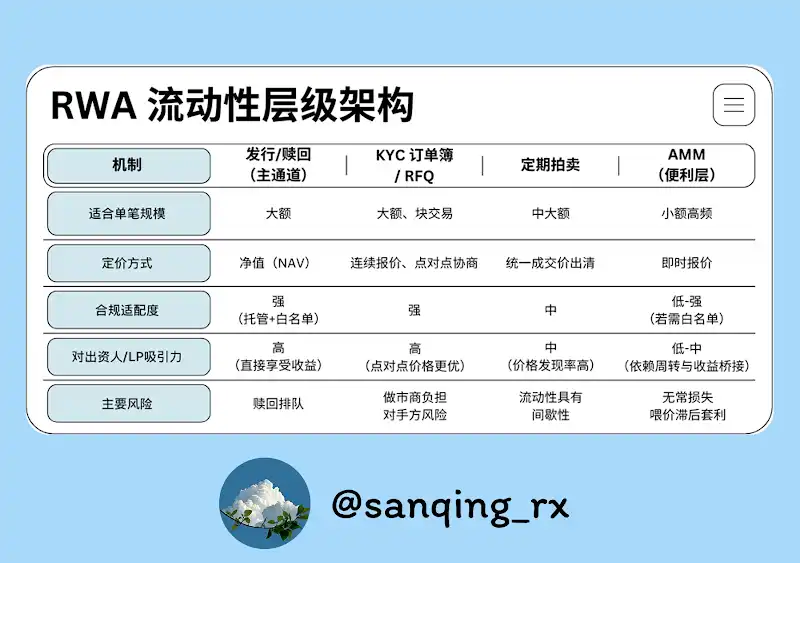

· Positioning: Issuance/Redemption, KYC Order Book/RFQ, and Periodic Auctions should be set as the "main thoroughfare" for RWA liquidity; AMMs should step back to the "convenience layer" and only cater to small, daily, and convenient secondary trading needs.

· Method: Through the combination of "Narrow-Band Market Making + Oracle Slippage/Hook + Yield Bridging," the native returns of RWA (such as interest, rent) will be truly passed on to LPs, supplemented by robust risk management and disclosure of information.

I. AMMs Should Not Become the "Primary Market" for RWA

RWA pursues a financial mainline that is predictable, measurable, and settleable. While the continuous quoting AMM mechanism is highly innovative, it faces three inherent challenges in most RWA scenarios: insufficient natural trading volume, slow information heartbeat, and elongated compliance paths. This makes LPs overly reliant on transaction fees for returns, while also being exposed to impermanent loss risks.

Therefore, our core viewpoint is: AMMs should not take on the responsibility of the "primary market" for RWA but should instead become the "last mile" of liquidity. Their role is to allow users to conveniently exchange small assets anytime, anywhere to improve user experience, but the core functions of large transactions and price discovery must be entrusted to other more suitable mechanisms.

2. Why is AMM a Natural Fit in the Crypto-native World?

To understand the limitations of AMM in the context of Real-World Assets (RWA), we first need to grasp its key success factors in the crypto-native world:

● Non-stop Trading: A 24/7 global market coupled with permissionless arbitrageurs ensures that any price discrepancies are instantly arbitraged away, fostering continuous trading activity.

● High Composability: Almost anyone, any protocol can effortlessly become a Liquidity Provider (LP) or participate in arbitrage, creating a strong network effect and self-amplifying liquidity.

● Embracing Volatility: High volatility brings significant trading demand and arbitrage opportunities, generating transaction fees that enable LPs to potentially "outperform" impermanent loss.

When we attempt to replicate these three points in the RWA space, we realize that the entire foundation has shifted: significantly lower trade frequency, extremely slow pricing updates, and significantly higher compliance requirements.

【Local Explanation | Pricing Update Frequency】

“Pricing update frequency” refers to the “rate at which trusted prices are updated,” which is a key differentiator between RWA and crypto-native assets.

· Crypto-native Assets: The frequency is usually in seconds (exchange quotes, oracle prices).

· Most RWAs: The frequency is often daily or even weekly (fund NAV updates, real estate valuations, auction closing prices).

The slower the asset's pricing updates, the less suitable it is for providing continuous quotes in a deep liquidity pool over the long term.

3. In the RWA Space, LPs' Economic Equation Doesn't Add Up

When an LP provides liquidity, their perception of "annualized returns" primarily depends on three things: the trading fee rate, the turnover intensity within the effective price range, and the annual frequency of trades.

For RWAs, this equation is challenging to balance because:

● Low Turnover Rates: The funds "parked" in the pool are seldom "activated" by high-frequency trading, resulting in meager fee income.

● High Opportunity Costs: External markets offer significant interest rates or risk-free rates. Using the same capital, LPs often find it more lucrative to directly hold the RWA asset itself (if possible) rather than providing liquidity.

● Risk-Return Imbalance: In the context of low transaction fee revenue, LPs also have to bear Impermanent Loss (compared to the loss from holding a single asset) and the risk of being front-run by arbitrageurs due to price oracle slippage.

Overall, the LP's economic model is inherently disadvantaged in an RWA AMM.

Four, Two Major Structural Frictions: Pricing and Compliance

In addition to the economic model, there are two structural issues hindering the application of AMMs.

· Misalignment of Pricing Rhythms: The valuation/auction process of RWAs has a "slow heartbeat," while AMMs provide real-time tradable quotes. This time gap gives those with the latest information a significant arbitrage window where they can easily exploit the LP's lack of understanding of price differentials on the AMM.

· Compliance's Segmentation of Composability: KYC, whitelists, transfer restrictions, and other compliance requirements lengthen the capital inflow/outflow path, breaking the DeFi "open to everyone" Lego block model. This directly leads to fragmented liquidity and insufficient depth.

· Cash Flow "Pipeline Engineering": RWA's cash flows such as interest or rent either manifest through net asset value appreciation or require direct distribution. If the AMM/LP mechanism is not designed to capture and distribute these earnings effectively, LPs may not receive their rightful share of the cash flow or may be diluted during arbitrage.

Five, Applicable Boundaries and Real-World Examples

Not all RWAs are incompatible with AMMs; we need to categorize them for discussion.

· More Friendly: Assets with a short duration, daily updatable net asset value, and high price transparency (such as money market fund shares, short-term treasury token, interest-bearing certificates). These assets have a clear central price and are suitable for providing convenient exchange services through narrow band AMMs.

· Less Friendly: Assets relying on offline valuations or infrequent auctions (such as commercial real estate, private equity). These assets have a slow heartbeat, severe information asymmetry, and are more suitable for order book/RFQ and periodic auction mechanisms.

Case Study: Plume Chain Nest's Arbitrage Window

· Background: The nALPHA and nBASIS tokens of the Nest project have AMM pools on Curve and the native Rooster DEX. Initially, their redemption process was fast (about 10 minutes), but the token price update frequency is about once a day, sometimes slower.

· Phenomenon: Due to the Net Asset Value (NAV) being "daily updated" while Automated Market Maker (AMM) prices are "instantly quoted," when a new NAV is announced, AMM prices fail to catch up in time, creating an arbitrage window where users can "buy at a low price on the DEX -> immediately request redemption from the project party -> settle based on the updated higher NAV."

· Impact: Arbitrageurs profit while AMM Liquidity Providers (LPs) bear all the impermanent loss, especially those providing liquidity in a more price deviated range, suffering heavier losses.

Post-mortem and Remediation Proposal:

● Post-mortem: The root cause of the issue lies in the mismatch of pricing updates, coupled with the protocol lacking necessary risk control guardrails and order routing mechanisms.

● Remediation Proposal:

-Order Routing: AMMs should only handle small trades (explained below), while large orders should be routed to Request for Quote (RFQ) or redemption channels.

-Active Price Tracking: Implement an "Oracle Slippage + Hook" mechanism, only providing liquidity within a narrow range around the latest NAV, automatically migrating price bands or temporarily increasing fees upon NAV updates.

-Risk Control Guardrails: Set Oracle freshness threshold, price discount premium circuit breaker mechanism, and switch to auction or redemption-only mode on days of significant valuation adjustments.

-Information Disclosure: Establish a public dashboard displaying premium/discount distribution, Oracle status, redemption queues, etc., enabling LPs to make informed decisions independently.

Six, Four-Channel Parallel "Liquidity Framework"

In a mature Real-World Asset (RWA) market, the liquidity architecture should be multi-layered.

[On-site Explanation | "AMMs Only Handle Small Trades"]

· Concept: Consider AMMs as the "last-mile" convenient exchange layer, handling daily small orders and asset fine-tuning.

· Practice: At the front-end routing level, for orders exceeding a specific threshold (e.g., single trade> 0.5%-1% of the pool TVL), redirect them to RFQ, order books, or redemption channels. The core responsibility of AMMs is to provide a smooth experience for users to "casually swap a bit," not to absorb the impact of large trades.

Seven, Precision Operations: The Three Musketeers for Leveraging RWA AMMs

In order for AMM to play a good role in its "convenience layer" positioning, three things need to be done:

1. Concentrated Liquidity

Provide liquidity only within a very narrow range around the asset's net asset value. This can greatly improve capital efficiency and reduce the time window for liquidity to be arbitraged against the "stale price."

2. Oracle Slip-Band / Hooks

This is a dynamic upgrade of concentrated liquidity. Through the arrangement of oracles and smart contracts, price automatic tracking is achieved, and a protection mechanism can be activated during market anomalies.

【On-the-spot Explanation | Oracle Slip-Band and Hook】

· Slip-Band: A small "quote corridor" that closely follows the oracle price feed (such as the net asset value). Liquidity is concentrated here.

· Hook: A "programmable action" embedded in the AMM contract. When the oracle price updates, the Hook is automatically triggered, moving the "slip-band" to the vicinity of the new price, and may even temporarily increase the fee rate to hedge risks.

Core Goal: Avoid being arbitraged against the stale price for a long time, while retaining the convenience of small trades.

3. Yield Bridging

A clear mechanism must be established to accurately allocate the cash flow generated by RWA assets, such as interest and rent, to the LP in the AMM pool. The key is to clearly define the complete path of "revenue into the pool → how to right by share → when can be claimed" at the code level, expanding the source of LP's revenue from a single fee to "fee + asset-native revenue."

Chapter Eight: Conclusion - From "Continuous Quote" to "Predictable Liquidity"

RWA may not need the 24/7 price frenzy of blockchain; what it really needs is a predictable, measurable, and settleable liquidity backbone.

Let's leave the professional matters to professional mechanisms:

· Issuance/Redemption, KYC Order Book/RFQ, Periodic Auctions —— Establish these main roads, where anchored price discovery and large transactions execution take place.

· AMM —— Position it in the "last mile," focusing on providing a small, smooth, and transparent exchange experience.

When capital efficiency aligns with regulatory reality, and when we can no longer and no longer insist on the AMM bearing the fantasy of the "main market," the on-chain secondary liquidity ecosystem of RWAs will instead become healthier and more sustainable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price dips below 88K as analysis blames FOMC nerves

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.