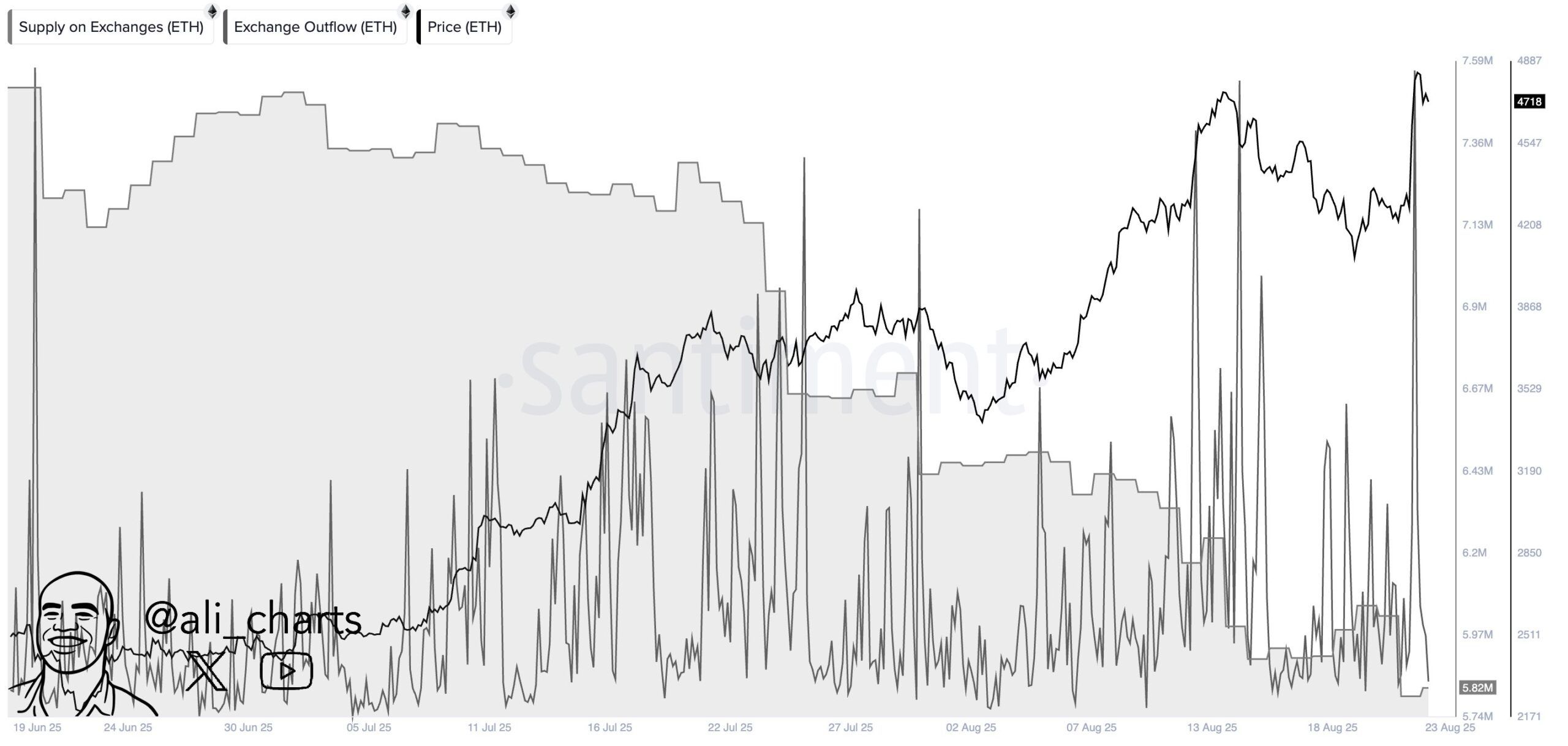

Ethereum has seen a powerful shift in market dynamics over the past 48 hours, with over 200,000 ETH withdrawn from centralized exchanges, according to analyst Ali Charts.

Such a rapid outflow often signals investor confidence, as coins are typically moved into self-custody or staking rather than being prepared for selling.

The move comes at a critical time: Ethereum is trading near $4,817, up more than 32% in the past month, with a market cap of $581.5 billion. Trading volume, however, has dropped by over 50% in 24 hours, suggesting that supply scarcity could be a key factor driving the next move higher.

Technical Setup Points Toward $5K

Price action shows Ethereum consolidating just below $4,820 after a strong rally. Indicators like the Relative Strength Index ( RSI ) sit at 64, close to overbought but not yet overheated. Meanwhile, the MACD is holding above neutral, hinting at a potential continuation of upward momentum.

If bulls maintain pressure, the next resistance sits around the $5,000 psychological level. Historically, large withdrawals paired with rising spot demand have preceded sharp upward moves.

Roadmap Upgrades Add Long-Term Fuel

Ethereum’s upcoming technical improvements further strengthen the bullish case. The 10-year “Lean” roadmap aims for 10,000 transactions per second (TPS) on Layer 1, while integrating quantum-resistant cryptography by 2026. EIP -7702 will introduce broader smart account compatibility, and Fusaka will enable parallel EVM execution, targeting scalability without sacrificing decentralization.

With Ethereum maintaining a 61% share of DeFi and hosting $7.5 billion in real-world assets (RWAs), these upgrades could extend its dominance across key sectors. Past upgrades like the Merge drove price rallies of 30–50%, setting a precedent for potential future surges.

Institutional Demand Adds a Layer of Uncertainty

While institutional appetite is rising, particularly with Ethereum ETF discussions gaining traction, the outlook remains mixed. Stronger regulatory scrutiny and volatile inflows can either amplify momentum or spark corrections depending on macroeconomic conditions.

For now, the combination of exchange outflows, bullish technicals, and an ambitious roadmap suggests Ethereum could be gearing up for a decisive attempt at breaking the $5,000 mark in the coming days or weeks.