Bio Protocol launches Aubrai, the first-ever decentralized AI agent for longevity science

Bio Protocol has introduced Aubrai, the world’s first decentralized BioAgent designed to accelerate longevity research.

- Co-developed with VitaDAO and informed by Dr. Aubrey de Grey’s longevity research, Aubrai leverages decentralized mechanisms to overcome traditional funding gaps and accelerate translational science.

- Aubrai can generate and validate research hypotheses, design wet-lab experiments, and securely encrypt data.

Bio Protocol ( BIO ) has launched Aubrai, the world’s first decentralized AI agent designed to advance longevity research.

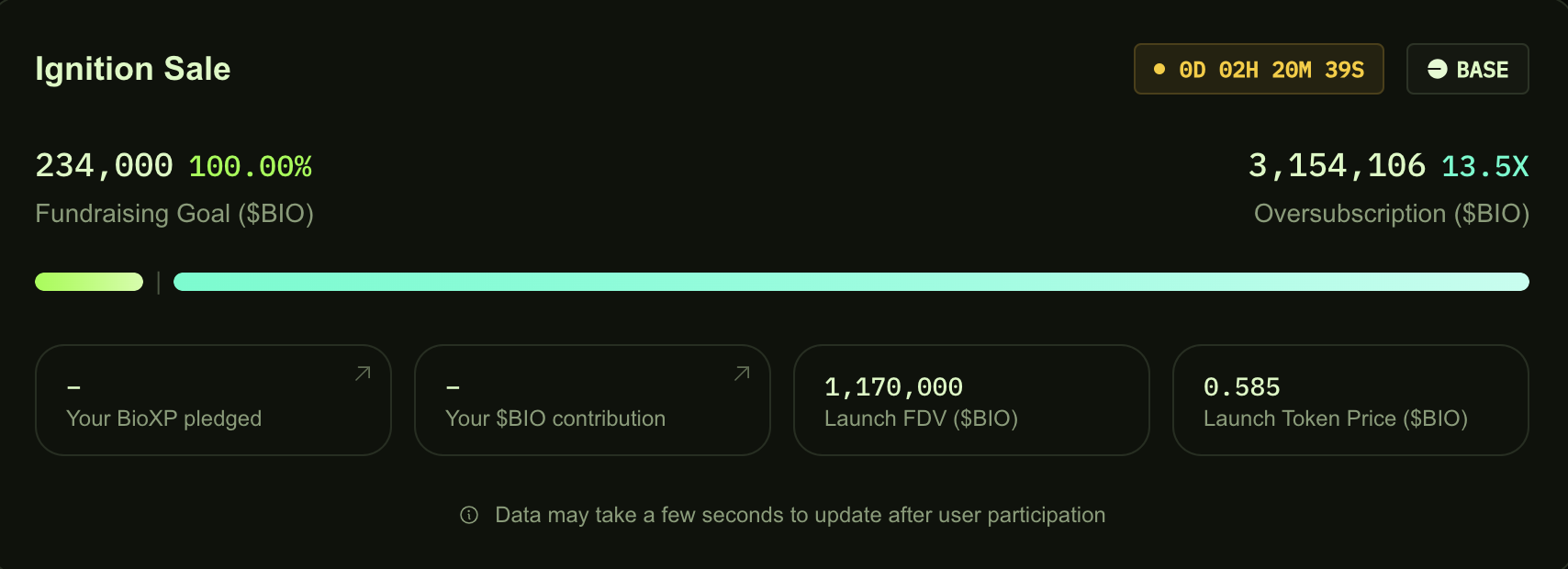

The launch price is set at 0.585 BIO per AUBRAI.

The ongoing sale, conducted on the BASE blockchain, set a fundraising target of 234,000 BIO and has already been oversubscribed 13.5x.

Source: bio.xyz

Source: bio.xyz

About Bioprotocol’s Aubrai

Co-developed by Bio Protocol and VitaDAO, Aubrai is the world’s first decentralized BioAgent, drawing knowledge from thousands of private lab notes, internal chats, and unpublished insights from the lab of Dr. Aubrey de Grey. De Grey is best known for pioneering longevity research through his Strategies for Engineered Negligible Senescence (SENS) framework and advocating the idea that aging is a disease that can be treated.

“The consequences of traditional financing are a chronic funding gap, over-reliance on philanthropy, and a ‘valley of death’ between discovery and the clinic. That’s why we champion alternative mechanisms – DAOs, longevity-focused venture funds, and DeSci platforms – which can tolerate long horizons, align incentives around societal benefit, and crowd-source risk,” de Grey told CoinDesk in an interview.

Aubrai functions as an on-chain AI co-scientist. It can generate and validate hypotheses, design wet-lab experiments, and encrypt data to protect trade secrets while enriching research outputs. At the heart of Aubrai’s mission is the Robust Mouse Rejuvenation (RMR2) project — de Grey’s ambitious study aiming to double the remaining lifespan of middle-aged mice. Aubrai has already demonstrated its capabilities in the RMR2 study, suggesting methodological tweaks and flagging dosing caveats.

AUBRAI token holders gain governance rights over the agent’s research outputs. They also share in potential revenues from discoveries commercialized by the project.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stunning Bitcoin Price Prediction: Could BTC Really Hit $1.42 Million by 2035?

NEAR Supported on Solana: A Revolutionary Cross-Chain Leap for Users

Bitwise Sees Solana Hitting Records in 2026: Major Rally Incoming?

Intuit USDC Integration: A Revolutionary Step for Crypto Tax and Accounting