Pantera’s $1.25 Billion Solana Bet Fails to Halt SOL’s 10% Market Slide

Pantera’s $1.25 billion Solana treasury push has failed to spark gains as SOL slides nearly 10%. Weak futures demand and bearish signals point to further downside risks.

Solana faces renewed pressure today despite reports that Pantera Capital is pursuing a $1.25 billion raise to create a Nasdaq-listed Solana treasury vehicle.

The announcement, which could have been a bullish driver, has been overshadowed by a wider market dip that has dragged SOL down nearly 10% over the past 24 hours.

$1.25 Billion Pantera Bet Fails to Boost Solana

BeInCrypto reported earlier that Pantera Capital is preparing to raise $500 million from investors to transform a Nasdaq-listed company into a publicly traded Solana investment vehicle, called “Solana Co.” The raised funds will be used to acquire SOL, with Pantera committing $100 million of its own capital and holding an option to raise an additional $750 million.

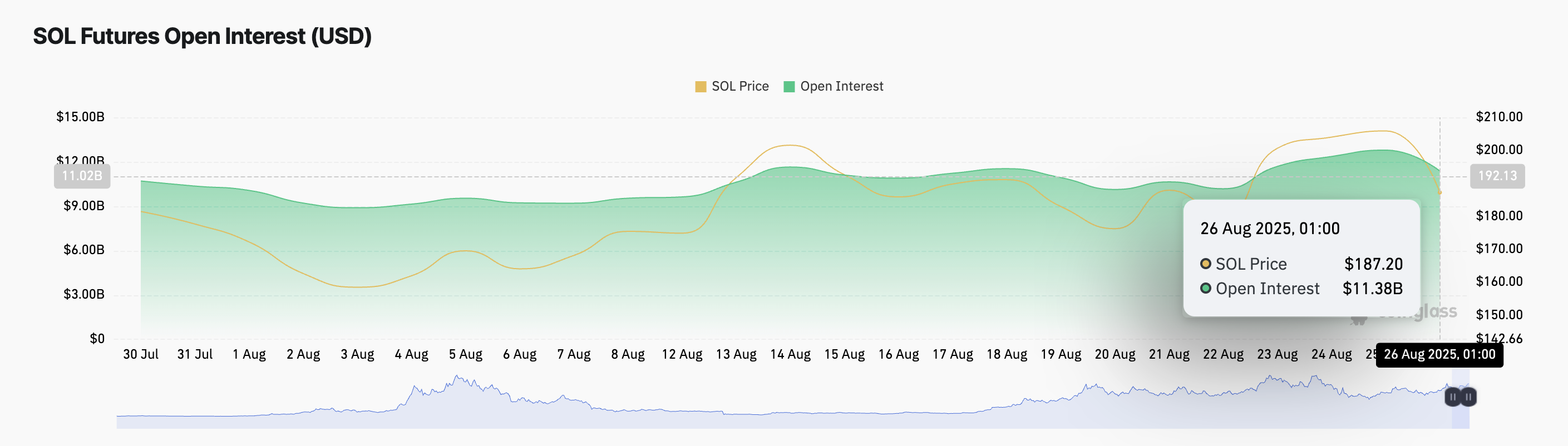

Despite this news, SOL’s price reaction has remained muted. The broader market downturn has dragged the coin down by almost double digits over the past day. During that period, its futures open interest has fallen 11% to reach $11.38 billion as of this writing.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

SOL Futures Open Interest. Source:

Coinglass

SOL Futures Open Interest. Source:

Coinglass

Open interest measures the total number of outstanding derivative contracts—like futures or options—that have not yet been settled. When it falls alongside a declining price, traders close positions rather than take new ones. This suggests waning market conviction or reduced speculative interest.

Despite the bullish narrative of Pantera’s $1.25 billion fundraising push, SOL’s price and open interest drop show that the bulls are losing their grip on the market.

Solana Bears Gain Strength

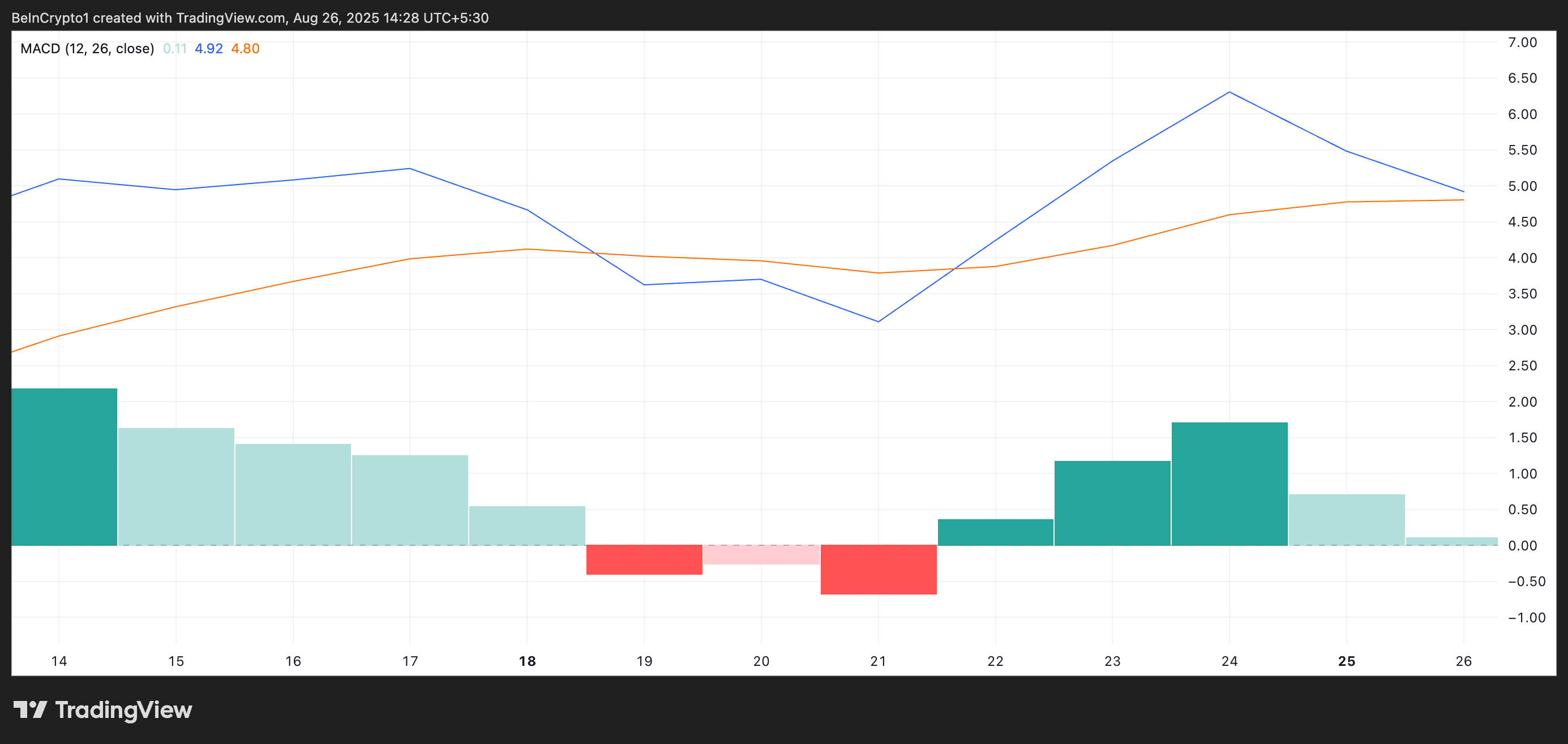

Further, on the daily chart, SOL’s Moving Average Convergence Divergence (MACD) is forming a bearish crossover, hinting at deeper losses in the near term.

SOL MACD.Source:

TradingView

SOL MACD.Source:

TradingView

The MACD indicator identifies trends and momentum in an asset’s price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

A bearish crossover pattern emerges when an asset’s MACD line (blue) falls below its signal line (orange), indicating a breakdown in the market’s bullish structure.

As with SOL, when the MACD line crosses below the signal line, it signals growing bearish momentum and fading buying strength.

Will Solana Slide or Soar?

Traders usually interpret a potential MACD bearish crossover as a sell signal. Therefore, if sellofs spike, SOL could extend its decline and fall to $171.88.

SOL Price Analysis.Source:

TradingView

SOL Price Analysis.Source:

TradingView

On the other hand, if demand rockets and the bulls regain control, they could trigger a rebound toward $195.55.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH whales uneasy as onchain, derivatives data reduce chance for rally to $4K

ECB official Kazaks warns: "It is too early to talk about rate cuts," inflation risks remain a concern

European Central Bank official Kazaks has warned that it is too early to discuss interest rate cuts, dampening market expectations.

A two-week MVP: Parity is building a "daily usable" Web3 for Polkadot!