Is the blockchain developed by Google considered a Layer 1?

Will Google really build a permissionless and fully open public blockchain?

Will Google really build a permissionless, fully open public blockchain?

Written by: Nicky, Foresight News

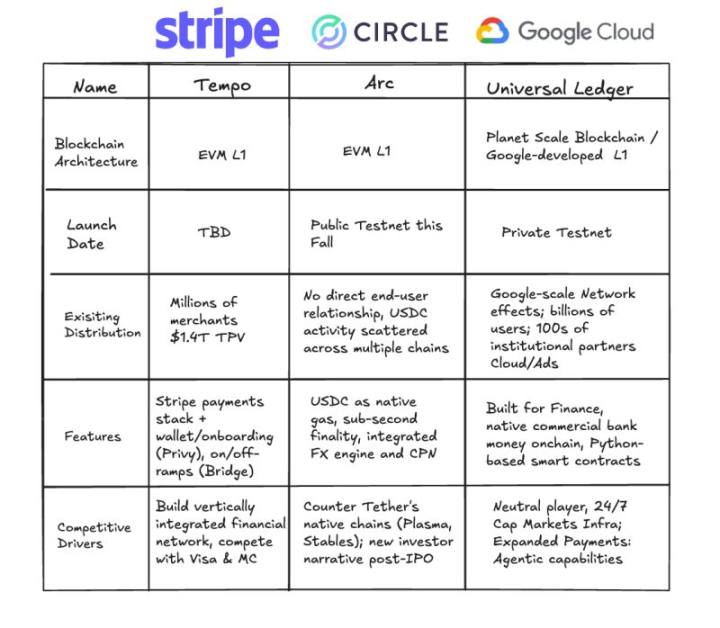

Recently, Rich Widmann, Head of Web3 Strategy at Google, announced via social media that Google Cloud has officially launched its blockchain network, Google Cloud Universal Ledger (GCUL), and defined it as a "Layer1 blockchain." This has sparked discussions about its technical positioning: Is GCUL truly a Layer1 public blockchain, or is it closer to a traditional consortium chain?

Official Positioning and Core Features

According to the official description, GCUL is designed as a "high-performance, trusted-neutral, and Python smart contract-enabled" distributed ledger platform, currently in a private testnet phase, mainly providing services to financial institutions. Google Cloud emphasizes that GCUL aims to simplify the management of commercial bank currency accounts and, through distributed ledger technology, enable multi-currency and multi-asset transfers and settlements, while also supporting programmable payments and digital asset management.

In the official article "Beyond Stablecoins: The Evolution of Digital Currency," Google further elaborates on GCUL's positioning: it does not seek to "reinvent money," but rather to solve the fragmentation, high costs, and inefficiencies of traditional financial systems by upgrading infrastructure. GCUL is packaged as a service, provided via API interfaces, emphasizing its ease of use, flexibility, and security, especially in terms of compliance (such as KYC verification) and privatized deployment.

It is worth noting that early testing of GCUL has already begun in collaboration with CME Group. In March 2025, the two parties announced the launch of a distributed ledger pilot to explore solutions for wholesale payments and asset tokenization.

CME CEO Terry Duffy stated that GCUL is expected to improve efficiency in areas such as collateral management and margin settlement under the "24/7 trading trend"; Rohit Bhat, General Manager of Financial Services at Google Cloud, emphasized that this cooperation is "a typical case of traditional financial institutions transforming their business through modern infrastructure."

Layer1 vs Consortium Chain: Definitions and Differences

In the blockchain field, Layer1 usually refers to foundational public blockchains such as Ethereum and Solana, whose core features include decentralization, permissionlessness, and transparency. Any user can freely participate in network validation, transactions, or deploy smart contracts, and on-chain data is visible to all.

In contrast, a consortium blockchain is a permissioned distributed ledger maintained by specific organizations or institutions, with controlled node access and customizable data access permissions. Typical applications include Hyperledger Fabric and AntChain. The advantages of consortium chains lie in compliance, controllability, and higher performance, but at the cost of openness and censorship resistance.

Which Model Does GCUL Fit Better?

Based on currently disclosed information, GCUL exhibits obvious consortium chain characteristics:

- Private and Permissioned: GCUL clearly operates on a "private and permissioned network," with node access and account permissions controlled by a managing authority.

- Target Users: Focused on financial institutions (such as CME Group), rather than public participation.

- Compliance First: Designed with traditional financial compliance requirements in mind, including KYC verification and transaction fees that meet outsourcing regulations.

- Technical Architecture: Although it supports smart contracts (based on Python), its underlying infrastructure is centrally maintained by Google Cloud, which differs from the decentralized Layer1 concept.

However, Google Cloud still insists on calling it "Layer1," emphasizing "trusted neutrality" and "infrastructure neutrality"—meaning any financial institution can use it, not just specific interest groups. This narrative attempts to blur the boundaries between public and consortium chains.

Third-Party Perspectives: Doubts and Observations

Industry practitioners have expressed different views on GCUL's positioning:

- Liu Feng, partner at BODL Ventures, believes that GCUL is more in line with the characteristics of a "consortium chain," and is fundamentally different from decentralized, permissionless public blockchains.

- Omar, partner at Dragonfly, said that Google's previous statements about GCUL were rather vague, and now the team is clearly inclined to package it as "Layer1," but the actual technical details have not been fully disclosed.

- Mert, CEO of Helius, pointed out that GCUL is still a "private and permissioned" system, different from the open model of public blockchains.

Despite the doubts, some believe that GCUL may represent a form of "incremental innovation." For example, the pilot between Google and CME Group shows that institutions have a demand for distributed ledger technology in scenarios such as settlement and collateral management. If GCUL can integrate Google's technical capabilities and financial compliance experience, it may find a practical path between traditional finance and blockchain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin due 2026 bottom as exchange volumes grind lower: Analysis

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.