HBAR Price Rebounds as Bullish Divergence Hints at Reversal

HBAR Price climbed 3% after weeks of decline, with traders spotting classic reversal signals. Technical and on-chain data now suggest the market could be shifting.

At press time, the HBAR price was trading near $0.240 after rebounding almost 3% in the past 24 hours. The bounce comes after a weak month where HBAR dropped 16.5%, showing a clear downtrend.

On the 7-day chart, gains were over 2%, suggesting the token has only just begun stabilizing. Still, technical and on-chain signals point to a deeper shift, with early signs of a bullish reversal emerging.

RSI Divergence Signals Buyers Returning

The most important indicator is the Relative Strength Index (RSI), which measures buying and selling momentum. Typically, when prices fall, RSI also trends lower. However, between August 19 and 25, HBAR’s price made a lower low, while RSI made a higher low.

HBAR Price And Possible Trend Reversal:

HBAR Price And Possible Trend Reversal:

This mismatch is called a bullish divergence. It means that even though the price went down further, sellers were weaker than before. Buyers absorbed more pressure and prevented momentum from collapsing.

Such divergences are often seen before a trend reversal, suggesting that the HBAR price may be close to ending its one-month decline. But that’s not the only bullish sign in play.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Net Flows and Bull-Bear Power Add Confirmation

Hedera (HBAR) netflows also support the case. On August 26, the token experienced net inflows of approximately $3.2 million into exchanges, indicating selling pressure.

By August 27, this had flipped to outflows of nearly $695,000. That shift represents a swing in net flows in just one day — a sign that buyers were starting to regain control.

HBAR Exchange Outflows Turn Negative:

HBAR Exchange Outflows Turn Negative:

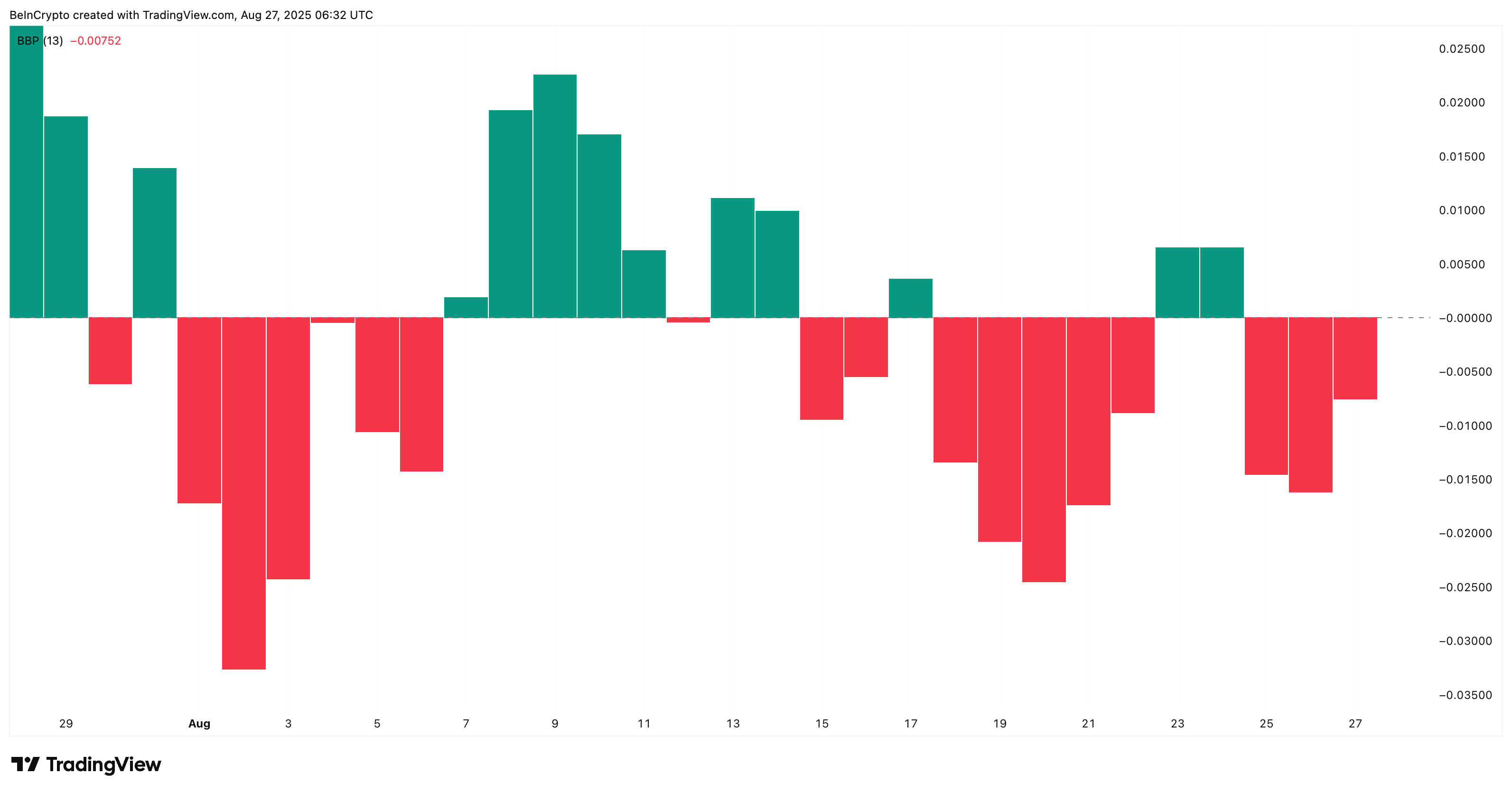

The Bull-Bear Power (BBP) indicator, which compares bullish strength against bearish pressure, also showed improvement. Bearish momentum fell from August 26 to 27, similar to drops seen between August 15–16 and August 21–22.

HBAR Bears Losing Hold:

HBAR Bears Losing Hold:

In both those earlier cases, HBAR bulls briefly took control. The current shift looks like a repeat, adding another layer of support to the bullish case. The HBAR bulls taking control this time, while the bullish divergence plays out, could be the trigger that the Hedera (HBAR) price has been eyeing.

HBAR Price Levels Show Critical Reversal Zones

The HBAR Price has also flipped a key level of $0.239 into support. This matters because levels once seen as resistance often act as bases when retested.

HBAR Price Analysis:

HBAR Price Analysis:

If HBAR Price holds this base, the next upside targets are $0.246 and $0.252. Breaking $0.257 would confirm a reversal, while a move above $0.276 would re-establish full bullish momentum and end the month-long downtrend.

If $0.239 fails, however, the HBAR Price could slip back toward $0.228, invalidating the bullish setup.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Espresso co-founder’s decade in crypto: I wanted to disrupt Wall Street’s flaws, but witnessed a transformation into a casino instead

Everything you've been hoping for may have already arrived; it just looks different from what you expected.

Solana Foundation Steps In as Kamino and Jupiter Lend Dispute Intensifies

Bitcoin Firms Confront the Boomerang Effect of Excessive Leverage

Ethereum Burns $18B, Yet Its Supply Keeps Growing