HYPE Hits $50 All-Time High as Hyperliquid Targets Breakout to $73

Hyperliquid’s HYPE hit a $50 ATH, gaining institutional attention via BitGo custody. Analysts now eye $55–$73 if momentum holds.

Hyperliquid (HYPE) has set a new all-time high (ATH) at $50, marking a key milestone.

With strong technical momentum and an outstanding growth story, HYPE is now facing the opportunity to break out toward $55–$73 in the short term.

From “Niche DEX” to An Institutional Asset in Focus

Data shows that Hyperliquid (HYPE) reached a new ATH of around $50.99 before pulling back slightly. This move signals an important psychological threshold as the ecosystem’s market capitalization and liquidity expand.

The new ATH for HYPE comes as BitGo announced custodial support for HyperEVM/HYPE for institutional clients. Support for a standardized custody channel, self-custody options, and an extensive wallet infrastructure enable institutional capital to participate.

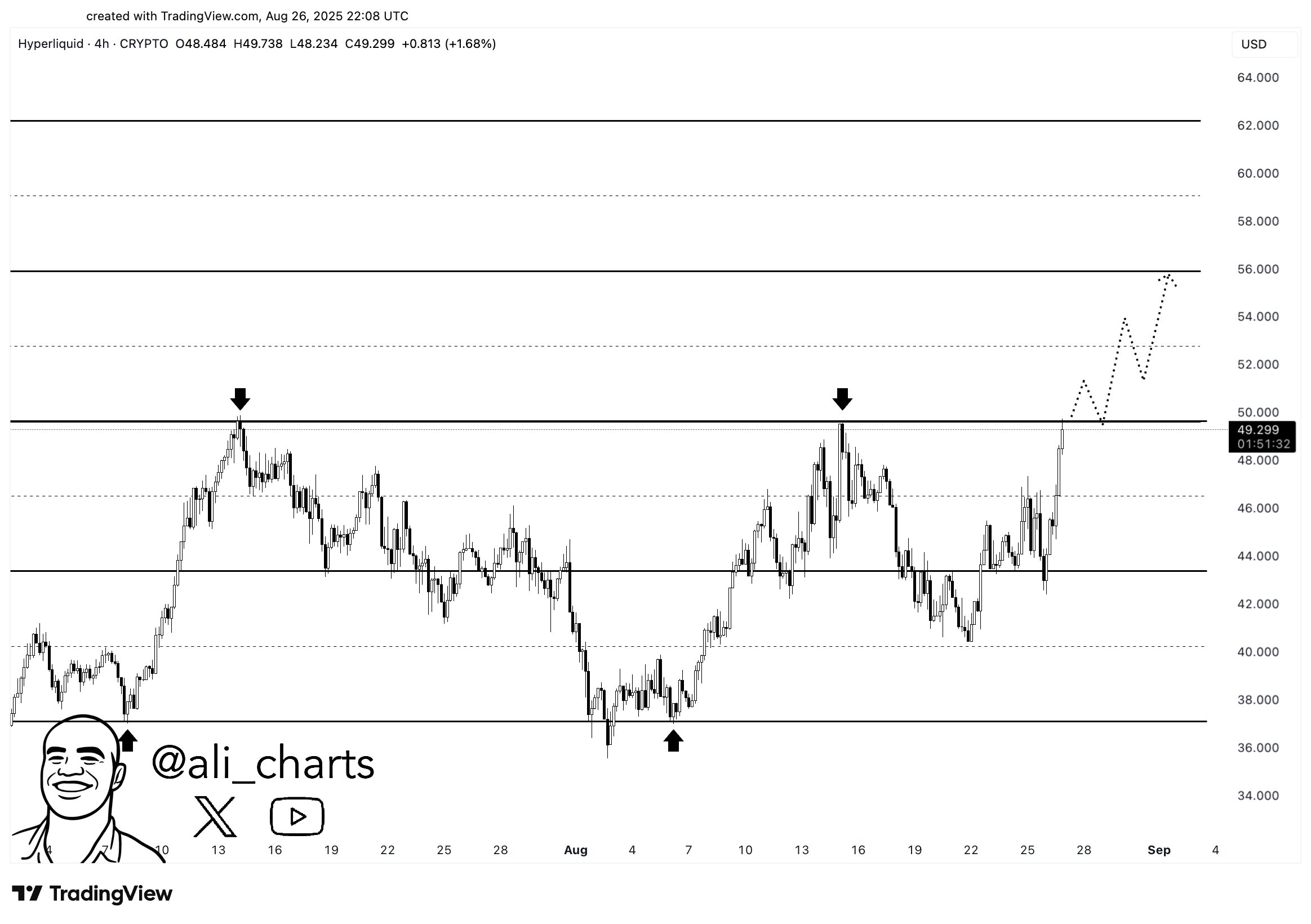

From a technical perspective, the $50–$51 zone represents a clear resistance level, coinciding with the fresh ATH. If this zone flips into support, the bullish trend structure would gain a second confirmation.

Some technical analysts highlight that the current breakout could extend toward $55. This aligns with the nearest measured move target after breaking short-term consolidation.

4H HYPE chart. Source:

4H HYPE chart. Source:

On larger timeframes, momentum signals suggest HYPE may advance to the 1.618 and 2.618 Fibonacci extensions, around $58 and $73. This advance is contingent on the rally sustaining and no bearish divergence emerging.

1D HYPE chart. Source:

1D HYPE chart. Source:

“HYPE is very close to break the resistance, and by judging from its momentum, there is a high probability that the resistance will be broken.” Kurnia Bijaksana stated.

On the fundamental side, Hyperliquid’s performance in recent months has been impressive. As BeInCrypto reported, the project’s revenue-per-employee ratio surpasses Apple and Tether. This offers an interesting glimpse into resource efficiency and potential profit margins for its on-chain orderbook model.

Moreover, July was a record-breaking month for ecosystem activity. If the current momentum and deflationary mechanism are maintained, Hyperliquid could see a boom in the future.

HYPE to Rise 126x in 3 Years?

With such developments, many experts believe HYPE could be the next hidden gem in the market. Arthur Hayes, co-founder of BitMEX, recently expressed optimism, predicting that HYPE could rise to 126x within three years.

This bold projection is based on the potential growth of the stablecoin segment and revenue from fees within the Hyperliquid ecosystem.

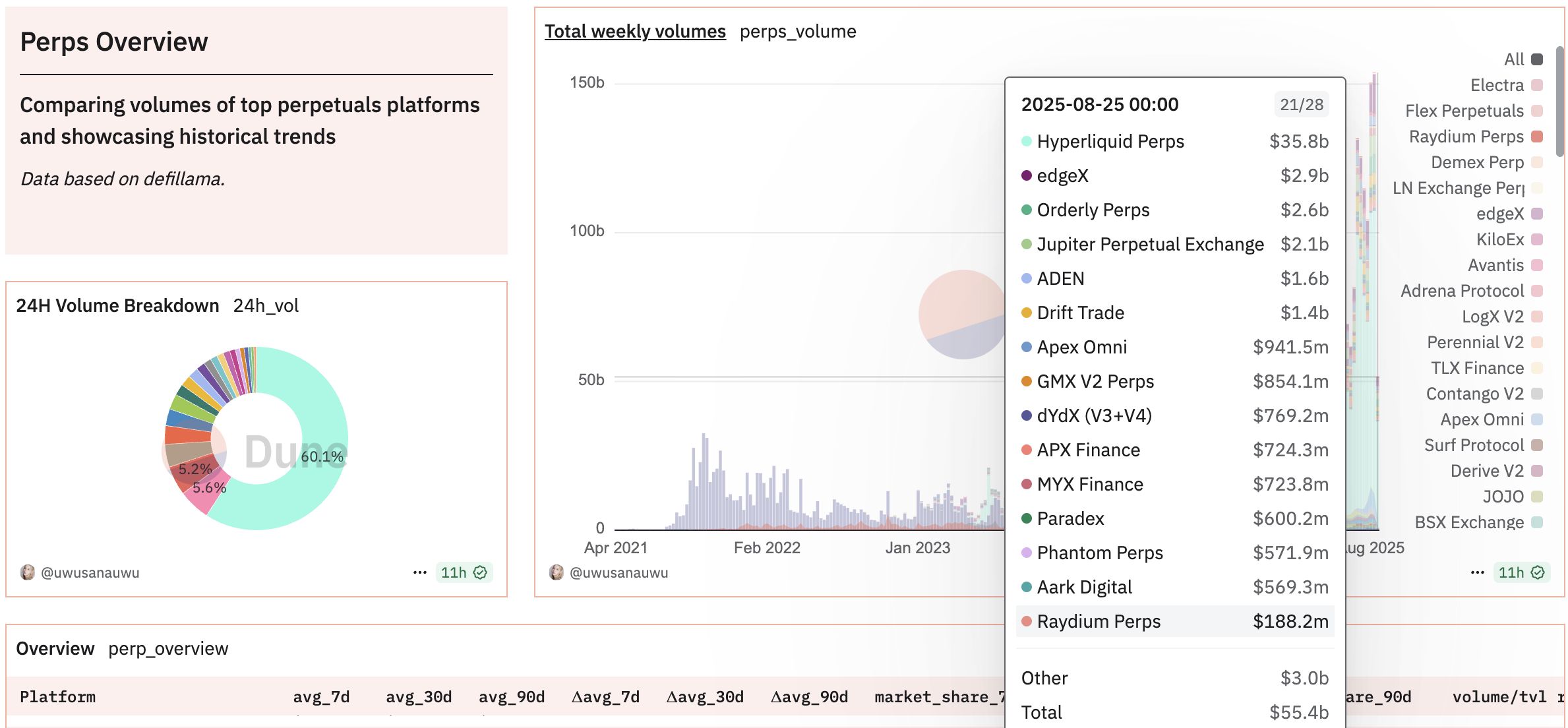

Perps DEXs’ market share. Source:

Perps DEXs’ market share. Source:

While this may seem ambitious, it reflects the broader view that Hyperliquid could benefit from network effects as the on-chain perpetuals market share expands. Data from Dune shows that Hyperliquid is currently at the top of the DEX perps with a total weekly trading volume of over $35.8 billion.

That said, investors must set realistic expectations. Targets of $55–$73 are achievable only if the $50 level holds as new support, breakout volume sustains, and no clear distribution pressure emerges on the daily chart.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Espresso co-founder’s decade in crypto: I wanted to disrupt Wall Street’s flaws, but witnessed a transformation into a casino instead

Everything you've been hoping for may have already arrived; it just looks different from what you expected.

Solana Foundation Steps In as Kamino and Jupiter Lend Dispute Intensifies

Bitcoin Firms Confront the Boomerang Effect of Excessive Leverage

Ethereum Burns $18B, Yet Its Supply Keeps Growing