Cronos (CRO) Price Surges on Trump Media Hype, But Liquidation Risks Mount

Cronos rallies on Trump Media hype, but overheated indicators and leveraged longs suggest liquidation risks could spark a pullback.

CRO has emerged as the market’s top gainer, surging nearly 50% in the past 24 hours. The rally is fueled by renewed strength in the broader crypto market and news of Trump Media Group (TMTG) acquiring CRO tokens.

While the surge has drawn bullish attention, on-chain signals point to a market that may already be overheated, raising the likelihood of a near-term pullback.

CRO Rockets on $6.42 Billion Trump Media Buzz

CRO has surged nearly 50% in the past 24 hours, with much of the rally tied to reports linking Trump Media to a large-scale CRO acquisition.

BeInCrypto reported that earlier news suggested Trump Media was preparing to purchase $6.42 billion worth of CRO tokens, which fueled market speculation and spurred bullish sentiment.

However, new disclosures now indicate that the plan is more measured. Rather than an immediate $6.42 billion buyout, the company will begin with approximately $200 million in cash and a token position equal to around 19% of CRO’s market cap.

Traders Pile Into Longs, Raising Liquidation Risks

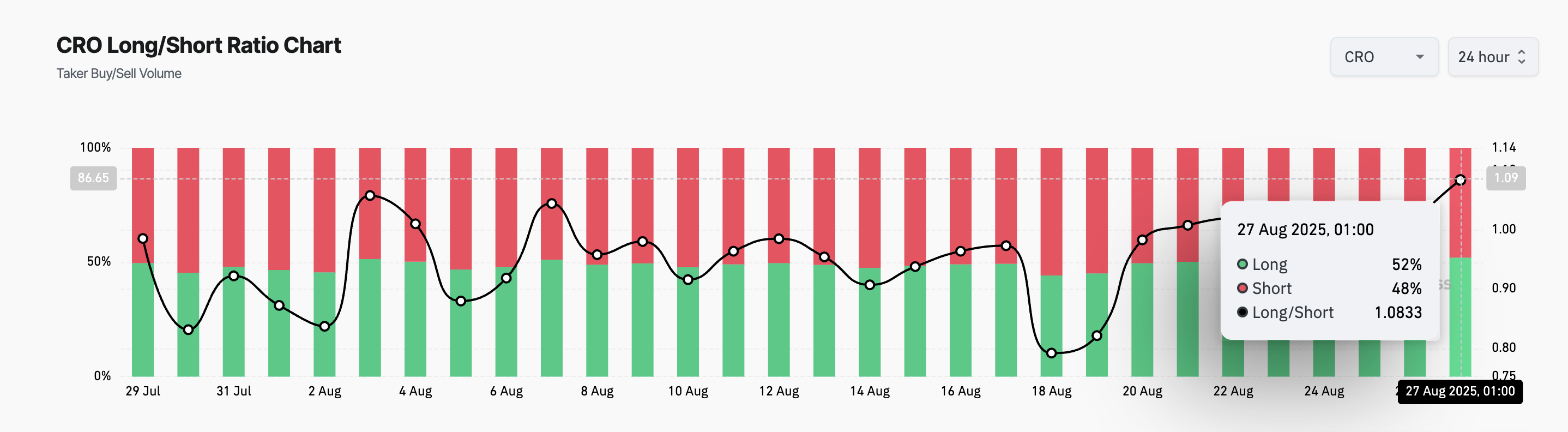

As CRO surged, its futures traders have rushed into long positions, pushing the token’s long/short ratio to a 30-day high. As of this writing, this stands at $1.08, per Coinglass.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

CRO Long/Short Ratio. Source:

Coinglass

CRO Long/Short Ratio. Source:

Coinglass

The long/short ratio measures the balance between traders betting on price increases versus those anticipating declines. A reading above 1 indicates that more traders are taking long positions, signaling strong bullish conviction, while values below one indicate a high demand for shorts.

While CRO’s long/short ratio suggests confidence in its upward momentum, it also exposes the market to greater liquidation risks. If its price faces a reversal, the heavy concentration of longs could trigger many forced sell-offs, worsening market volatility.

CRO Enters Overbought Zone

Readings from CRO’s Relative Strength Index (RSI) on the daily chart show that the altcoin has entered overbought territory, a classic indicator that it may be due for a dip. At press time, this indicator stands at 80.77.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 80.15, CRO’s RSI suggests the likelihood of a correction in the near term, with buyer exhaustion worsening. Any reversal in CRO’s current trend could trigger a drop to $0.195, its next major support floor.

CRO Price Analysis. Source:

TradingView

CRO Price Analysis. Source:

TradingView

On the other hand, if buyers continue accumulating CRO, it could reclaim $0.23 and rally to $0.27, a high last seen in May 2022.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Espresso co-founder’s decade in crypto: I wanted to disrupt Wall Street’s flaws, but witnessed a transformation into a casino instead

Everything you've been hoping for may have already arrived; it just looks different from what you expected.

Solana Foundation Steps In as Kamino and Jupiter Lend Dispute Intensifies

Bitcoin Firms Confront the Boomerang Effect of Excessive Leverage

Ethereum Burns $18B, Yet Its Supply Keeps Growing