Chainlink’s Institutional Push Redefines DeFi’s Future

- Chainlink (LINK) gains institutional traction with 20% monthly price surge, $24.03 valuation, and $16.31B market cap as of August 2025. - Bitwise files first U.S. LINK ETF while SBI Group partners for Asian tokenized assets, cross-border payments, and stablecoin infrastructure. - Chainlink Reserve accumulates $3.8M in LINK via real revenue, enhancing scarcity while achieving ISO 27001/SOC 2 compliance for institutional trust. - Resilient 12% 24-hour rally amid market volatility highlights strategic buyba

Chainlink (LINK) continues to strengthen its position in the blockchain and decentralized finance (DeFi) ecosystems, with recent developments highlighting its growing institutional adoption and market resilience. The token has surged approximately 20% over the past month, outpacing the DeFi category average of around 16%. As of August 2025, the price of LINK stands at $24.03, with a 1-year growth of 115.36% and a market capitalization of $16.31 billion. Despite a 5% decline in the last 24 hours following resistance at $27, the token has shown notable strength in the broader market.

Chainlink has also made headlines with the filing of a spot Chainlink Exchange-Traded Fund (ETF) by Bitwise, marking a significant milestone in bringing single-token crypto funds to U.S. markets. This move reflects growing institutional interest in LINK and underscores the token’s increasing recognition as a key infrastructure asset for blockchain applications. Meanwhile, SBI Group, a Japanese financial conglomerate with over $200 billion in assets, has formed a strategic partnership with Chainlink to advance tokenized assets, cross-border payments, and stablecoin infrastructure in Asia. This collaboration signals a potential expansion of Chainlink’s utility beyond its current DeFi and smart contract functions.

The Chainlink Reserve, launched in early August, has further demonstrated the project’s commitment to institutional-grade governance and transparency. The reserve has accumulated 150,770.02 LINK tokens, valued at approximately $3.8 million, through real revenue generated from institutional services and protocol fees. This initiative, funded by actual earnings, aims to enhance the token’s scarcity and provide a stable financial foundation for future growth. The reserve’s rapid accumulation rate suggests potential for increased market influence as the project scales further.

In addition to institutional partnerships and reserve growth, Chainlink has achieved compliance with ISO 27001 and SOC 2 standards, becoming the first on-chain oracle service provider to meet these benchmarks. These certifications are critical for financial institutions seeking secure on-chain integration and position Chainlink as a trusted partner for Web3 banking applications. Analysts highlight that this development aligns with the broader trend of traditional finance moving toward blockchain-based solutions, potentially unlocking new revenue streams for the Chainlink network.

Chainlink’s technological foundation remains central to its continued relevance in the crypto space. As the leading decentralized oracle network, Chainlink enables smart contracts on Ethereum and other blockchains to access secure, real-world data inputs and external APIs. This infrastructure is essential for DeFi platforms, insurance protocols, and automated blockchain applications. The network’s staking mechanism and node operator incentives ensure data integrity and reliability, reinforcing its role as a cornerstone of decentralized systems.

While the broader crypto market experiences volatility, Chainlink has shown resilience, particularly in the face of macroeconomic uncertainty. In August 2025, LINK outperformed the broader market by defying short-term weakness, with a 12% rally in a single 24-hour period. This performance was attributed to a combination of strategic buybacks, institutional adoption, and strong on-chain activity. Analysts suggest that Chainlink’s growth trajectory could continue if the project maintains its focus on expanding real-world asset (RWA) tokenization and cross-chain interoperability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether financial analysis: Needs an additional $4.5 billion in reserves to maintain stability

If a stricter and fully punitive approach is applied to $BTC, the capital shortfall could range from 1.25 billion to 2.5 billion USD.

The fundraising flywheel has stalled, and crypto treasury companies are losing their ability to buy the dip.

Although the treasury companies appear to have ample resources, the disappearance of stock price premiums has cut off their financing channels, causing them to lose their ability to buy the dip.

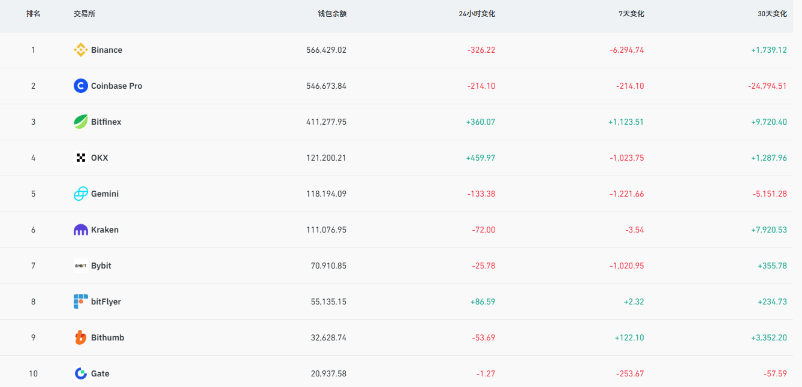

Nearly 10,000 bitcoins withdrawn from exchanges, is the market about to change direction?