Swarm Network raised $13 million to build a decentralized AI verification protocol, securing $10 million via NFT-based agent licenses and $3 million in strategic investments to scale onchain verification of offchain data.

-

$10M raised through NFT agent licenses enabling daily operator rewards

-

$3M from strategic investors including Sui, Ghaf Capital, Brinc, Y2Z, and Zerostage

-

Early adoption: Rollup News reports 128,000 users verified over 3 million posts

Swarm Network funding: $13M raise for decentralized AI verification; learn how NFT agent licenses power onchain data verification — read the report.

What is Swarm Network’s $13 million raise?

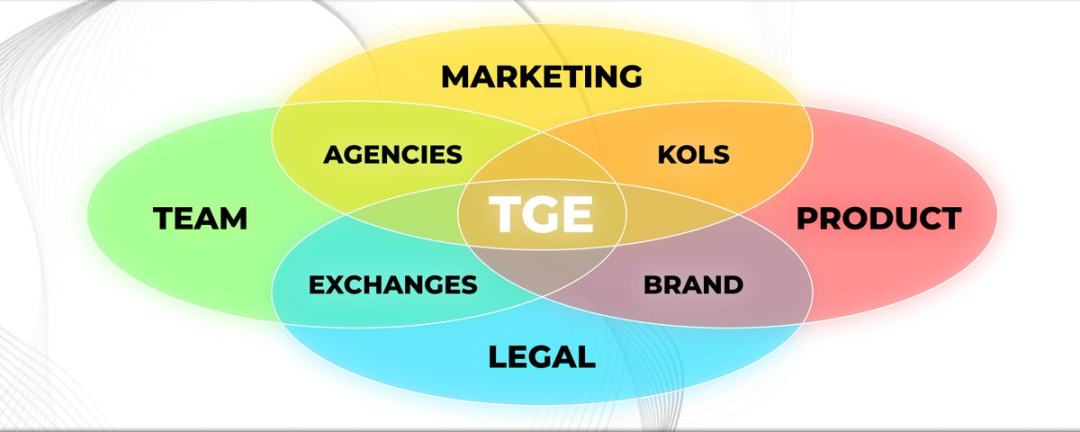

Swarm Network funding is a $13 million capital raise to develop a decentralized AI verification protocol that turns offchain data into verifiable onchain information. The round included $10 million from NFT-based agent licenses and $3 million from strategic investors to accelerate protocol development and adoption.

How were the funds raised and who invested?

Swarm sold NFT agent licenses that grant holders the right to operate agents and earn daily rewards, accounting for $10 million of the total. The remaining $3 million came from strategic backers including Sui, Ghaf Capital, Brinc, Y2Z, and Zerostage. Investments followed Swarm’s participation in the SuiHub Dubai global accelerator.

Why does Swarm Network matter for crypto and AI?

Swarm’s protocol addresses a core challenge: making offchain information auditable and trustable onchain. By combining decentralized agents with verifiable attestations, the project aims to increase transparency for AI-driven content verification and other data-sensitive blockchain applications.

What early traction has Swarm shown?

Swarm’s technology is already used by the AI-powered fact-checking solution Rollup News, which reports 128,000 users have verified over 3 million posts. This early adoption demonstrates demand for decentralized verification in content integrity workflows.

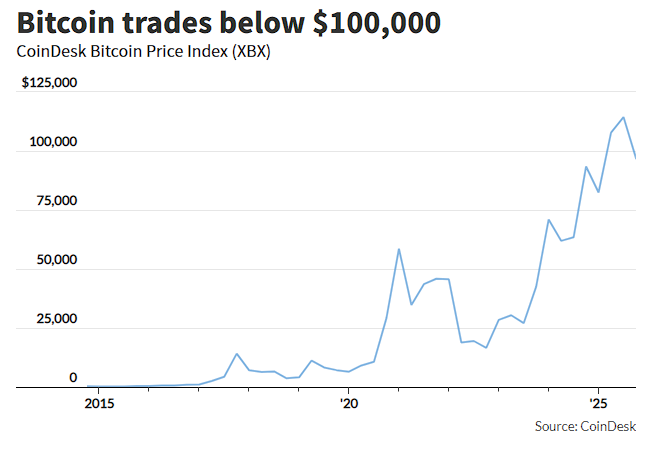

How does this fit into wider crypto-AI trends?

Blockchain and AI integration is accelerating. Institutional and venture capital interest in crypto-AI products is growing, with firms exploring AI-driven asset management, trading automation, and infrastructure pivots toward AI hosting. Swarm’s funding round is part of this broader movement to pair decentralization with AI capabilities.

What are the implications for AI agents in crypto?

AI agents that access tools and act autonomously are poised to become major protocol users. Industry commentary suggests agents will play larger roles in decentralized communities, with trust anchored by verifiable, onchain attestations produced by networks like Swarm.

Frequently Asked Questions

How do NFT agent licenses generate rewards?

License holders operate agents that perform verification tasks; the protocol distributes daily rewards to active operators based on participation metrics and network rules.

Can Swarm’s verifications replace centralized fact-checking?

Swarm provides verifiable attestations that increase transparency, but adoption depends on integration with applications and community governance; it augments rather than immediately replaces centralized systems.

Key Takeaways

- Funding structure: $10M from NFT licenses, $3M strategic investment.

- Use case: Decentralized conversion of offchain data into verifiable onchain attestations.

- Adoption signal: Rollup News reports large-scale user verification activity, indicating practical demand.

Conclusion

Swarm Network’s $13 million raise supports the buildout of a decentralized AI verification protocol that leverages NFT agent licenses to incentivize operator participation. With strategic backers and early adoption in content verification, Swarm aims to make onchain verification of offchain data practical and auditable. Follow developments from COINOTAG for updates and analysis.