Stellar price is positioned for a potential September rebound toward $0.50: XLM fell 11.17% over the last 30 days but a 38.59% surge in trading volume and historical September gains indicate a high probability of recovery to $0.40–$0.50 if bullish momentum continues.

-

Stellar price could reclaim $0.50 in September if historical averages repeat and volume-driven momentum holds.

-

Trading volume rose 38.59% to $471.95M, signaling increased investor interest and potential accumulation.

-

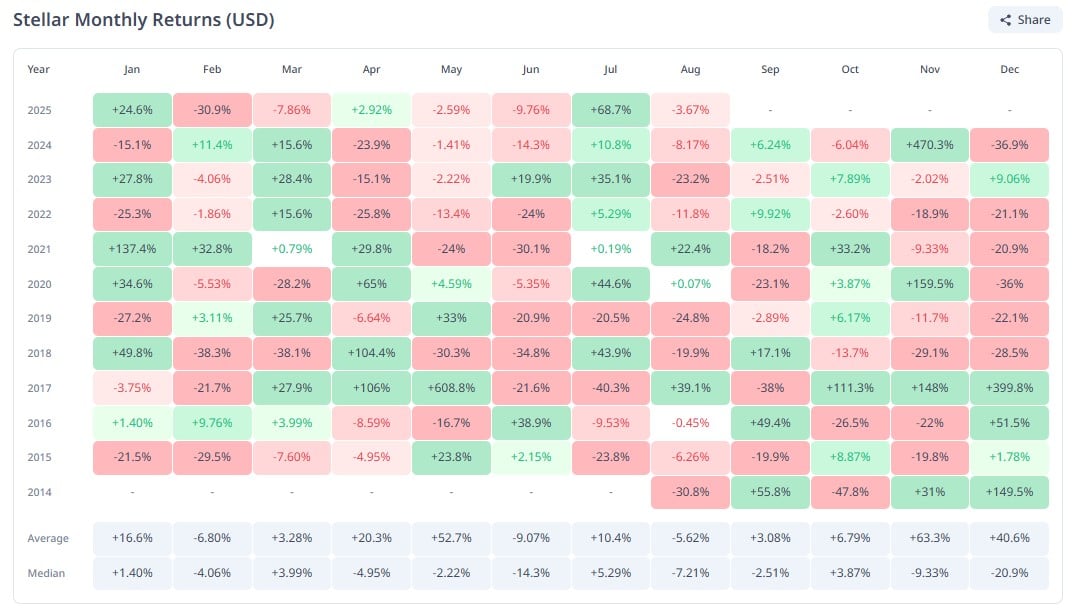

Historically, September averages from Cryptorank show positive returns (3.08% average; 6.24% in 2024), supporting bullish scenarios.

Stellar price outlook: XLM price shows rising volume and historical September strength—track momentum and act if price holds above $0.38. Read our analysis.

What is the current Stellar price outlook?

Stellar price is showing early bullish signals despite an 11.17% decline over the past 30 days, with the XLM price trading near $0.3869 and volume up 38.59% to $471.95 million. If historical September performance repeats, XLM could move toward $0.40–$0.50 in the coming weeks.

How does historical performance affect Stellar’s September prospects?

Cryptorank data indicates Stellar’s average September growth is 3.08%, and in 2024 the asset posted a 6.24% gain in September. Over the past 11 years, Stellar posted peak monthly gains—55.8% in September 2014 and notable rallies in 2016, 2018 and 2022. These recurring seasonal patterns increase the probability of a September rally for XLM.

Why has Stellar price been volatile recently?

Stellar has experienced notable short-term volatility, registering an 11.17% decline over 30 days as macro and crypto market flows shifted. The recent pullback coincided with broader altcoin rotation and profit-taking, while on-chain activity and trading volume spiked—often a precursor to directional moves.

What do volume and on-chain signals suggest for XLM price?

Trading volume climbed 38.59% to $471.95 million, indicating renewed investor interest. Higher volume on price dips typically signals accumulation by traders. Combined with historical September strength from Cryptorank and market sentiment tied to altcoin season, volume raises the odds of a recovery to the $0.40–$0.50 range.

Stellar Historical Performance | Source: Cryptorank

Stellar Historical Performance | Source: Cryptorank

When could Stellar price realistically reach $0.50?

If Stellar matches its average September growth, the asset could hit around $0.40 as a baseline and extend toward $0.50 if market-wide altcoin momentum accelerates. Short-term catalysts include increased adoption, higher trading velocity, and clearer regulatory signals for related assets.

What are key bullish and bearish catalysts for XLM?

Bullish catalysts: rising trading volume, seasonal September strength, and spillover from broader altcoin rallies. Bearish risks: renewed macro weakness, reduced liquidity, or negative regulatory developments that pressure crypto markets.

Frequently Asked Questions

Can Stellar realistically reclaim $0.50 this month?

If market momentum and volume persist, Stellar has a realistic path to $0.50. Short-term support around $0.38–$0.40 would need to hold while altcoin sentiment improves for XLM to reach that level.

How should investors interpret the recent 38.59% volume increase?

A 38.59% jump in volume to $471.95M often signals increased buying interest or institutional participation. Investors should combine volume data with price action and on-chain metrics before adjusting positions.

Key Takeaways

- Seasonal edge: Historical September performance favors modest gains for Stellar.

- Volume surge: A 38.59% increase in trading volume points to renewed market interest.

- Actionable insight: Watch support at $0.38–$0.40 and volume trends; a sustained breakout above $0.40 increases the probability of a move to $0.50.

Conclusion

This analysis finds Stellar price showing early signs of recovery after an 11.17% 30-day decline. With strong volume and historical September strength, XLM could retest $0.40 and target $0.50 should altcoin momentum accelerate. Monitor price, volume, and market-wide catalysts for confirmation. — COINOTAG Research, published 2025-08-27.

published: 2025-08-27 | updated: 2025-08-27 | author: COINOTAG