Solana Price Prediction: Can SOL Break Through $215 and Soar to $300?

Solana is struggling with key resistance around the $205 to $215 range—will increased institutional inflows push SOL above $300, or will a failure to hold support drive it lower? Here are today’s price predictions and outlook.

Solana (SOL) is once again in the spotlight, testing a key resistance level around $205 to $215 amid a surge in institutional capital inflows. Analysts predict that if this crucial technical threshold holds, a breakout could push its price toward the $300 region. Meanwhile, Solana’s treasury remains cautious in staking activities, adding a layer of strategic prudence to the bullish narrative.

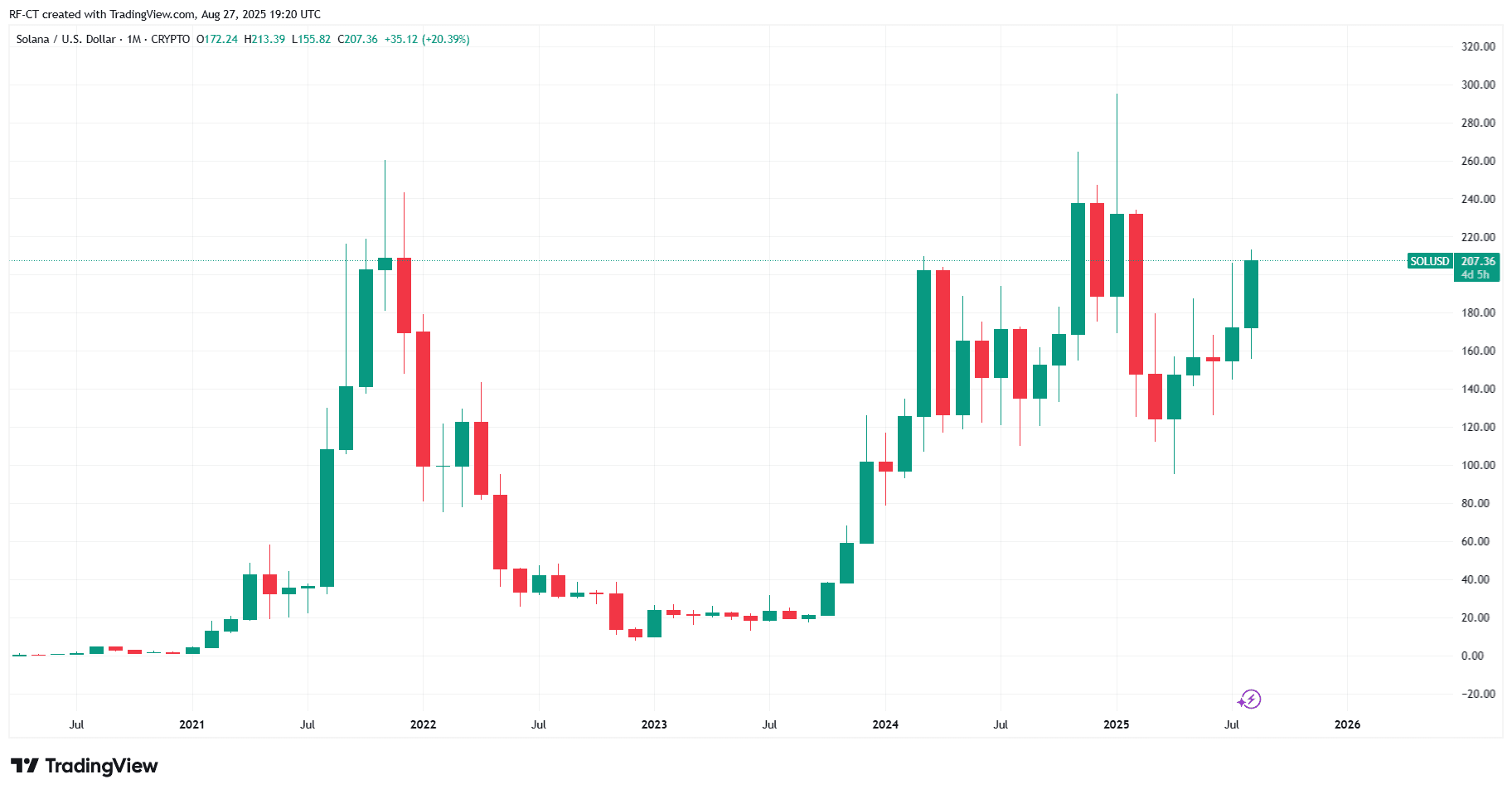

By TradingView - SOLUSD_2025-08-27 (YTD)

By TradingView - SOLUSD_2025-08-27 (YTD) SOL Pressures Key Resistance in the $205–$215 Range

Today, Solana’s price is at a strategic juncture. Technicals show frequent trading activity in the $205 to $215 range, and a breakout from this area could unleash significant upward momentum. Futures trading volume has soared—a source noted that $50 billion in SOL futures were recently exchanged—indicating heightened market interest and the potential for a breakout move.

Institutional Capital Flows May Drive the Next Rally

Institutional demand is coming to the forefront. Pantera Capital plans to raise up to $1.25 billion to establish a public “Solana company” treasury, signaling a deep conviction in SOL’s upward trend. This strategic accumulation could provide a launchpad for SOL to break through resistance.

SOL Price Prediction: $300 Within Reach

Multiple sources agree that a bullish scenario could unfold if resistance is breached:

- BraveNewCoin predicts that a breakout above $207 could validate a move toward $300, with $176 as downside support and $210–$215 as the decisive test.

- CoinStats notes strong support at $188, and a breakout could push SOL toward $215–$220, with a long-term target of $295.83.

- FXEmpire points out that with futures surging and SOL surpassing $200, the next wave may be underway—potentially paving the way for a new all-time high.

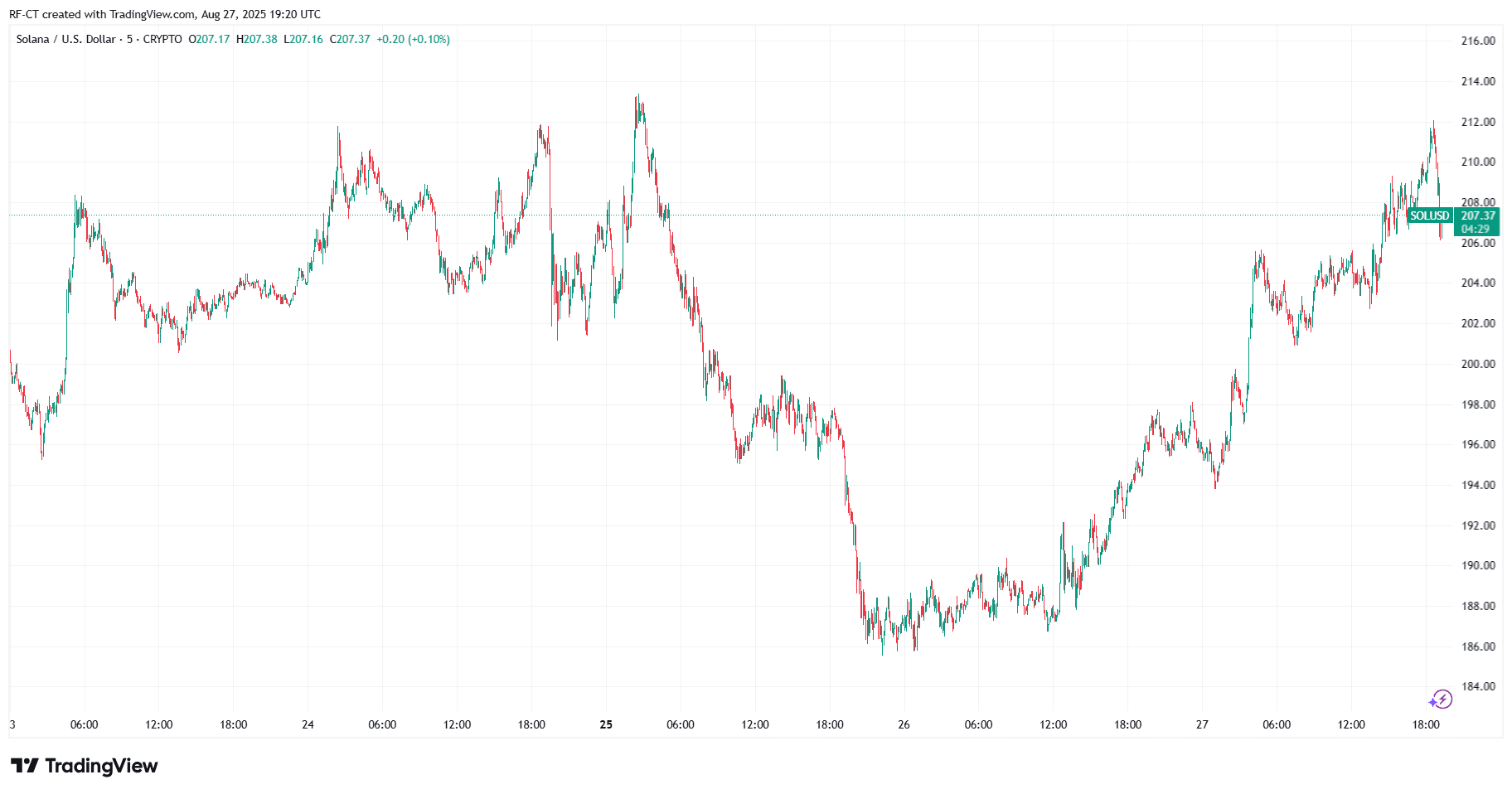

By TradingView - SOLUSD_2025-08-27 (5D)

By TradingView - SOLUSD_2025-08-27 (5D) Overall, if SOL decisively breaks through the $215 barrier, a move toward $300 seems well within the realm of possibility.

Staking Activity Remains Unexpectedly Low

Even as price action heats up, Solana’s treasury has yet to fully capitalize on staking opportunities. Most institutionally held SOL remains unstaked, which could limit the accumulation of passive yields and suggests a cautious treasury strategy amid volatile conditions.

Balancing Bullish Momentum with Risk Factors

Despite strong optimism, downside risks remain if SOL fails to hold the $200–$202 level:

Analysts warn that a drop below this threshold could keep SOL range-bound—or worse, lead to a decline toward $150, while a break below $190 could target $170.

Meanwhile, others highlight robust whale accumulation and ecosystem buybacks driving prices toward the $250–$295 range, which would strengthen the bullish case if momentum persists.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.