Numeraire (NMR) Cryptocurrency Soars After JPMorgan Invests $500 Million in AI Tokens

- Numeraire rises 100% after contribution from JPMorgan

- AI Tokens Reach $29,4 Billion in Value

- Jamie Dimon softens criticism and opens space for cryptocurrencies

The Numeraire (NMR) token, linked to the Numerai hedge fund, saw a strong surge in value after JPMorgan Asset Management confirmed its commitment to allocate $500 million to the project. The move placed the asset at the center of the artificial intelligence token market, a sector that has regained momentum this week.

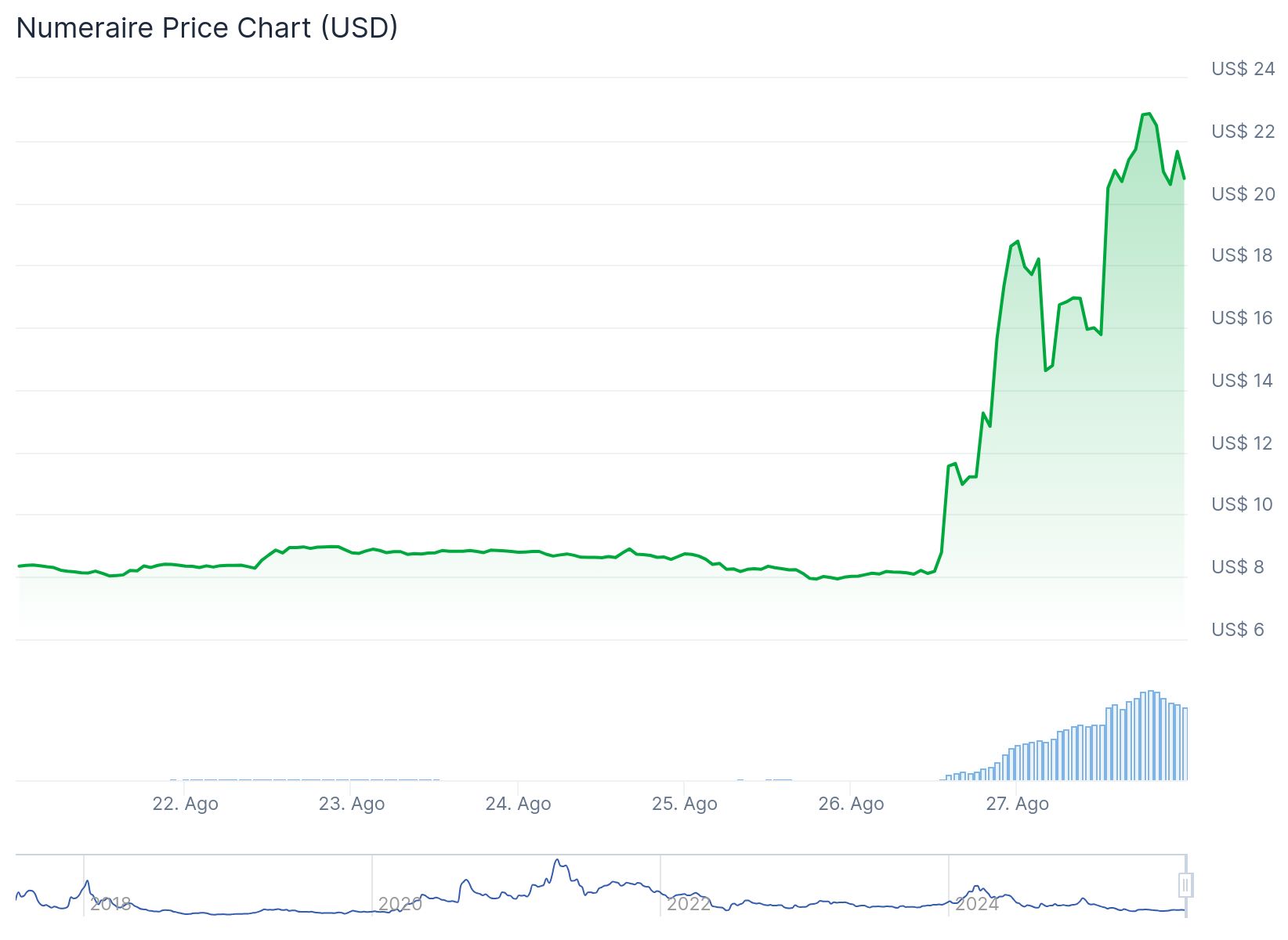

According to data, the NMR cryptocurrency soared more than 100% in just 24 hours, trading at around $23. This performance placed the cryptocurrency as a standout among AI assets, which together advanced 5,8% in the same period, reaching a market value of $29,4 billion.

The breakthrough occurred even after Nvidia disclose second-quarter results below expectations. The North American company, a leader in artificial intelligence hardware, is often seen as a bellwether for the sector.

Founded in 2015, the Numerai adopts a unique model in the financial market, crowdsourcing predictions from data scientists. Participants compete in cryptographic tournaments to predict stock prices, receiving NMR rewards for the best performances. This strategy has already attracted renowned investors such as Paul Tudor Jones, Naval Ravikant, and Howard Morgan, co-founder of Renaissance Technologies.

In the hedge fund industry, the term "capacity" means that an investor guarantees access to a fund with a pre-defined value, even if new contributions are limited in the future. This practice signals a capital commitment, even if the funds are not immediately transferred.

JPMorgan's involvement with Numerai also reflects a shift in the bank's stance on cryptocurrencies. CEO Jamie Dimon, who in the past called Bitcoin a "fraud" and compared digital assets to "decentralized Ponzi schemes," has adopted a more flexible tone. In May, he stated that, while he does not personally support Bitcoin, he allows the bank's clients access to the asset. In June, the institution revealed it was evaluating cryptocurrency-backed loans and credit products secured by digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP's Distribution Phase and Path to $20: A Bullish Investment Case

- XRP’s $20 price target is supported by technical indicators, institutional adoption, and macroeconomic catalysts, with consolidation near $3.00 and key resistance levels at $3.01–$3.03. - Ripple’s ODL service processed $1.3T in Q2 2025, while SEC lawsuit resolution unlocked $7.1B liquidity and ETF inflows signaled growing institutional confidence in XRP. - Macro factors like potential $8.4B ETF inflows and 80% approval probability by October 2025, plus XRP’s role in 300+ financial institutions, amplify i

Ethereum’s Strategic Dominance in the Stablecoin Era: A Wall Street-Backed Opportunity

- Ethereum dominates 50% of the global stablecoin market ($102B in USDT/USDC) by August 2025, driven by institutional adoption and regulatory clarity. - Institutional investors allocated $3B to Ethereum staking by Q2 2025, with tokenized assets surging to $412B, including $24B in real-world asset tokenization. - The U.S. GENIUS Act (July 2025) mandated 1:1 HQLA reserves for stablecoins, while Ethereum ETFs attracted $10B in assets, outpacing Bitcoin counterparts. - Ethereum's Pectra/Dencun upgrades reduced

Chimpzee Charity Tickets and the Rise of Impact-Driven ReFi NFTs: How $50 Reusable NFTs Are Bridging Crypto Speculation and Environmental Stewardship

- Chimpzee Charity Tickets offer $50 reusable NFTs combining crypto incentives with measurable environmental impact via tree planting and CO₂ removal. - The project’s four-tier Passport system rewards long-term participation through staking and exclusive perks, aligning financial gains with conservation efforts. - Over 20,000 trees planted and 1,000 sqm of rainforest protected through verified partnerships, with $250,000 in direct environmental funding from ticket sales. - Leveraging Ethereum’s energy-effi

Why Ethereum and Remittix (RTX) Present High-Conviction Opportunities in September 2025

- In September 2025, crypto investors balance Ethereum (macro-driven) and Remittix (utility-first) to hedge risks and capture growth. - Ethereum gains from institutional ETF inflows ($5.4B+), staking yields (4.5–5.2%), and Pectra/Dencun upgrades boosting DeFi TVL by 33%. - Remittix targets $19T remittance market with 0.1% fees, 50% fee burning, and 7,500% projected returns by 2026, outpacing Ethereum's 130%. - Low correlation between assets enables diversification: Ethereum offers stability, while RTX deli