Blockchain-Driven Electoral Reform in Africa: A High-Impact, High-Growth Investment Opportunity

- Africa's electoral systems face fraud, delayed elections, and authoritarian overreach, undermining democracy and foreign investment. - Blockchain offers tamper-proof voting through decentralization, biometric authentication, and cryptographic transparency to restore trust. - Despite $122.5M in 2024 funding, blockchain electoral startups remain undercapitalized, presenting a high-impact investment niche with $1.2T global market potential. - Risks include infrastructure gaps and political resistance, but h

Africa's democratic governance is at a crossroads. For decades, traditional voting systems across the continent have been plagued by fraud, manipulation, and a lack of transparency. From Comoros to Mali, leaders have circumvented term limits, delayed elections, or co-opted institutions to maintain power. Yet, amid these challenges lies a transformative opportunity: blockchain technology. By decentralizing electoral processes, ensuring immutability, and fostering trust, blockchain could redefine democracy in Africa—and unlock a high-impact, high-growth investment niche for forward-thinking investors.

The Problem: A Fractured Electoral Landscape

Africa's electoral systems are increasingly under siege. In 2024 alone, 19 countries held presidential or general elections, many of which were marred by authoritarian overreach. Military juntas in Mali and Chad have postponed elections indefinitely, while leaders in Comoros and Senegal have manipulated legal frameworks to extend their tenure. Traditional electronic voting systems, such as Namibia's 2014 EVMs or Nigeria's biometric verification, have proven unreliable due to technical failures and limited accessibility. These issues erode public trust and destabilize economies, as political uncertainty deters foreign investment and exacerbates social tensions.

The Solution: Blockchain as a Democratic Catalyst

Blockchain technology offers a compelling antidote to these systemic flaws. Its decentralized, tamper-proof ledger system ensures that votes are recorded securely, verified transparently, and stored immutably. Key advantages include:

- Anonymity with Transparency: Voters remain anonymous, but their votes are publicly verifiable through cryptographic hashing.

- Fraud Prevention: Biometric authentication and smart contracts eliminate double-voting and unauthorized alterations.

- Decentralized Infrastructure: A distributed network of nodes prevents single points of failure, reducing the risk of manipulation.

Experimental models, such as the Byzantine General Problem-based BBVV system tested on Algorand's TestNet, demonstrate blockchain's potential to enhance local and national vote aggregation. Meanwhile, policy roadmaps like Engineering Trust (2025) outline scalable strategies for integrating blockchain into Sub-Saharan Africa's electoral systems, emphasizing Nigeria as a testbed for innovation.

The Investment Landscape: A Niche with Explosive Potential

Despite its promise, blockchain-driven electoral reform remains underfunded. The African Blockchain Report 2024 reveals that startups in this space secured only $122.5 million in venture capital in 2024—a 36% drop from 2023. Most funding is concentrated in financial services (e.g., DeFi platforms), while electoral reform projects struggle to attract capital. However, this gap represents a golden opportunity.

Why Invest Now?

1. High-Impact Social Returns: By enabling free and fair elections, blockchain startups can stabilize democracies, reduce political violence, and attract foreign investment. A 2024 study in Digital Policy Studies links digital transparency to a 20% increase in investor confidence in emerging markets.

2. Scalable Infrastructure: As African governments prioritize digital transformation, blockchain solutions will become critical for modernizing electoral commissions. For example, South Africa's 2024 municipal elections showcased early-stage digital tools, signaling a path toward national adoption.

3. Policy Tailwinds: The African Union and regional bodies like ECOWAS are increasingly advocating for technology-driven electoral reforms. Startups that align with these frameworks will benefit from regulatory support and public-private partnerships.

Risks and Mitigations

- Infrastructure Gaps: Limited internet access and digital literacy in rural areas pose challenges. However, hybrid models (e.g., offline biometric verification with blockchain back-end) can bridge this divide.

- Political Resistance: Incumbents may resist blockchain adoption to preserve power. Investors should prioritize startups with strong institutional partnerships and phased implementation strategies.

- Technical Complexity: Scalability and energy consumption remain hurdles. Startups leveraging energy-efficient consensus mechanisms (e.g., proof-of-stake) and modular architectures will gain an edge.

Data-Driven Insights: Tracking the Opportunity

The performance of African blockchain firms like Yellow Card and Kredete—despite their focus on financial services—highlights the continent's growing appetite for digital innovation. While electoral reform startups lag in funding, their potential to disrupt a $1.2 trillion global election technology market cannot be ignored.

The Road Ahead: A Call to Action for Investors

Blockchain-driven electoral reform is not just a technological shift—it's a political and economic revolution. For investors, this sector offers a unique blend of social impact and financial upside. Early-stage bets on startups developing secure, scalable blockchain solutions for Africa's electoral systems could yield exponential returns as adoption accelerates.

Key Investment Criteria:

- Government Partnerships: Startups with pilot projects in Nigeria, Kenya, or South Africa.

- Technical Robustness: Use of AI for fraud detection and energy-efficient consensus algorithms.

- Community Trust: Solutions that prioritize voter education and local stakeholder engagement.

In an era where democracy is under threat, blockchain is more than a tool—it's a lifeline for African nations seeking to reclaim their political futures. For investors, the time to act is now.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 15th November, 2025

Cathie Wood’s ARK Invest Buys Circle, BitMine, and Bullish Shares Amid Market Dip

Bitcoin Heads Into Weekend Under Pressure as Price Tests Key Support Levels

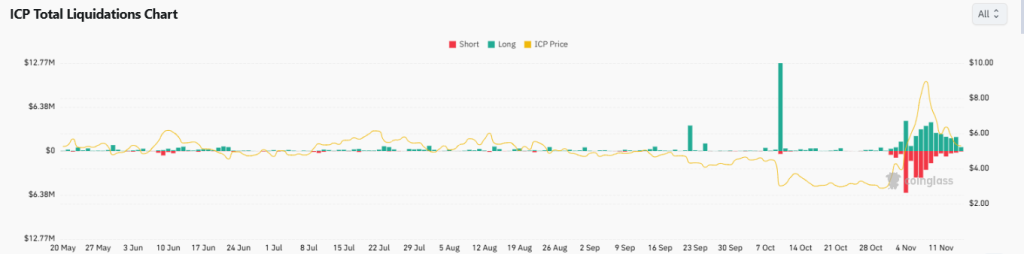

Internet Computer Price Prediction 2025: Is ICP Aimed for $1 Fall Before a Reversal Ahead?