Navigating the Hidden Dangers of DEXs: Systemic Risks and Institutional Investor Strategies

- DEXs offer DeFi innovation but pose systemic risks via AMM price lags and liquidity vulnerabilities, as seen in the 2025 XPL token collapse. - Whale-driven market manipulation exploits pre-market thin liquidity, draining pools and triggering $7.1M in retail losses during the XPL incident. - Institutional investors adopt dynamic risk tools, smart contract audits, and regulatory advocacy to mitigate DEX risks, with 85% loss reduction reported by some funds. - Growing DeFi-TradFi integration raises systemic

In the fast-evolving world of decentralized finance (DeFi), decentralized exchanges (DEXs) have emerged as both a beacon of innovation and a hotbed of systemic risk. For institutional investors, the allure of DEXs—transparent pricing, instant settlement, and tokenized assets—comes with a dark underbelly: thin liquidity, algorithmic pricing flaws, and the potential for explosive market manipulation. As we approach 2025, the lessons from recent events like the XPL token collapse on Hyperliquid DEX underscore the urgent need for a recalibration of risk management strategies.

The Mechanics of DEX Vulnerabilities

DEXs rely on Automated Market Makers (AMMs) to set prices using mathematical formulas, such as the constant product invariant. While this model eliminates intermediaries, it creates a lag in price adjustments to new information. Arbitrageurs exploit this gap, triggering Loss-Versus-Rebalancing (LVR) for liquidity providers. For example, a 2025 incident saw a $47.5 million manipulation of the XPL token, where whales drained liquidity pools and triggered cascading liquidations of retail short positions. The attack exploited the lack of circuit breakers and real-time surveillance tools, leaving institutional investors exposed to sudden, unidirectional losses.

Pre-Market Risks: A Perfect Storm

Pre-market trading on DEXs is particularly perilous. Unlike centralized exchanges, DEXs often lack the safeguards of order books and specialists to stabilize prices. Thin liquidity in pre-launch tokens—assets with undefined circulating supplies—creates fertile ground for manipulation. In the XPL case, four whale addresses injected $16 million in USDC to corner the market, triggering a liquidity vacuum that wiped out $7.1 million in retail positions. For institutions, this highlights the danger of overexposure to low-liquidity tokens, where a single whale can dictate price movements.

Institutional Investor Strategies: Mitigating the Risks

To navigate these challenges, institutional investors must adopt a multi-layered approach:

- Dynamic Risk Tools: Platforms like Nansen and Dune Analytics offer real-time dashboards to track liquidity pools, TVL (Total Value Locked), and whale activity. For instance, monitoring Liquidity Stability Impact Scores (LSIS) can preemptively flag fragile pools.

- Smart Contract Audits: Post-2023, 48% of institutions integrated third-party audits to identify vulnerabilities in cross-chain bridges and AMMs. A European fund reduced DEX-related losses by 85% after implementing automated compliance checks and multi-signature wallets.

- Regulatory Advocacy: Push for mandatory reporting of large trades and anti-manipulation protocols. The Financial Stability Board (FSB) has already flagged the need for cross-border cooperation to address DeFi's regulatory gaps.

The Bigger Picture: Systemic Implications

The XPL incident isn't an isolated event. As DeFi grows, its integration with traditional finance (TradFi) could amplify systemic risks. For example, tokenized equities or bonds traded on DEXs could trigger cascading failures if liquidity dries up. The FSB warns that while current interlinkages are limited, the potential for spillovers increases with scale. Institutions must prepare for scenarios where DEX collapses ripple into TradFi, destabilizing portfolios and markets.

Actionable Advice for Investors

- Avoid Over-Concentration: Steer clear of pre-launch tokens with undefined liquidity. Stick to established DEXs with robust TVL metrics.

- Leverage Analytics: Use tools like altFINS and Hypurrscan to track order-book depth and whale activity in real time.

- Demand Institutional Safeguards: Advocate for mandatory circuit breakers, position limits, and dynamic EMA (Exponential Moving Average) caps on DEX platforms.

Conclusion

The rise of DEXs has democratized access to financial markets, but it has also introduced unprecedented risks. For institutional investors, the key lies in balancing innovation with vigilance. By adopting advanced analytics, pushing for regulatory clarity, and avoiding speculative tokens, institutions can mitigate the systemic threats of DEXs while capitalizing on their transformative potential. The future of DeFi will be defined not by its technology alone, but by how well it adapts to the realities of market stability.

In the end, the lesson from XPL and other DEX crises is clear: in the decentralized world, transparency is a double-edged sword. Those who wield it wisely will thrive; those who ignore it will find themselves on the wrong side of history.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Heads Into Weekend Under Pressure as Price Tests Key Support Levels

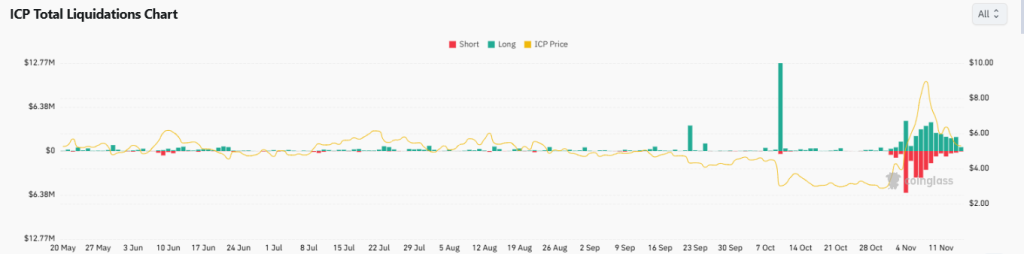

Internet Computer Price Prediction 2025: Is ICP Aimed for $1 Fall Before a Reversal Ahead?

Why XRP Price Didn’t Surge After the ETF Launch?

Bitcoin’s “Silent IPO”: A Sign of Market Maturity and Future Implications