CME XRP Futures: A Catalyst for Institutional Adoption and Regulatory Legitimacy in Crypto Markets

- CME XRP Futures (May 2025) transformed XRP into a strategic institutional asset, with $9.02B open interest by August. - SEC's 2025 legal clarity removed regulatory barriers, enabling 11 XRP ETF applications and potential $5–$8B inflows if approved. - XRP's real-world utility in cross-border payments (300+ institutions) and $0.0002 transaction costs reinforce its legitimacy vs. speculative altcoins. - Global regulatory shifts (U.S. Project Crypto, Canada's ETF approvals) and $30B crypto derivatives market

The resolution of the SEC vs. Ripple lawsuit in August 2025 marked a turning point for XRP , but the true test of its legitimacy lies in how institutions have responded. The launch of CME XRP Futures on May 19, 2025, and the subsequent explosion in open interest—surpassing $9.02 billion by August—demonstrate that institutional investors are no longer viewing XRP as a speculative token but as a strategic asset in regulated markets. This shift is not just a technicality; it's a seismic change in how crypto assets are integrated into mainstream finance.

Legal Clarity as a Foundation for Institutional Confidence

The SEC's confirmation that XRP is not a security on public exchanges removed a critical regulatory overhang. For years, institutions avoided XRP due to the risk of SEC enforcement actions. Now, with a clear legal framework, asset managers can allocate capital to XRP without fear of regulatory reprisal. This clarity has directly enabled the filing of 11 spot XRP ETF applications, including from Grayscale, Bitwise, and Franklin Templeton. If approved in October 2025, these products could inject $5–$8 billion into XRP, mirroring the ETF-driven price surges seen in Bitcoin and Ethereum .

CME XRP Futures: A New Benchmark for Liquidity and Legitimacy

CME Group's entry into the XRP derivatives market was no small feat. By offering micro and standard-sized contracts (2,500 and 50,000 XRP, respectively), CME provided a scalable tool for hedging and speculation. The use of the CME CF XRP-Dollar Reference Rate—calculated daily at 4:00 p.m. London time—ensures transparency and reduces counterparty risk, two red flags for institutional investors.

The numbers tell the story:

- $19 million in notional volume within 24 hours of the first block trade.

- $143.2 million in average daily trading volume by August.

- $9.02 billion in open interest in just over three months, a 1,100% increase.

This growth outpaces even Bitcoin and Ethereum's derivatives adoption curves, signaling that XRP is now a core component of institutional crypto portfolios.

Real-World Utility: XRP as a Payments Infrastructure Play

Beyond derivatives, XRP's value proposition lies in its utility. Over 300 financial institutions , including Santander , Standard Chartered, and American Express , use XRP via RippleNet for cross-border payments. The token's ability to settle transactions for $0.0002—compared to SWIFT's $50+ per transaction—has made it a cost-effective solution for global treasuries. This real-world adoption reinforces XRP's legitimacy, distinguishing it from speculative altcoins.

Regulatory Tailwinds and the Path to Mainstream Acceptance

The U.S. regulatory landscape is shifting under SEC Chairman Paul Atkins' Project Crypto initiative, which prioritizes modernizing digital asset rules over enforcement. This includes clearer guidelines for crypto issuance, regulatory sandboxes, and investor protection measures. The dropping of multiple enforcement cases and the reversal of prior constraints have created a more favorable environment for innovation.

Internationally, Canada's approval of three XRP spot ETFs in June 2025 provides a blueprint for U.S. regulators. As global adoption accelerates, XRP's role in cross-border payments and institutional portfolios will only strengthen.

Investment Implications and Strategic Considerations

For investors, the convergence of legal clarity, derivatives infrastructure, and real-world utility creates a compelling case for XRP. The October 2025 ETF decision is a pivotal event: if approved, it could drive XRP to $10–$15, a 200–300% gain from current levels. Even without ETFs, the $30 billion notional open interest in CME crypto derivatives (with XRP at $1 billion) suggests sustained institutional demand.

However, risks remain. While the SEC's stance has softened, regulatory uncertainty persists for other tokens. XRP's success hinges on its unique position as a utility-driven asset, not a speculative play. Investors should also monitor the $3.38 resistance level and the broader crypto market's reaction to macroeconomic trends.

Conclusion: A New Era for Crypto Derivatives

CME XRP Futures are more than a product—they are a signal. They reflect the maturation of crypto markets, where derivatives infrastructure, regulatory clarity, and real-world utility converge to create legitimacy. For institutions, XRP is no longer a fringe asset but a tool for hedging, diversification, and global payments . For investors, this represents a rare opportunity to participate in a crypto asset with both speculative upside and foundational value.

As the October ETF decision looms, the stage is set for XRP to break through its current price ceiling. In a world where crypto's future is increasingly tied to institutional adoption, CME XRP Futures are the bridge between speculation and mainstream acceptance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Canary Capital Files for Staked Injective ETF, Will INJ Price Recover From 30% Monthly Drop?

Trump Media is merging with fusion power company TAE Technologies in $6B+ deal

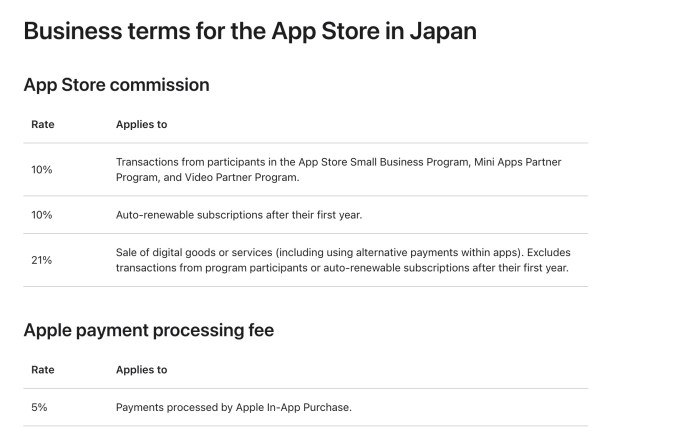

Apple opens up its App Store to competition in Japan

Top 5 Presale Tokens Investors Are Accumulating in 2025: IPO Genie ($IPO) Ranks High