Decentralized AI Verification as a Scalable Infrastructure Play: Why Swarm Network’s $13M Raise Signals a High-Growth, Mission-Driven Entry Point in

- Swarm Network raised $13M via NFT-based Agent Licenses and strategic investors to build decentralized AI verification infrastructure. - The platform combines blockchain transparency with AI agents, enabling 10,000+ license holders to validate data and earn rewards. - Partnerships with Sui blockchain and tools like Rollup News (3M+ verified posts) demonstrate scalable solutions for combating misinformation. - Targeting a $10B+ market by 2030, Swarm's model addresses trust gaps in AI while creating financi

The convergence of artificial intelligence and blockchain is no longer a speculative trend but a foundational shift in how trust is established in the digital economy. At the heart of this transformation lies a critical question: How can we verify the integrity of AI-generated data at scale? Swarm Network’s recent $13 million raise—$10 million from public NFT-based Agent Licenses and $3 million from strategic investors like Sui , Ghaf Capital, and Brinc—offers a compelling answer. This funding round, coupled with the launch of its AI Agent Layer, positions Swarm as a mission-driven infrastructure play in a market projected to exceed $10 billion by 2030 [1].

The Infrastructure Opportunity

Decentralized AI verification is emerging as a $10B+ market, driven by the need to combat misinformation, secure data integrity, and democratize AI development [1]. Traditional centralized systems struggle with scalability and trust, while blockchain’s transparency and tokenized incentives create a framework for decentralized collaboration. Swarm’s approach is unique: it tokenizes AI verification through Agent Licenses, NFTs that grant operators the right to run AI agents and earn rewards for validating off-chain data. With over 10,000 license holders already active, the network has demonstrated a scalable model for incentivizing participation [2].

This model contrasts with competitors like Bittensor, which focuses on decentralized AI model training, and Numerai, which relies on data scientists for financial predictions. Swarm’s differentiation lies in its real-world application—Rollup News, an AI-powered fact-checking platform with 128,000 users who have verified over three million posts. This practical use case underscores the network’s ability to address immediate societal needs while building infrastructure for broader AI adoption [3].

Strategic Partnerships and Scalability

Swarm’s partnership with Sui, a high-throughput blockchain, is a strategic masterstroke. Sui’s architecture supports the volume of transactions required for AI verification, ensuring the network can scale without compromising speed or cost efficiency. This collaboration also earned Swarm a spot in SuiHub’s Dubai accelerator, a program that selected only six startups from 630 applicants—a testament to its technical and business potential [4].

In contrast, Bittensor’s subnet-based structure and Numerai’s institutional backing highlight different paths to scalability. However, Swarm’s hybrid model—combining NFT-based licensing with strategic investments—creates a self-sustaining ecosystem. The Agent BUIDL tool, which allows license holders to customize AI agents for specific tasks, further enhances this model by enabling niche verification applications [5].

A Mission-Driven Investment Thesis

Swarm’s mission extends beyond profit. By decentralizing AI verification, it empowers individuals to participate in a trust layer for the digital economy. The Rollup News platform exemplifies this: users earn rewards for fact-checking, creating a financial incentive to combat misinformation. This aligns with broader industry trends, such as the integration of AI and blockchain in finance and supply chain management, where transparency is paramount [6].

For investors, the opportunity is twofold: first, to capitalize on a market growing at 23% CAGR [1], and second, to support a project with a clear social impact. Swarm’s $13 million raise is not just a funding event—it’s a signal that the infrastructure for decentralized AI verification is maturing.

Conclusion

Swarm Network’s $13 million raise represents a high-growth entry point in the AI-blockchain convergence. By combining tokenized incentives, strategic partnerships, and real-world applications, it addresses both the technical and societal challenges of AI verification. As the market for decentralized AI infrastructure expands, Swarm’s mission-driven approach positions it to capture a significant share of this emerging opportunity.

Source:

[5] Swarm Network's $13M Raise, Including Sui Investment ...

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

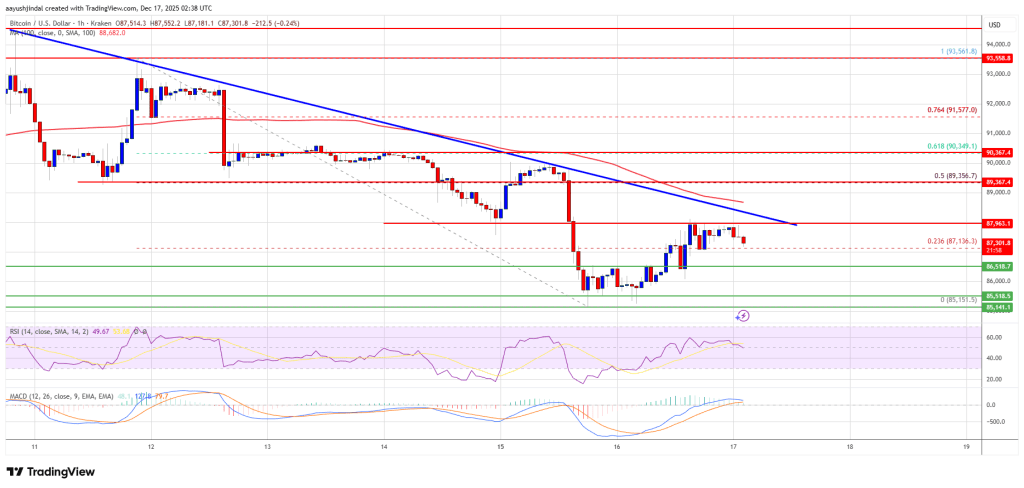

Bitcoin price regroups after decline—Is a directional breakout imminent?

Two main reasons why the current decline of ONDO is only temporary.