Bitcoin balances on ‘knife-edge’ as short-term investors brace for macro events: analyst

Quick Take Analysts say a break below $110,000 could spell downside pressure for bitcoin, but note that short-term holder selling may mitigate any near-term relief rally. Still, experts believe long-term fundamentals are strong as ETFs and institutions continue to sweep four times more BTC than miners produce.

Bitcoin sits 9% away from its all-time high of $124,128 on Thursday, as short-term holders face stress and key supports come into play ahead of upcoming U.S. macro data releases.

According to The Block’s price page , bitcoin has fallen over 4.5% in the last month amid rising volatility and monetary policy uncertainty in the United States.

Following the price dip, BTC supply in profit just hit a historically significant threshold of around 90%, The Block's data dashboard shows. Maintaining above this level or slipping below it could determine if Bitcoin soon returns to its peak or retraces, according to a CryptoQuant analyst. “Dropping back below this 90% threshold has very often marked the beginning of a corrective phase, whether short or long term,” the analyst said.

Glassnode’s latest report maps a six-month trading band with support clustered around $107,000–$108,900 and resistance near the three-month holder cost basis of $113,600. BTC also trades below the average one-month acquisition price of $115,600, adding more pressure on new buyers.

A bounce toward that resistance could meet supply from underwater buyers, while a breakdown risks a deeper move toward $93,000–$95,000. So far, Glassnode has characterized recent realized losses as “shallow,” while spot demand floats neutral, and perpetual futures positioning is fragile but bearish.

The six-month cost basis forms the first line of defense, while a price upswing may incentivize stressed holders to sell into strength.

“Currently, Bitcoin trades beneath the cost basis of both the one-month and three-month cohorts, leaving these investors under stress,” Glassnode wrote. “Any relief rally is therefore likely to encounter resistance, as short-term holders seek to exit at breakeven.”

BTC cost distribution heatmap. Image- Glassnode

The setup follows a cautious turn in risk assets after last week’s remarks from Federal Reserve Chair Jerome Powell. It also coincides with today’s second estimate of U.S. second-quarter GDP and other potential high-impact events in the coming weeks.

Next week, officials will release job data, followed by the Consumer Price Index release on Sept. 11 and the Federal Open Market Committee session on Sept. 17.

ETFs keep absorbing supply amid strong fundamentals

Timothy Misir, head of research at BRN, shares a similar outlook. He notes that bitcoin trading is just below the one- and three-month holder cost bases, with the six-month level as critical support.

Miris pegs intraday resistance at around $112,000, arguing that a clean move above that level with volume opens the way for a move toward $116,000. At the same time, choppy price action risks another sweep of $108,700 to consolidate.

Despite neutral spot conviction and a slightly negative cumulative volume in perpetuals, Misir highlights strong structural demand from institutions. U.S. spot ETF flows added about $81.3 million to bitcoin funds and $307 million to ether funds over the past day.

ETFs, corporates, and governments are absorbing roughly 3,600 BTC per day, about four times the current miner issuance, Misir shared with The Block in a note. Japan’s Metaplanet also outlined plans to raise the equivalent of $881 million to buy about $837 million in bitcoin across September and October, adding a fresh Q4 demand vector.

Furthermore, network fundamentals remain firm. Misir points to an all-time-high hashrate, a sign of miner confidence, even as short-term investors feel the heat.

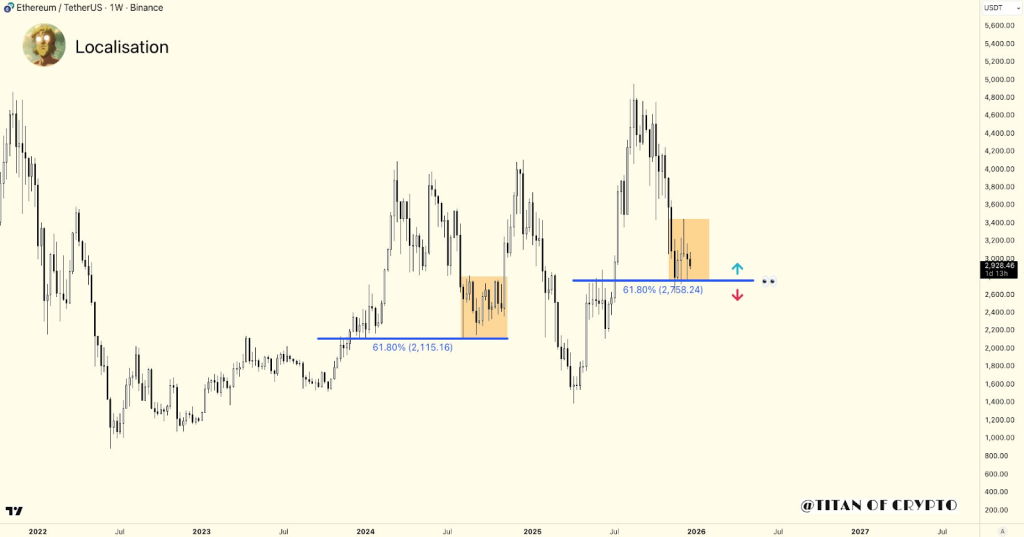

Elsewhere, ether continues to consolidate around the $4,500–$4,600 area with steady ETF demand. Solana is also holding above the $200 psychological level, supporting its status as a high-beta market leader when risk appetite returns, Misir argues.

Still, BRN’s analyst advised caution as the market may swing either way. “Bitcoin and crypto balances on a knife-edge,” he said. “Current strategy will be to maintain a neutral-to-cautious risk approach while waiting on confirmed breakouts from defined price levels, as ETH maintains its leadership for now.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum’s TVL Could Explode in 2026 as Stablecoins and RWAs Expand

10x Research Outlines Key Events That Could Move Crypto in 2026

Ethereum Price at Critical Levels: Breakout or Breakdown Next?

Bitcoin Dominance Suggests a Mini Altcoin Season in Early January 2026