What To Expect From Pi Coin In September 2025?

Pi Coin enters September under heavy pressure, with selling and Bitcoin correlation threatening new lows unless $0.362 is reclaimed.

Pi Coin continues its extended downtrend, trading dangerously close to its all-time low. The cryptocurrency last touched this level at the beginning of August, and conditions suggest a retest may occur in September.

Investor behavior indicates growing pessimism, with selling pressure keeping the altcoin from recovering previous support levels.

Pi Coin Is Facing Pressure

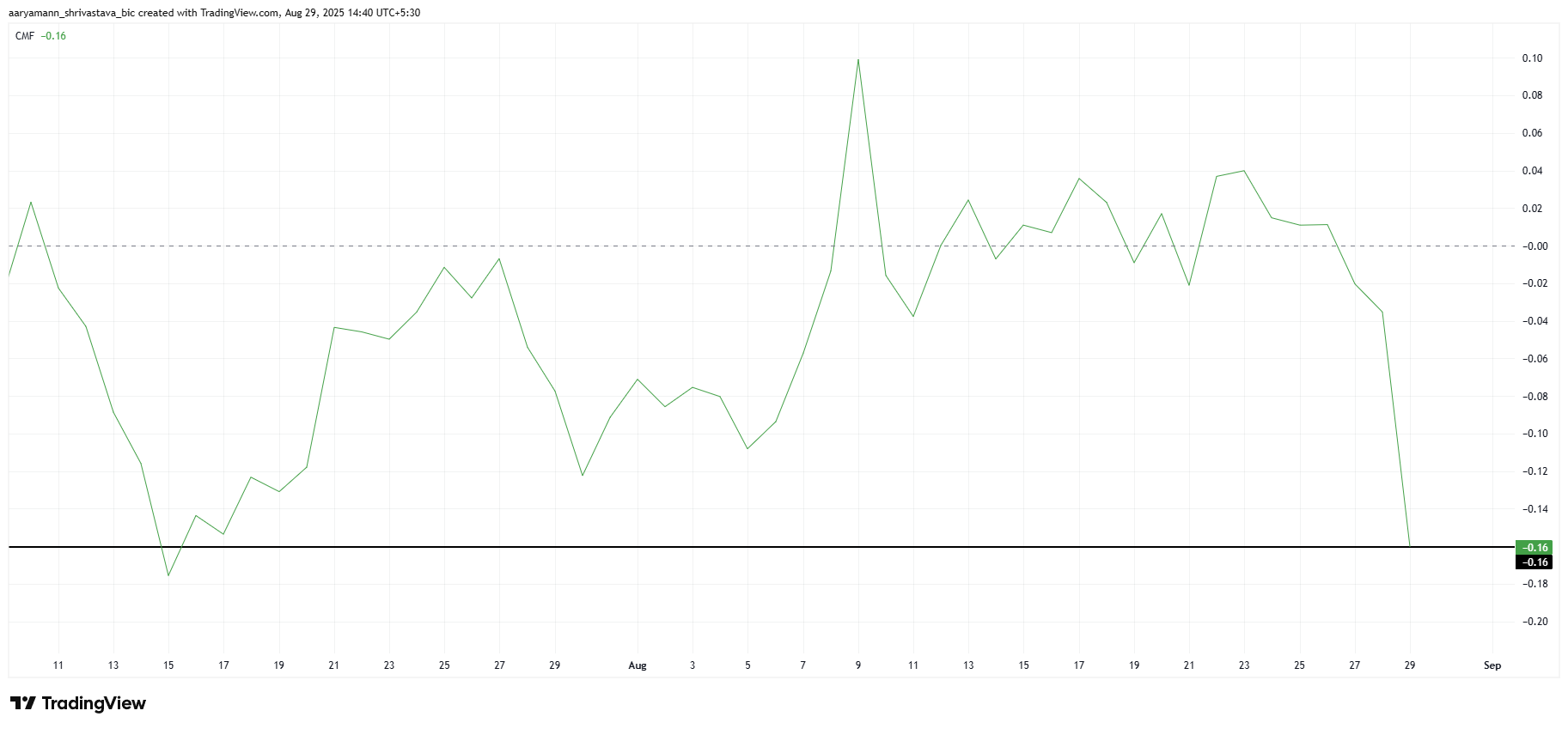

The Chaikin Money Flow (CMF) highlights significant outflows from Pi Coin at the moment. The indicator has dropped to its lowest point in six weeks, reflecting strong selling pressure. Investors are pulling capital from the asset, undermining the chance of a rebound as it trades near critical support.

These persistent outflows indicate weakening confidence in Pi Coin’s stability. As investors liquidate holdings, fresh inflows remain absent, limiting potential price recovery. With the token hovering close to its all-time low, sentiment is turning increasingly negative, suggesting heightened vulnerability to further losses in the near-term market environment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pi Coin CMF. Source:

Pi Coin CMF. Source:

Pi Coin CMF. Source:

Pi Coin CMF. Source:

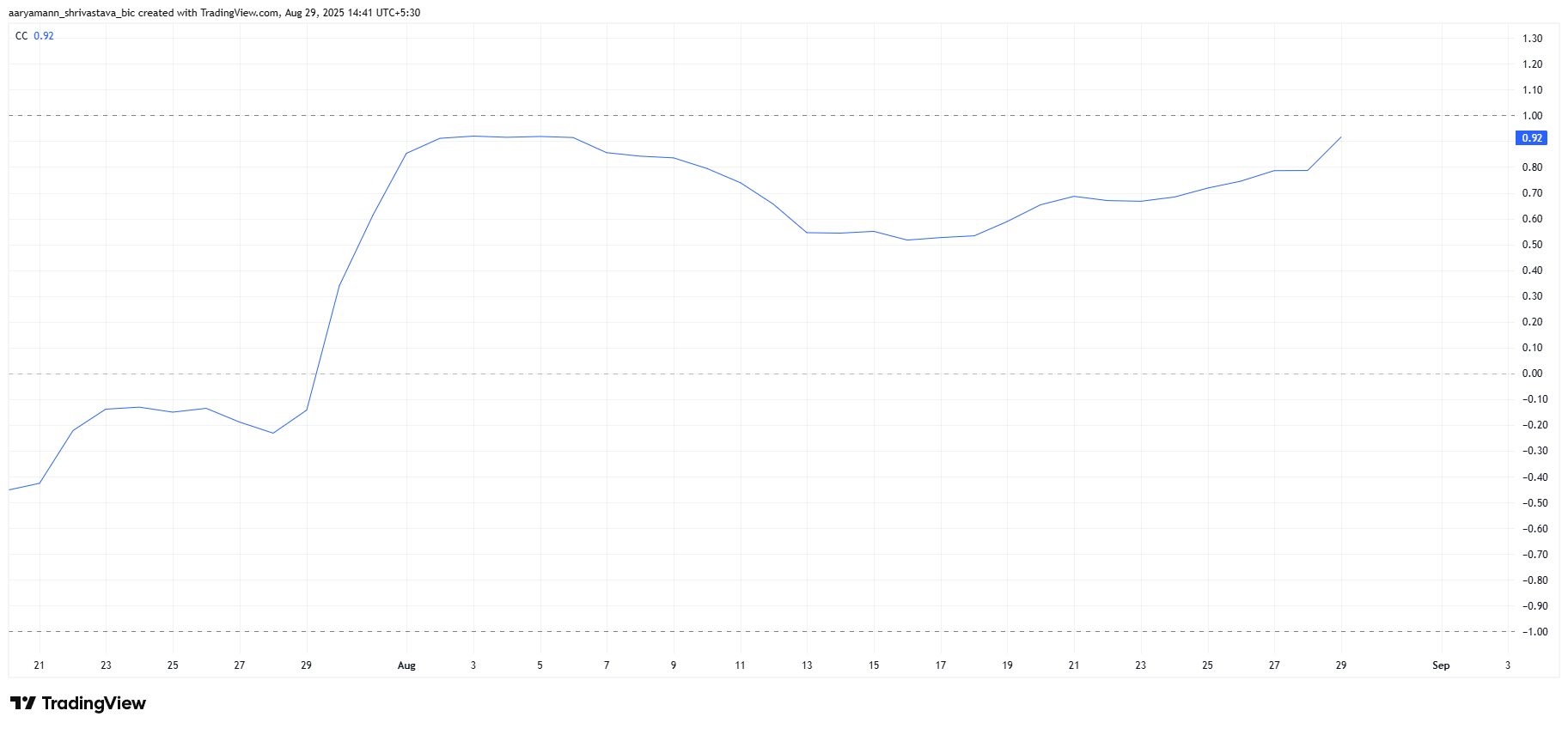

Correlation with Bitcoin is adding to Pi Coin’s fragility. At present, the correlation coefficient stands at 0.92, one of the highest readings this year. Such a strong connection means Pi Coin is highly likely to follow Bitcoin’s trajectory, regardless of independent developments or smaller technical signals on its own chart.

Throughout August, this correlation kept Pi Coin locked in a downtrend alongside Bitcoin’s struggles. BTC has failed to reclaim $115,000 as a sustainable support level, raising the risk of continued weakness. Should Bitcoin decline further, Pi Coin will likely mirror the move, potentially slipping to new multi-month lows.

Pi Coin Correlation To Bitcoin. Source:

Pi Coin Correlation To Bitcoin. Source:

Pi Coin Correlation To Bitcoin. Source:

Pi Coin Correlation To Bitcoin. Source:

PI Price Needs To Escape

Pi Coin trades at $0.353, just below resistance at $0.362. The altcoin remains trapped in a downtrend lasting more than three months. Attempts to break out have failed four times, leaving the token vulnerable and positioned close to its all-time low as selling pressure intensifies.

If these conditions persist, Pi Coin could lose support at $0.344. A decline to $0.322 would retest its all-time low, and continued selling may even push the price further down to $0.300. Such a move would confirm new weakness and mark fresh historic lows for the token.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

If Pi Coin breaks the downtrend and reclaims $0.362 as support, it could rally toward $0.401. This move would stabilize the market structure and counter bearish conditions. A recovery of this magnitude would challenge the ongoing selling narrative and provide short-term relief for investors holding the token.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street interprets the Federal Reserve decision as more dovish than expected

The market originally expected a "hawkish rate cut" from the Federal Reserve, but in reality, there were no additional dissenters, no higher dot plot, and the anticipated tough stance from Powell did not materialize.

The Federal Reserve cuts rates again but divisions deepen, next year's path may become more conservative

Although this rate cut was as expected, there was an unusual split within the Federal Reserve, and it hinted at a possible prolonged pause in the future. At the same time, the Fed is stabilizing year-end liquidity by purchasing short-term bonds.

Betting on LUNA: $1.8 billion is being wagered on Do Kwon's prison sentence

The surge in LUNA’s price and huge trading volume are not a result of fundamental recovery, but rather the market betting with real money on how long Do Kwon will be sentenced on the eve of his sentencing.

What is the overseas crypto community talking about today?

What have foreigners been most concerned about in the past 24 hours?