Bitcoin broke through the $100,000 ceiling and Ether reached a new ATH not so long ago.

Wall Street’s all in, ETFs are pouring billions into digital gold and silver, corporations stuffing their coffers with BTC and ETH like it’s the hottest new stock.

The main things of the year so far. Sounds like crypto’s big moment, right? Well, not exactly.

Surprisingly, Morgan Stanley’s latest intern survey revealed that the financial whizzes of tomorrow?

They’re just sitting there, watching, and not really jumping onto the bandwagon.

Not interested?

Over 650 bright-eyed summer interns, from North America and Europe, were asked about crypto. The results? A mere 18% own or use cryptocurrencies.

That’s up a bit from last year’s 13%, sure, but come on, it’s hardly a stampede. More than half, 55%, to be exact, don’t even give crypto a second thought.

Now, sure, that’s down from 63%, so there’s a crack of light in the tunnel, but majority disinterest? That’s a reality check.

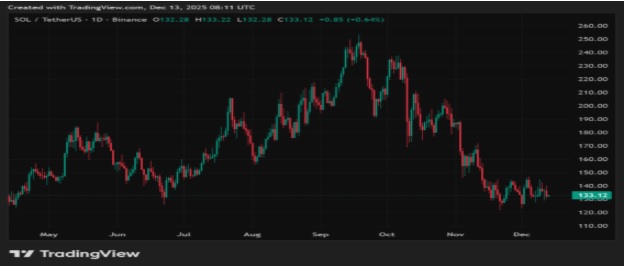

Crypto’s got a swagger show going on, since January 2024, 11 spot Bitcoin ETFs raked in tens of billions of dollars.

Ether ETFs? Another $12.4 billion. Big money, huh? Corporations are adding these assets to their balance sheets like they’re the next coffee stocks.

But the young finance crowd, the ones expected to shape Wall Street’s future, aren’t buying the hype wholesale yet. They’re cautious, skeptical.

Future tech

And they asked them about other topics too, like artificial intelligence. Now, that’s a different ball game.

Morgan Stanley’s survey paints a near-universal picture of AI adoption, 96% of U.S. interns, 91% in Europe, using AI tools daily, praising how these gizmos save time and make life easier.

But hold your applause, 88% also worry about AI’s accuracy. Those rookie doubts echo the big leagues’ worries about AI’s reliability.

Still, there’s no denying it, AI’s the shiny superstar commanding over half a trillion dollars in 2025 from the tech giants’ pockets. They’re banking on AI, not blockchain code.

The hero and the sidekick

So, what’s the moral here? Crypto, with its record-smashing prices and heavy institutional backing, is still playing the role of the underdog, the we’re still early mantra holding strong in 2025.

Now it looks like AI’s stealing the spotlight, winning hearts and spreadsheets alike, leaving cryptocurrencies looking like yesterday’s news on the intern playground.

Blockchain’s the quiet, uncertain sidekick, and AI’s the hero. And while Bitcoin’s hitting legendary heights, it’s the cautious silence of young financiers that tells the real tale.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.