Ethereum’s Strategic Grant Shift: Rebalancing Investor Risks and Long-Term Ecosystem Sustainability

- Ethereum Foundation pauses open grants, shifting to proactive funding for infrastructure, interoperability, and developer tools. - Strategic focus on layer-1 scaling and cross-chain solutions aims to reduce costs and boost DeFi adoption, though financial service projects face exclusion. - Treasury strategy reduces annual spending to 5% over five years, prioritizing GHO stablecoin borrowing and long-term sustainability over short-term liquidity. - This recalibration seeks to strengthen Ethereum’s ecosyste

The Ethereum Foundation’s recent decision to pause open grant applications under its Ecosystem Support Program (ESP) marks a pivotal shift in its funding strategy. By transitioning from a reactive model to a proactive, curated approach, the Foundation aims to align resources with long-term priorities such as infrastructure, interoperability, and developer tooling [1]. This recalibration, while potentially disruptive in the short term, reflects a calculated effort to address systemic challenges in Ethereum’s ecosystem and reinforce its position as a leader in decentralized finance (DeFi).

Strategic Priorities and DeFi Implications

The Foundation’s new focus on infrastructure and interoperability is designed to tackle two critical bottlenecks: scalability and fragmentation. By prioritizing layer-1 scaling solutions and cross-chain interoperability, the Foundation seeks to reduce transaction costs and enhance user experience, which are vital for DeFi’s mass adoption [2]. Projects like Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Polygon’s Layer-2 solutions are already benefiting from this shift, as they align with the Foundation’s vision of a more resilient and interconnected ecosystem [3].

However, this reallocation of resources creates a dichotomy for DeFi innovation. While infrastructure-focused projects gain momentum, initiatives in financial services—such as stablecoins or lending platforms—are excluded from academic grants [4]. This exclusion could stifle innovation in certain DeFi niches, particularly those reliant on rapid prototyping and iterative development. Investors must weigh this risk against the potential for long-term gains from a more robust foundational layer.

Investor Risk Rebalance and Treasury Strategy

The Foundation’s decision to reduce annual spending from 15% to 5% of its treasury over five years underscores a commitment to sustainability [5]. This fiscal discipline may initially raise concerns about reduced liquidity for grantees, but it also signals a strategic rebalancing of investor risks. By limiting ETH sales and adopting DeFi-centric treasury strategies—such as borrowing GHO stablecoins from Aave—the Foundation is integrating itself more deeply into the very ecosystems it supports [6]. Such moves could stabilize investor sentiment by demonstrating a long-term, self-sustaining model rather than a speculative one.

Moreover, the Foundation’s emphasis on privacy, open-source development, and decentralization aligns with broader investor preferences for projects with strong governance and ethical frameworks [7]. This alignment may attract institutional capital, which often prioritizes sustainability and risk mitigation over short-term volatility.

Long-Term Ecosystem Sustainability

The Foundation’s roadmap, expected in Q4 2025, will likely detail how these strategic shifts foster ecosystem resilience. By addressing layer-2 fragmentation and prioritizing scalable solutions, Ethereum can better compete with blockchains like Solana and Avalanche , which have gained traction through performance-driven narratives [8]. The Q1 2025 distribution of $32.6 million in grants—focusing on zero-knowledge cryptography and developer tools—already hints at a foundation-first approach that could yield compounding benefits for DeFi [9].

Conclusion

Ethereum’s grant strategy realignment is a double-edged sword: it introduces short-term uncertainty for certain DeFi projects but lays the groundwork for a more sustainable, scalable ecosystem. Investors must navigate this transition by distinguishing between high-impact infrastructure bets and niche financial services. The Foundation’s treasury innovations and focus on interoperability suggest a future where Ethereum’s ecosystem thrives not through sheer volume of grants, but through strategic, targeted support. As the roadmap unfolds, the true test will be whether these changes translate into tangible improvements in user adoption and network resilience.

Source:

[1] Ethereum Foundation Pauses Open Grants to Refocus Ecosystem Strategy

[2] Ethereum Foundation Pauses Grants Program to Refocus Ecosystem Strategy

[3] Altcoins Dominate Ethereum Capital Outflow

[4] Academic Grants Round | Ethereum Foundation ESP

[5] Ethereum Foundation Unveils Bold Treasury Plan to ...

[6] Ethereum Foundation Borrows GHO Stablecoins from Aave

[7] Ethereum Foundation Suspends Grants to Reassess ...

[8] Ethereum Foundation Pauses Open Grants as It Overhauls ...

[9] Ethereum Foundation Distributed $32.6M Grants to Support Education and ZK Tech

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin rebounds on Japan rate hike as Arthur Hayes sees dollar at 200 yen

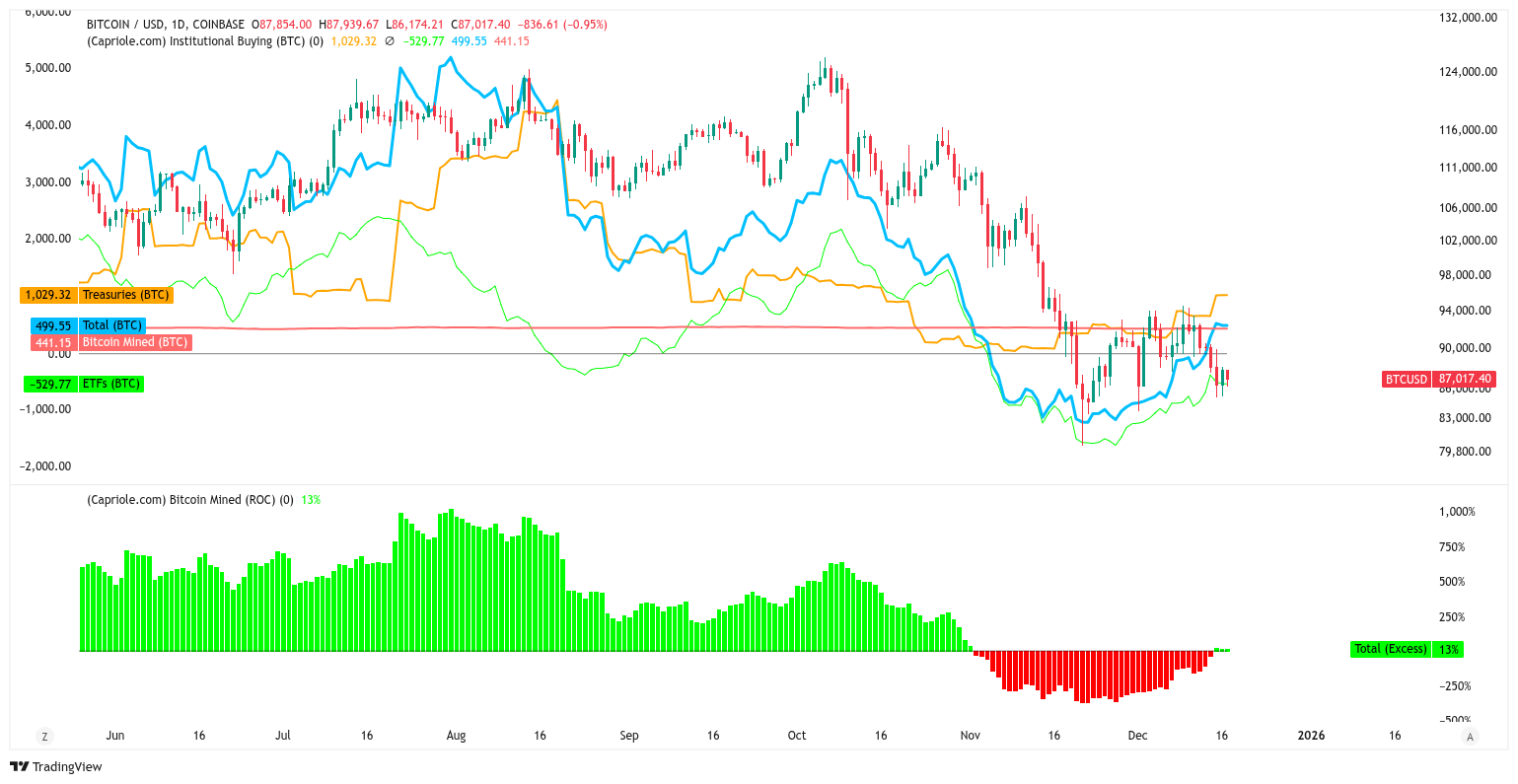

Bitcoin institutional buys flip new supply for the first time in 6 weeks

US Senate Confirms Michael Selig, Travis Hill to Lead CFTC and FDIC

Metaplanet ADR: A Strategic Gateway for US Investors to Access Bitcoin-Backed Assets