The Trump Family's Strategic Influence on Bitcoin and the Path to $1M

- Trump administration's pro-crypto policies, including the Strategic Bitcoin Reserve and deregulation, have accelerated institutional adoption, with 59% of portfolios now holding Bitcoin. - Regulatory clarity and $82.5B from spot ETFs (e.g., BlackRock's IBIT) reduced volatility to 30%, signaling institutional confidence in Bitcoin as a mainstream asset. - Geopolitical moves like 24% tariffs and CBDC bans positioned Bitcoin as a hedge against fiat instability, with prices peaking at $112,000 amid macroecon

The Trump family’s aggressive embrace of cryptocurrency has catalyzed a seismic shift in Bitcoin’s institutional adoption and geopolitical relevance. By aligning U.S. policy with pro-crypto deregulation, establishing strategic digital asset reserves, and leveraging family offices to legitimize Bitcoin as a mainstream asset, the Trump administration has created a framework that could propel Bitcoin toward a $1 million valuation by the late 2020s. This trajectory hinges on three pillars: regulatory clarity, geopolitical realignment, and institutional capital flows.

Regulatory Clarity and the Rise of the U.S. as a Crypto Capital

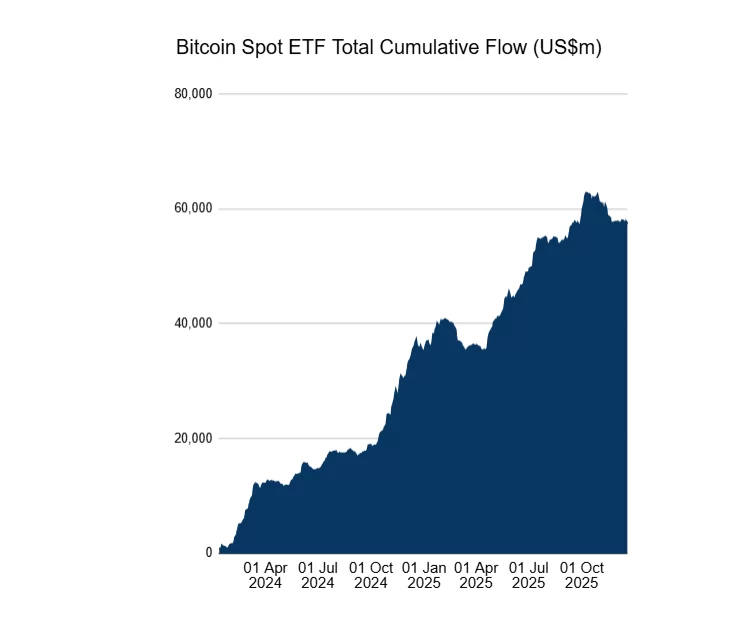

The Trump administration’s early 2025 executive order to establish the Strategic Bitcoin Reserve (SBR) and a U.S. Digital Asset Stockpile marked a paradigm shift in how governments view Bitcoin. By treating Bitcoin as a strategic reserve asset alongside gold, the administration normalized its role in national financial planning [1]. This move was complemented by the rescission of Biden-era regulatory restrictions, including the rollback of the IRS’s “broker rule,” which had burdened decentralized finance (DeFi) platforms [2]. The approval of spot Bitcoin ETFs—such as BlackRock’s iShares Bitcoin Trust (IBIT)—injected $82.5 billion into the asset by mid-2025, with 59% of institutional portfolios now including Bitcoin [3].

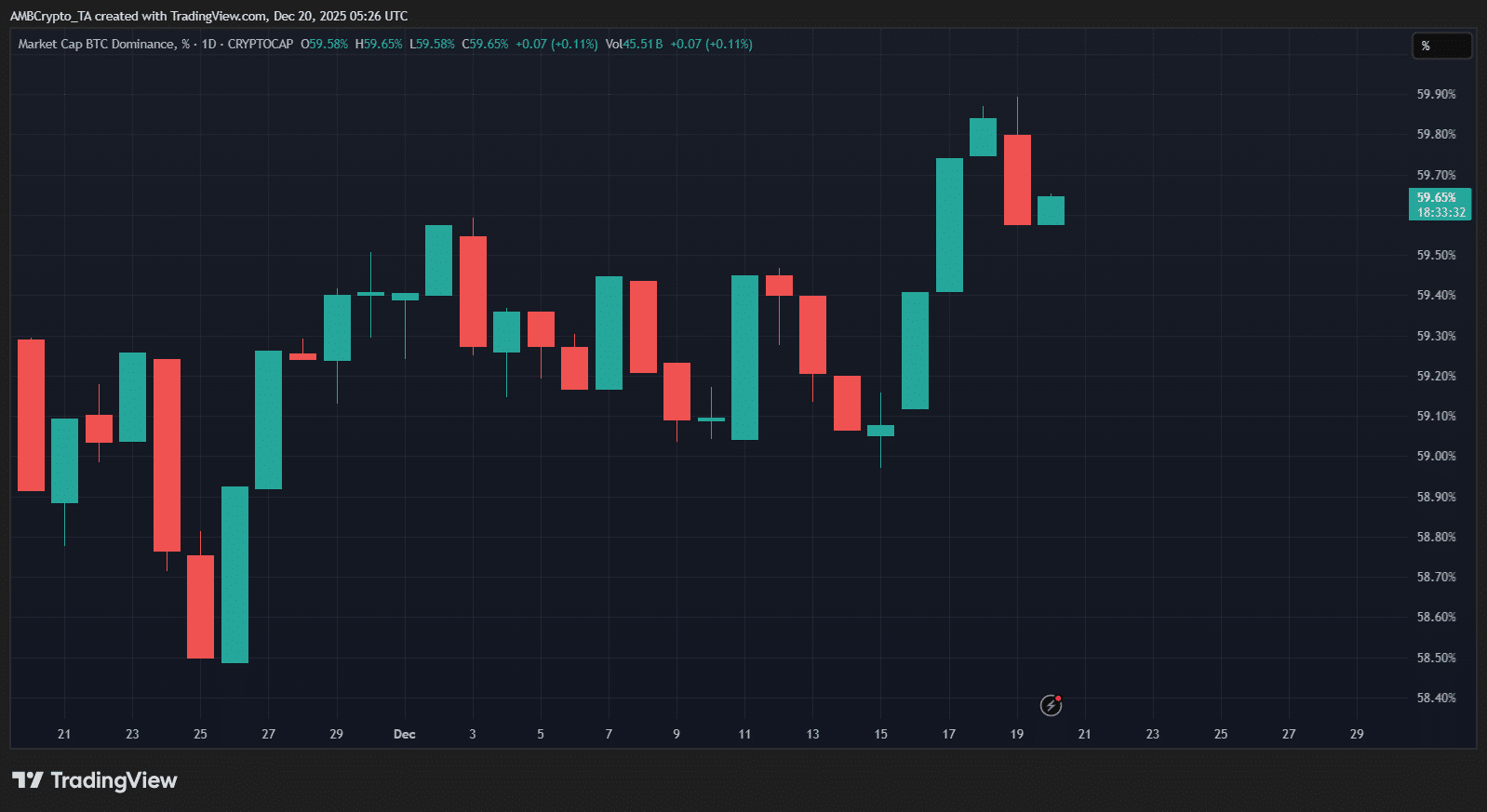

The administration’s deregulatory approach extended to tax policy, with the exclusion of stablecoins from the corporate alternative minimum tax (CAMT) and simplified staking rewards incentivizing long-term Bitcoin holdings [4]. These reforms reduced compliance burdens for institutions, enabling a surge in capital inflows. By Q2 2025, Bitcoin’s volatility index had dropped from 60% in 2015 to 30%, reflecting newfound institutional confidence [5].

Geopolitical Realignment and the Dollar’s Role

Trump’s geopolitical strategies, including aggressive tariffs on China, Canada, and Mexico, have indirectly bolstered Bitcoin’s appeal as a hedge against fiat currency instability. The “Liberation Day” tariff announcement in April 2025, which imposed a 24% weighted rate on imports, triggered a global repricing of risk assets, including Bitcoin [6]. While the S&P 500 and other equities corrected sharply, Bitcoin’s price resilience—peaking at $112,000 by June 2025—highlighted its role as a store of value amid macroeconomic uncertainty [7].

The administration’s decision to ban the creation of a U.S. central bank digital currency (CBDC) further underscored its commitment to decentralized alternatives [2]. This stance aligns with broader efforts to position the U.S. as a global crypto leader, countering China’s dominance in Bitcoin’s hashrate (16.61% of the global network) and regulatory influence [8]. By fostering a pro-crypto ecosystem, the U.S. has attracted $3 trillion in potential institutional capital, dwarfing traditional gold reserves [9].

Institutional Adoption and the Path to $1M

The Trump family’s personal crypto ventures—such as forming a digital asset treasury company with Crypto.com and promoting the $TRUMP meme coin—have amplified Bitcoin’s cultural and financial legitimacy [1]. However, the administration’s institutional policies have been the true catalyst. The President’s Working Group on Digital Asset Markets, led by David Sacks, established a federal framework for stablecoins and digital assets, reducing regulatory ambiguity for banks and asset managers [3].

Family offices have also played a pivotal role. By 2024, over 30% of U.S. family offices allocated Bitcoin to their portfolios, driven by macroeconomic uncertainty and the asset’s low correlation with traditional markets [4]. The EU’s Markets in Crypto-Assets Regulation (MiCA) further legitimized Bitcoin as a strategic asset, enabling cross-border institutional adoption [10].

Challenges and the Road Ahead

While the Trump family’s policies have created a favorable environment, risks remain. China’s hashrate dominance and geopolitical tensions could reintroduce volatility [8]. Additionally, the family’s financial stakes in crypto ventures—such as World Liberty Financial’s USD1 stablecoin—raise concerns about conflicts of interest [11]. However, the administration’s focus on institutional-grade products (e.g., crypto ETPs) and the Federal Reserve’s potential appointment of a pro-crypto chair suggest a long-term commitment to Bitcoin’s integration into global finance [12].

Conclusion

The convergence of Trump-era deregulation, geopolitical realignment, and institutional adoption has positioned Bitcoin as a cornerstone of modern finance. With regulatory clarity, macroeconomic tailwinds, and a growing role in 401(k) plans and corporate treasuries, Bitcoin’s path to $1 million is no longer speculative—it is a plausible outcome of sustained institutional demand and strategic policy alignment. The next few years will determine whether this new era of crypto adoption is a fleeting cycle or the dawn of a permanent financial revolution.

Source:

[1] Fact Sheet: President Donald J. Trump Establishes the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile

[2] Crypto Policy Under Trump: H1 2025 Report - Galaxy

[3] The U.S. Strategic Bitcoin Reserve and Institutional Adoption

[4] Bitcoin's Institutional Adoption: Political Endorsements and Family Office Allocations

[5] July 2025 in Crypto: Prices rally on US regulatory clarity

[6] Asymmetric Market Update™️ #28

[7] Bitcoin (BTC) Price Prediction 2025 - 2030

[8] The Trump Family's Crypto Push: Is Bitcoin's $1M Valuation a Realistic Bet?

[9] Bitcoin Institutional Adoption: How U.S. Regulatory Clarity Is Unlocking Institutional Capital

[10] U.S. Regulatory Shifts and the Path to Institutional Crypto Adoption

[11] Trump's cryptocurrency endeavor caps a political career

[12] Trump's Bitcoin Reserve & Crypto Stockpile: Innovation or Corruption?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z: 17 Exciting New Crypto Directions for 2026

‘Altcoin season isn’t gone’ – Why 2026 may be the year to watch

Crypto Trends Capture Attention as Market Struggles

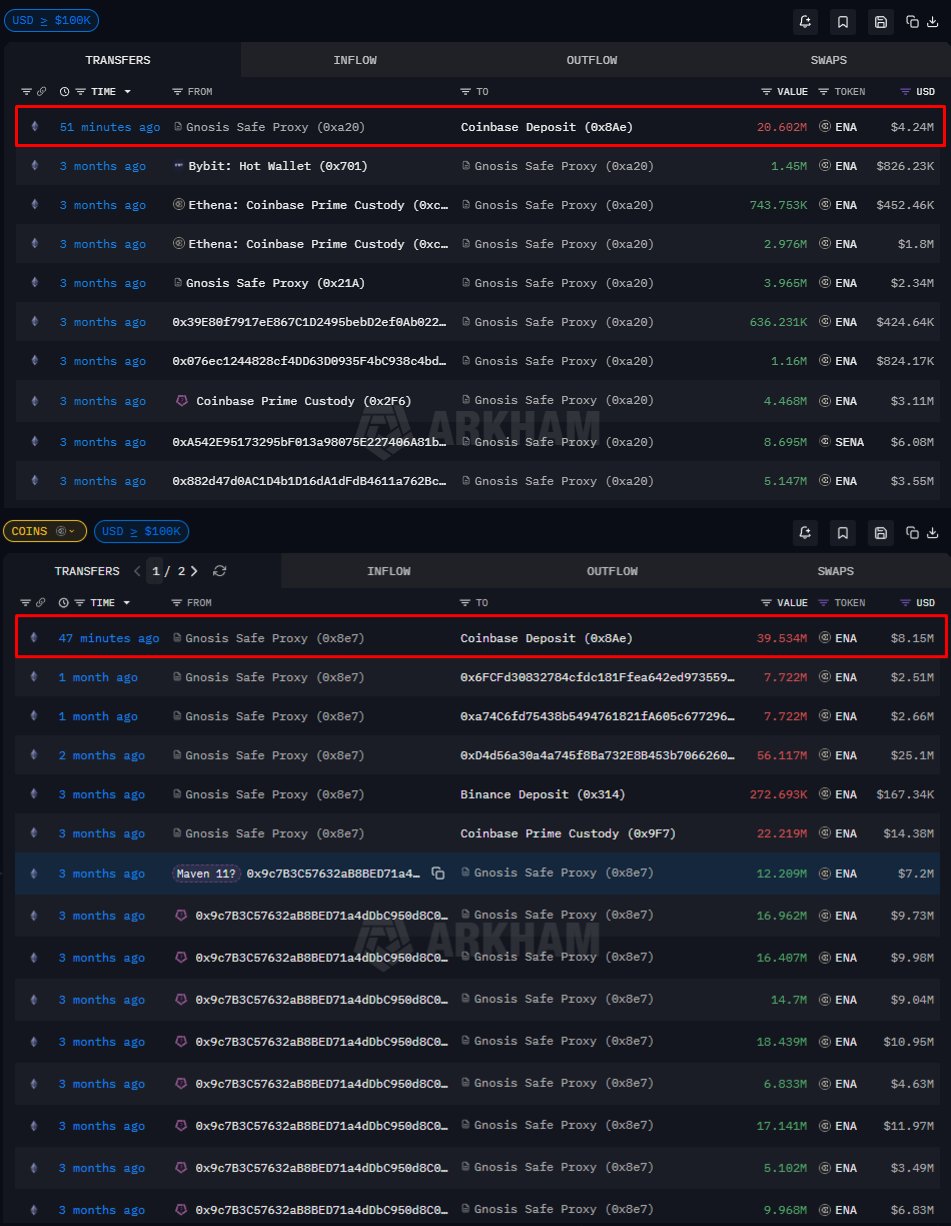

Can Ethena hold $0.20 after 101M ENA flood exchanges?