zkLend Removes 21-Day Wait, Boosts STRK Liquidity

- zkLend completes 21-day unstaking for kSTRK, enabling users to redeem STRK tokens after meeting requirements. - Direct validator stakers bypass waiting periods but require manual unstaking/delegation via platforms like Voyager. - The move enhances liquidity in Starknet's DeFi ecosystem by improving staking flexibility and asset accessibility. - Increased STRK redemption could impact market dynamics as liquidity-sensitive participants access underlying assets.

zkLend, a Layer 2 native money market protocol based on Starknet, has completed the 21-day un-staking process for kSTRK, allowing most token holders to withdraw STRK from the zkLend staking portal. The protocol announced the redemption and withdrawal process, marking a significant step for users who have been holding kSTRK, an interest-bearing token representing staked STRK. This development enables holders to access their underlying STRK assets after meeting the unstaking requirements [1].

According to the announcement, users who have not yet claimed their kSTRK from the Recovery Portal must first claim their tokens before initiating the unstaking process. After unstaking, they must wait 21 days before redeeming the tokens for STRK. The Recovery Portal remains accessible for the next six months, providing a window for users to complete the withdrawal process [1]. For users who staked directly to zkLend validators through platforms such as Voyager or Endurfi, the unstaking process requires manual intervention—users must either unstake or delegate their stake to another validator. However, the exit queue does not apply to these users, allowing for a potentially faster redemption process.

This move by zkLend aligns with broader trends in the DeFi sector, where protocols are increasingly focusing on user liquidity and flexibility. The redemption of kSTRK into STRK enhances the utility of zkLend's staking mechanism, which has previously offered users the ability to earn yield on their staked assets while maintaining exposure to the underlying token. The removal of the 21-day waiting period for previously unstaked kSTRK is a key point of interest for liquidity-sensitive participants.

The release of this functionality comes amid continued growth in the Starknet ecosystem, where zkLend has positioned itself as a key player in facilitating on-chain lending and borrowing activities. The protocol's decision to streamline the redemption process could encourage broader adoption and participation, particularly among users looking to actively manage their crypto assets. Analysts note that the availability of withdrawal options often plays a critical role in user retention and trust in DeFi platforms.

As users begin to access their STRK tokens, the market impact will become more evident in the coming weeks. The redemption of large quantities of kSTRK could influence the supply dynamics of STRK, potentially affecting its market price. While there are no explicit forecasts from the protocol or market analysts regarding price movements, the increased liquidity could lead to greater trading activity and market participation. This development is being closely monitored by both traders and investors in the broader Starknet and Ethereum ecosystems.

Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

‘It felt so wrong’: Colin Angle on iRobot, the FTC, and the Amazon deal that never was

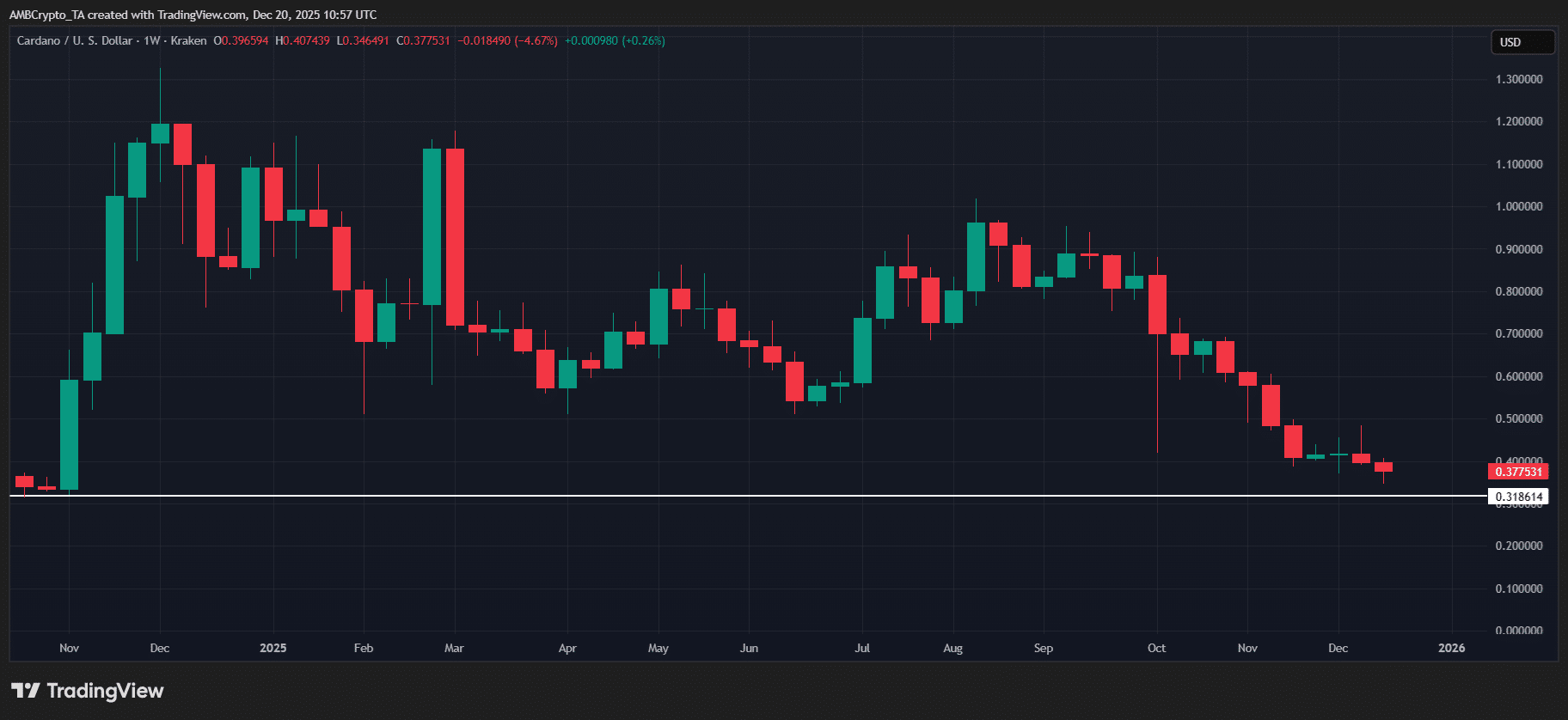

Cardano erases 100% of election rally gains – Can ADA hold top 10?

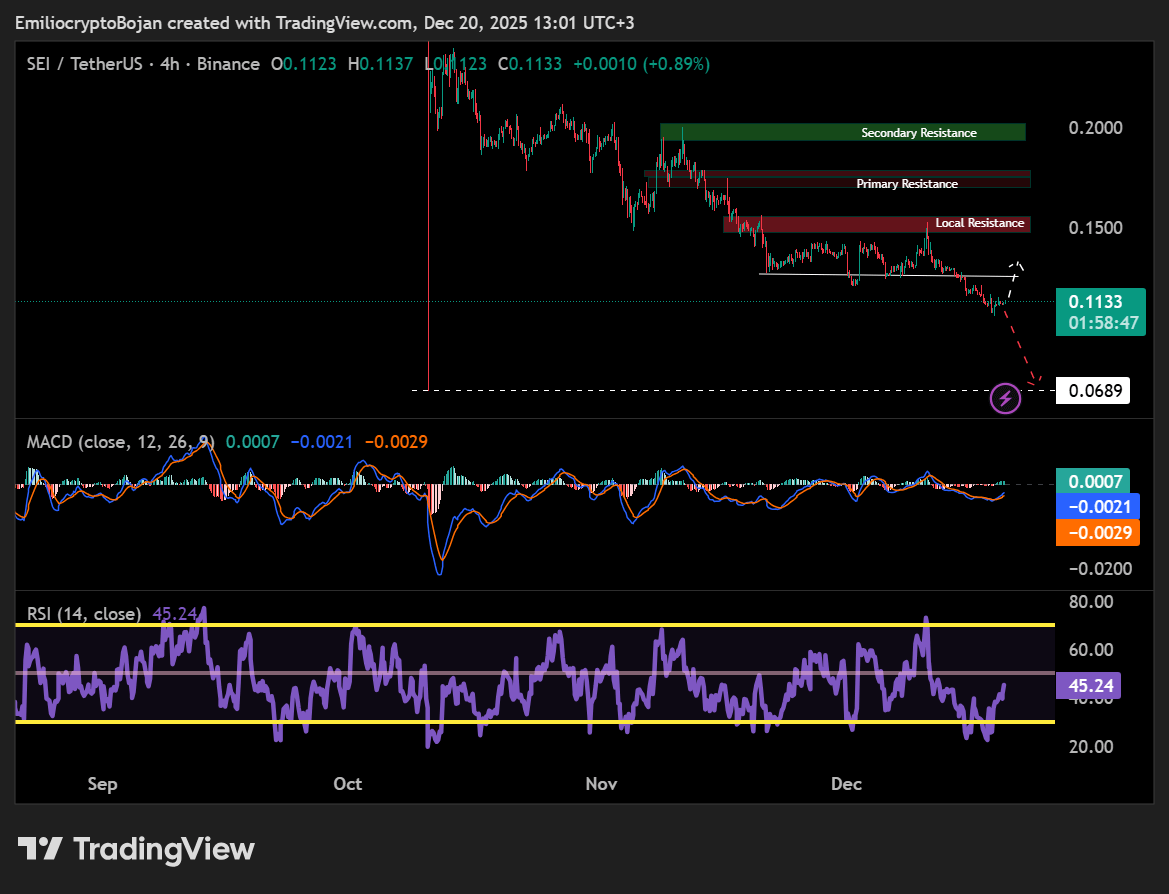

Why SEI must reclaim KEY support to avoid drop below $0.07