Ethereum ETF Outflows Signal Institutional Profit-Taking Amid Stronger Bitcoin Reallocations

- Ethereum ETFs saw $164.6M net outflow on Aug 29, 2025—the largest since launch—driven by profit-taking amid inflation concerns and geopolitical risks. - Institutional capital temporarily shifted to Bitcoin ETFs as BlackRock/Fidelity injected $129M, reflecting Bitcoin's "safe haven" appeal during Fed rate delay uncertainty. - Ethereum's fundamentals remain strong: 71% YTD gains, 94% reduced Layer 2 fees post-Dencun/Pectra, and $223B DeFi TVL despite short-term outflows. - ETF inflows ($3.87B in August) ou

The recent $164.6 million net outflow from Ethereum ETFs on August 29, 2025, marked a pivotal shift in institutional capital reallocation, reflecting both short-term profit-taking and broader macroeconomic recalibration [1]. This outflow, the largest since Ethereum ETFs’ launch, followed a six-day inflow streak driven by Grayscale and Fidelity, underscoring the volatile nature of institutional positioning in crypto markets [1]. While Ethereum’s price dipped below $4,300 amid inflation concerns and geopolitical risks, the underlying fundamentals—71% year-to-date gains and a deflationary token model—remained intact [2].

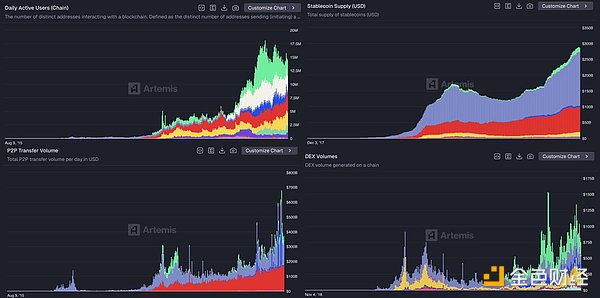

The outflow coincided with a broader trend: Bitcoin ETFs, which had faced $966 million in August outflows, began to see a reversal on August 25 as BlackRock and Fidelity injected $63.4 million and $65.6 million, respectively [5]. This suggests a temporary reallocation of capital from Ethereum’s yield-driven ecosystem to Bitcoin’s perceived “safe haven” status, particularly as the Federal Reserve delayed rate cuts and Trump-era trade policies heightened inflationary pressures [3]. Institutional investors, historically drawn to Ethereum’s staking yields (3.8–5.5%) and utility-driven tokenomics, shifted portions of their portfolios to Treasury Inflation-Protected Securities (TIPS) and Bitcoin ETFs as hedging mechanisms [4].

However, Ethereum’s long-term appeal remains robust. Its deflationary supply model, bolstered by the Dencun and Pectra hard forks, reduced Layer 2 fees by 94%, driving DeFi total value locked (TVL) to $223 billion [5]. Meanwhile, Ethereum ETFs added $3.87 billion in August 2025, outpacing Bitcoin’s inflows and signaling sustained institutional adoption [5]. This duality—short-term profit-taking versus long-term structural advantages—highlights a strategic inflection point for investors.

For the cautious investor, the August outflows represent a tactical opportunity to rebalance exposure. While Bitcoin’s zero-yield model and regulatory ambiguities persist, Ethereum’s ecosystem continues to evolve, offering a blend of yield generation, regulatory clarity (under the SEC’s CLARITY Act), and technological innovation [4]. The key lies in distinguishing between transient market rotations and enduring value propositions.

Source:[4] Ethereum ETF Inflows Signal Institutional Capital Reallocation [https://www.bitget.com/news/detail/12560604935910][5] Ethereum ETFs Outperforming Bitcoin: A Strategic Shift in [https://www.bitget.com/news/detail/12560604939773]

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nobel laureate criticizes: "Trump trade" is collapsing

Unlock cross-chain liquidity, Avail Nexus helps you seamlessly experience Monad applications

Monad is dedicated to achieving ultimate performance, while Avail Nexus focuses on unlimited scalability and seamless access.

Even the ex-boyfriend of ChatGPT's creator was robbed of over 10 million dollars—how crazy are foreign robberies?

Crypto enthusiasts no longer dare to flaunt their wealth.