Ethereum's Rising Dominance and the Shift in Institutional and Retail Sentiment

- Ethereum's 2025 rise redefined crypto markets via institutional adoption, regulatory clarity, and deflationary on-chain momentum. - Record $10B CME Ether Futures open interest and 3.8% staking yields outpaced Bitcoin's zero-yield model, driving $9.4B ETF inflows. - Ethereum's 29.4% staking participation, 0.5% annual supply contraction, and $223B DeFi TVL reinforced its utility-driven value proposition. - Bitcoin dominance fell to 56.54% as institutions allocated $7.88B to Ethereum, signaling capital real

Ethereum’s ascent in 2025 has redefined the crypto market structure, driven by institutional adoption, regulatory clarity, and on-chain momentum. As open interest in Ethereum derivatives surges to record levels and Bitcoin dominance declines, the network’s utility and deflationary dynamics are reshaping capital allocation. This shift signals a strategic inflection point for investors, warranting a rebalancing toward Ethereum-based exposure.

Derivatives Market: A Barometer of Institutional Confidence

Ethereum’s derivatives market has become a cornerstone of institutional participation. By August 2025, CME Ether Futures open interest (OI) surpassed $10 billion, with 101 large OI holders—a record—indicating robust professional involvement [1]. This milestone was accompanied by 500,000 open micro Ether contracts and $1 billion in notional options OI, reflecting a maturing ecosystem [1]. The ETH/BTC open interest ratio hit all-time highs, with Ethereum capturing 40% of total crypto OI in Q2 2025 [4].

The surge is fueled by regulatory tailwinds, such as the 2025 CLARITY Act, which reclassified Ethereum as a utility token and unlocked staking yields of 3.8% APY [2]. This yield advantage over Bitcoin’s zero-yield model attracted $9.4 billion in ETF inflows for Ethereum, compared to $548 million for Bitcoin [1]. Meanwhile, Bitcoin ETFs recorded a net outflow of $803 million in August 2025, underscoring a capital shift toward Ethereum [1].

On-Chain Momentum: Deflationary Dynamics and Utility

Ethereum’s on-chain metrics reinforce its institutional appeal. By August 2025, the network processed 1.74 million daily transactions, with 680,000 active addresses, reflecting a 43.83% year-over-year increase [1]. Gas fees plummeted to $3.78 from $18 in 2022, driven by Layer 2 solutions like Arbitrum and zkSync, which now handle 60% of Ethereum’s volume [1].

Staking participation reached 29.4% of the total supply (35.5 million ETH staked), generating annualized yields between 3% and 14% [3]. Institutional investors now control 7% of the supply, further solidifying Ethereum’s role as a yield-generating asset [1]. Deflationary dynamics, including EIP-1559 burns and staking lockups, created a 0.5% annual contraction in circulating supply, tightening liquidity and driving upward price pressure [3].

Ethereum’s Total Value Locked (TVL) in DeFi hit $223 billion by July 2025, with the network controlling 53% of tokenized real-world assets (RWAs) [1]. This utility-driven growth is amplified by the 97% profit-holding rate and a Network Value to Transactions (NVT) ratio of 37, signaling undervalued infrastructure and strong holder confidence [1].

Bitcoin Dominance and the Altcoin Reallocation

Bitcoin dominance, a key indicator of market sentiment, fell to 56.54% in late August 2025—the lowest since February 2025 [2]. This decline reflects a strategic reallocation of capital from Bitcoin to Ethereum and altcoins, driven by institutional adoption and innovations in DeFi and NFTs. Ethereum’s market share rose from 9.2% to 14.4% between July and August 2025, while Bitcoin’s dominance fell from 64.5% to 57.5% [5].

The altcoin market’s resilience, reaching $1.6 trillion by September 2025, highlights Ethereum’s role as a catalyst for broader crypto adoption [6]. Institutional treasuries, such as Tom Lee’s BitMine, accumulated 1.7 million ETH ($7.88 billion), further reducing supply and enhancing scarcity [5]. Meanwhile, Bitcoin’s resurgence to 64% dominance by Q3 2025 underscores its foundational role, but Ethereum’s yield and utility advantages position it as a compounding asset in a diversified portfolio [2].

Strategic Rebalancing Toward Ethereum

The confluence of derivatives-driven institutional adoption, on-chain deflationary mechanics, and declining Bitcoin dominance presents a compelling case for rebalancing toward Ethereum. With ETF inflows, staking yields, and DeFi utility reinforcing its value proposition, Ethereum is positioned to outperform Bitcoin in the near term. Investors should consider increasing exposure to Ethereum-based assets, including spot ETFs, staking protocols, and DeFi platforms, to capitalize on this structural shift.

Source:

[1] Ether Futures Open Interest on CME Hits Record $10B

[2] The Surge in CME Ether Futures Open Interest and Its Implications

[3] State of Ethereum Q2 2025

[4] Ethereum's Path to $5000: Whale Activity and Derivative Dynamics

[5] Institutional interest drives Ethereum growth as CME

[6] Altcoin Season 2025: Is Now the Time to Reallocate Capital

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Meme Coins to Buy – Pudgy Penguins Price Prediction

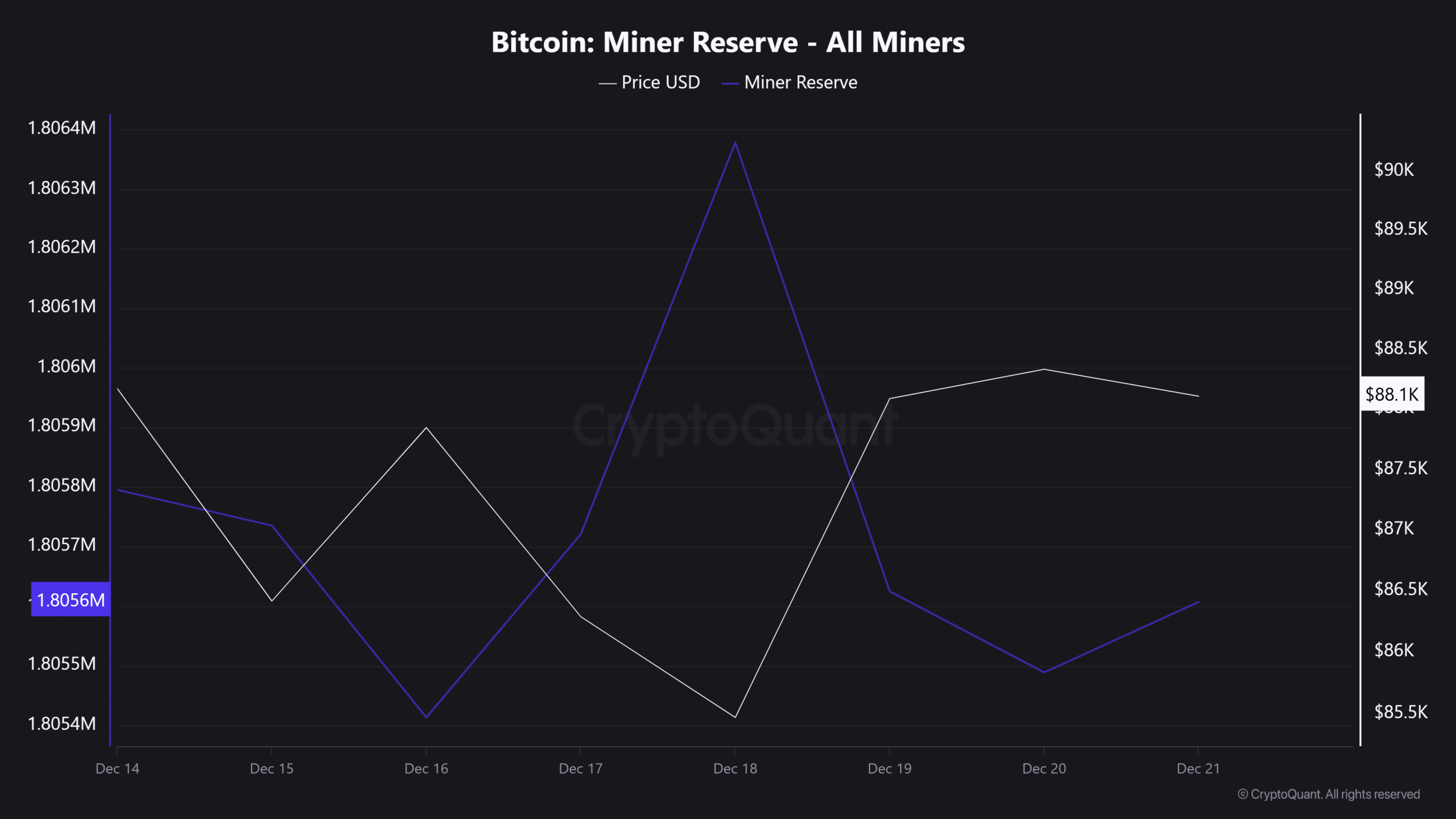

Bitcoin holds $85K despite miner stress – Is ‘buy the fear’ back?

Analyst Sends Critical Warning to XRP Holders: Largest Bear Trap In History

Shiba Inu Targets 25x, Yet Ozak AI Prediction Leans Toward a Triple-Digit Run