- LINK consolidates below strong resistance near $26.60 while maintaining support around $20.24, reflecting a steady bullish trend on the daily chart.

- The U.S. Department of Commerce has integrated official GDP and PCE data on-chain via Chainlink’s decentralized oracle network.

- Chainlink’s ecosystem grows with over 2,400 integrations, reinforcing its role as the leading provider of trusted data for DeFi and blockchain applications.

Chainlink (LINK) has seen a sharp rise recently but is now consolidating just below an important resistance level near $26.60. After testing this level twice without breaking through, the price has pulled back to around $24. The market is showing signs of caution, with technical indicators signaling mixed momentum.

LINK’s Current Price and Chart Setup

LINK is trading at $23.35 as at p r ess time . A 1.98% drop in the last 24 hours and 6.68% drop over the past week. The price has moved between $25.23 and $24.24 during the day. The 9-day Exponential Moving Average (EMA) is just above at $24.57, meaning LINK is testing short-term support. The 50-day Simple Moving Average (SMA) at $20.24 is providing solid support.

Source: Alpha Crypto Signal Via X

Source: Alpha Crypto Signal Via X

Since June, LINK’s daily chart has been showing a clear uptrend, with the coin trading in a range between $20.24 and $26.60, facing strong resistance at the $26.60 level. Trading volumes have remained steady overall, with a small increase during recent sell-offs.

Short-Term Signals Show Weakness

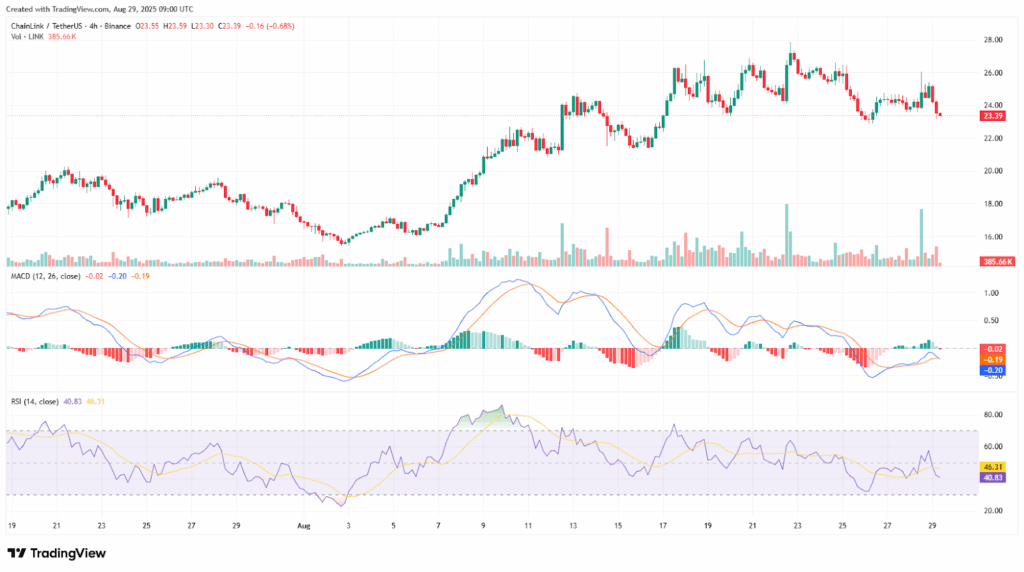

On the 4-hour chart, LINK is currently trading near $23.39 and has been unable to break higher, forming a pattern of lower highs. This points to growing selling pressure in the short term. Recently, the MACD dipped below its signal line at the same time, the RSI is sitting at 40.83, gradually edging closer to oversold levels but still hanging around neutral ground. This shows that the upward momentum is starting to slow down.

Source: CryptoRank

Source: CryptoRank

Support is seen near $22, where buyers stepped in previously. Resistance remains near $26, which LINK has tested several times but couldn’t break through with strong volume. The short-term trend appears bearish with small bounces failing to push prices higher.

Chainlink Gains From New Institutional Partnerships

Chainlink recently got a boost from a major announcement. The U.S. Department of Commerce now delivers official GDP and PCE data on-chain through Chainlink’s decentralized network. This data is available across Ethereum, Arbitrum, Avalanche, and other blockchains.This is the first time government data has been secured and distributed on blockchain infrastructure.

This development is expected to help automated trading, tokenized asset settlements, and institutional risk management. Following the news, the PYTH token surged 48%, and Chainlink reinforced its role as a leading oracle service with over 2,400 integrations.