Bitcoin Price Analysis Reveals Market-Bottom Cues, but $113,500 Remains the Key Test

Bitcoin price is holding above critical support as SOPR and URPD metrics flash potential market bottom signs. A test of $113,500 resistance now looks pivotal.

Bitcoin (BTC) is trading around $108,700, flat on the day but still down over 6% in the past month and about 5% over the last week. The muted Bitcoin price action reflects broader caution across the market, but under the surface, on-chain signals suggest that a rebound narrative is growing stronger.

Short-term holder capitulation, realized price clusters, and technical levels together point to a market preparing for its next decisive move.

Short-Term Holder SOPR Shows Weak Hands Exiting

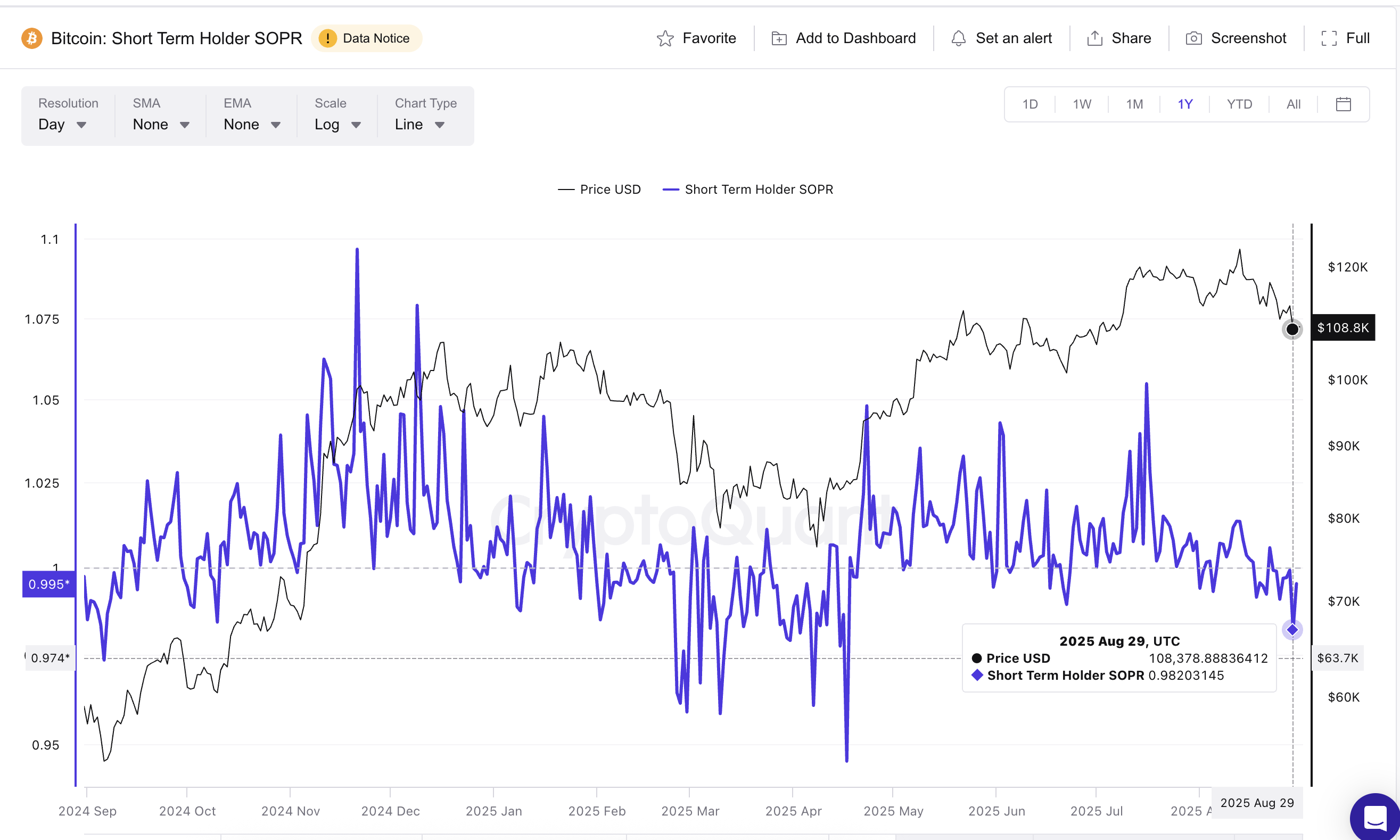

The Spent Output Profit Ratio (SOPR) measures whether coins moved on-chain were sold at a profit or loss. For short-term holders—who are usually the most reactive—the metric provides a near-real-time gauge of sentiment.

With Bitcoin’s price sliding in recent weeks, the short-term SOPR has dropped to 0.982 (on August 29), its lowest level in months. This means that a large share of short-term holders are selling at a loss, often interpreted as capitulation by weak hands.

Historically, such behavior clears the market of short-term speculators, creating conditions for stronger hands to step in.

Bitcoin Short-Term Holders Hinting At Market Bottom:

Bitcoin Short-Term Holders Hinting At Market Bottom:

A parallel can be seen on April 17, when SOPR touched 0.94, a one-year low. At the time, Bitcoin bottomed at $84,800 before rebounding 31.6% to $111,600 once SOPR flipped back above 1.

The current move exhibits a similar setup, suggesting that this latest capitulation may signal a market bottom.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

At press time, the short-term holder SOPR metric has risen to 0.99 but remains around the multi-week lows.

URPD Highlights Heavy Support and Resistance Clusters

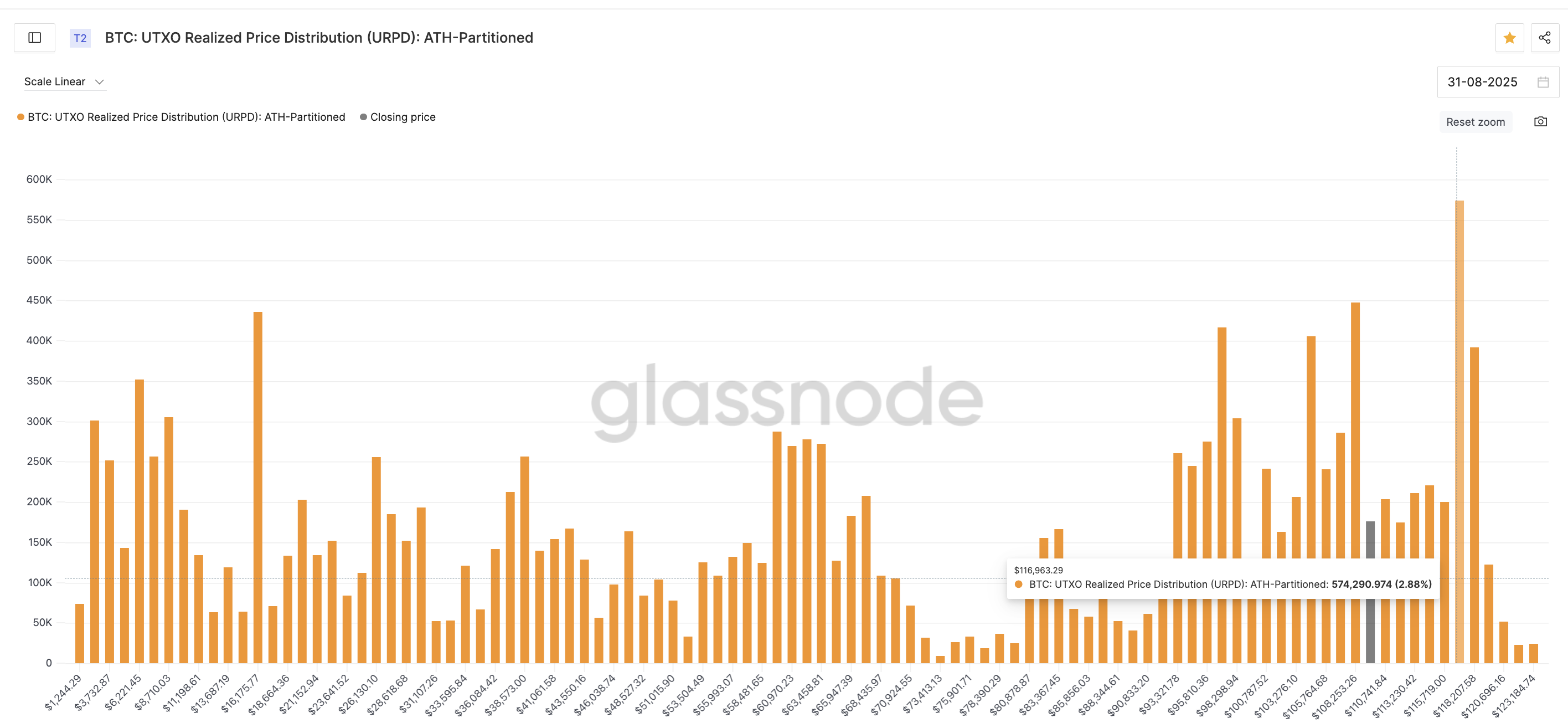

The UTXO Realized Price Distribution (URPD) maps where the existing BTC supply last moved, providing insight into support and resistance. Each cluster represents price levels where large amounts of Bitcoin were bought, creating natural barriers.

Key BTC Price Clusters:

Key BTC Price Clusters:

At the lower end, $107,000 anchors a strong cluster of 286,255 BTC (1.44%), while $108,200 ($108,253.26 on the chart) holds 447,544 BTC (2.25%). These concentrations explain why the Bitcoin price has steadied around the $108,000 zone despite continued selling pressure.

Interestingly, the latest SOPR low coincided with Bitcoin trading near $108,300 — almost the same as the $108,200 URPD cluster — reinforcing this area as a possible market bottom zone.

On the upside, resistance builds quickly. $113,200 (close to the key $113,500 level ) holds 210,708 BTC (1.06%), and $114,400 holds 220,562 BTC (1.11%). The most significant barrier lies at $116,900, where 2.88% of the supply was last transacted—the heaviest wall in this region. For bulls, reclaiming this zone is critical for any sustainable rebound.

Bitcoin Price Levels to Watch

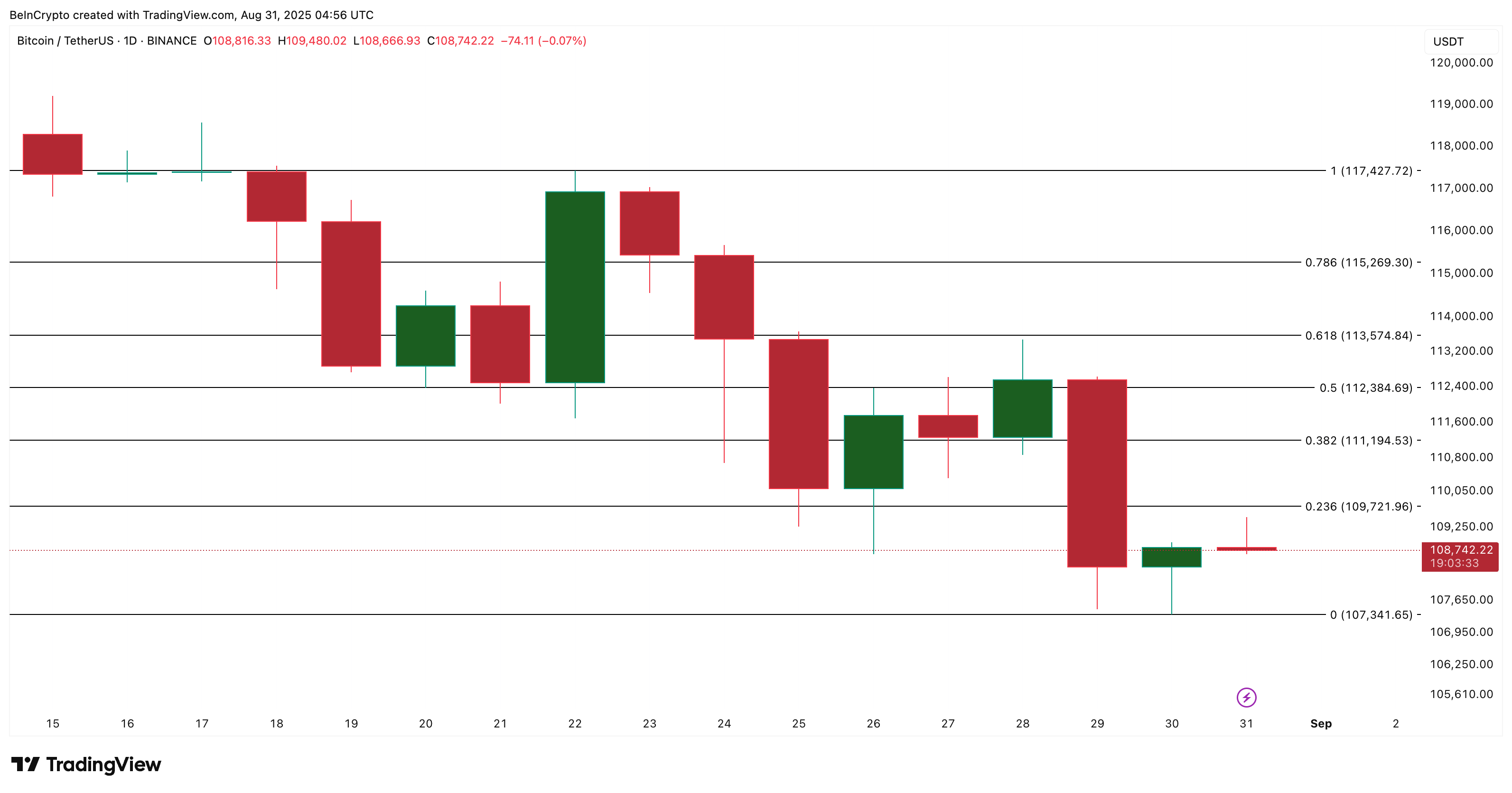

Technically, Bitcoin’s swing low at $107,300 remains the key invalidation level (close to the lowest key URPD anchor of $107,000). A close below it would confirm a bearish continuation and undermine the market bottom thesis.

On the rebound side, reclaiming $109,700 is the first sign of strength. Above that, $112,300 (Fib 0.5) and $113,500 (Fib 0.618) are the breakout zones that bulls need to flip.

Per visual cues, the $113,500 is a repeated rejection zone for the current Bitcoin price and remains the most critical level to change the narrative

Bitcoin Price Analysis:

Bitcoin Price Analysis:

For now, the story connects clearly. Weak hands are exiting (SOPR), strong hands are defending key clusters (URPD), and price is hovering near support. If the Bitcoin price pushes above $117,400, it could confirm renewed strength.

But failure to hold $107,300 would tilt the narrative back to the bears.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Metaplanet ADR: A Strategic Gateway for US Investors to Access Bitcoin-Backed Assets

Analyst: The Most Hated XRP Rally Is About to Start. Here’s why

Will the crypto industry be doing well in 2026?

What Is DOGEBALL? Inside the New Crypto Presale and Why Everyone Is Racing to Join the Whitelist