DIA -136.66% 24H Drop Sparks Market Analysis

- DIA plummeted 136.66% in 24 hours on Aug 31, 2025, sparking market analysis and volatility concerns. - Technical analysts highlight broken support levels and potential bearish trends below $0.65. - A proposed backtest examines historical DIA performance post-136.66% drops from 2022-2025. - Traders adjust risk strategies amid unexplained declines, despite no clear macroeconomic links.

On AUG 31 2025, DIA dropped by 136.66% within 24 hours to reach $0.7105, DIA dropped by 522.54% within 7 days, dropped by 832.79% within 1 month, and dropped by 11.41% within 1 year.

The dramatic 24-hour drop has triggered renewed attention from traders and analysts monitoring DIA’s price behavior. While the one-year decline remains relatively modest, the recent volatility reflects a sharp divergence in short-term market sentiment. The price movement has raised questions about the underlying factors driving DIA and whether structural changes in demand or liquidity have contributed to the steep declines.

Technical analysts have noted that the drop appears to align with several bearish indicators. A key level of support appears to have been breached, potentially signaling further downward momentum. However, some argue the price may have overreacted, creating a short-term oversold condition that could attract contrarian traders. Analysts project the next critical level to watch is the $0.65 psychological threshold, with a break below that potentially indicating the start of a longer bearish trend.

The technical profile suggests a continuation pattern is forming, with the possibility of either a sharp rebound or a prolonged decline. Traders are closely watching whether the price can stabilize above $0.68, which would suggest a short-term floor. Below that level, the path toward $0.60 could be more likely, especially if volume remains low and bearish momentum indicators fail to reverse.

The drop has also triggered questions about the effectiveness of existing risk management strategies. Some traders have already adjusted their exposure, either hedging with derivatives or shifting to alternative assets. While no direct correlation has been established between broader market trends and DIA’s movement, the timing of the drop has caused speculation about external pressures, including macroeconomic shifts or sector-specific events.

Backtest Hypothesis

In light of the recent price movement, a potential backtest strategy has been proposed to analyze the impact of such sharp price declines on DIA’s future performance. To ensure accuracy, the backtest will need to clarify a few key definitions. The term "down 136.66%" implies a one-day price drop of this magnitude, which is not feasible under normal market conditions, as a 100% drop would render the asset worthless. It is important to confirm whether the intention was a 13.66% drop or a decline in dollar terms—such as 136.66 USD.

Additionally, the backtest must determine how to define the "event": as a daily return, an intraday move, or a peak-to-trough drop. Clarifying whether to treat each instance of a qualifying drop as a standalone event or to group them within a larger drawdown sequence will also be critical.

Once the event criteria are defined, the backtest will analyze the historical performance of DIA following these events, using a testing window from 2022-01-01 through 2025-08-30. The goal is to understand how similar past movements have influenced the asset’s trajectory and whether a predictive pattern might emerge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When AI Makes Candlestick Charts Speak

Ethereum Bearish Pressure Intensifies: 3 Critical Factors Threatening ETH’s Price

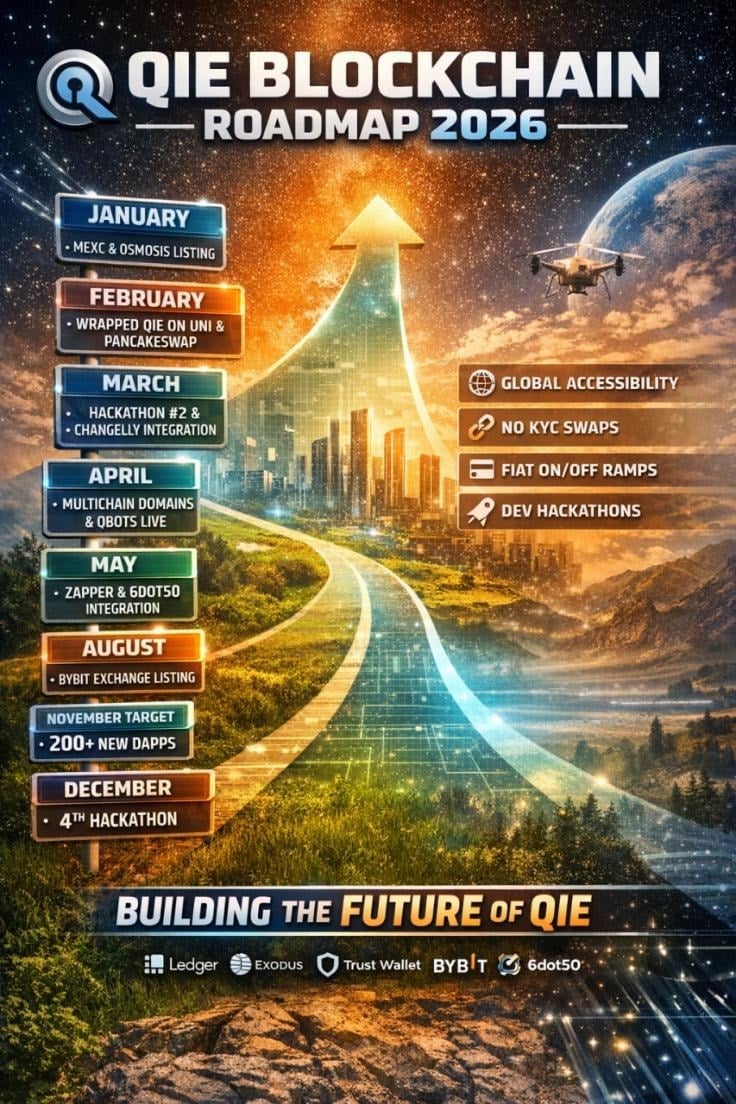

QIE 2026 Roadmap: Building the Infrastructure for Real Web3 Use

Ripple advances protocol safety with new XRP Ledger payment engine specification