Bitcoin’s Price Correction and Rising Retail Interest: Is Institutional “Smart Money” Exiting or Rebalancing?

- Bitcoin's 30% August 2025 price drop triggered debates over institutional exit vs. strategic rebalancing, with data showing diversification into Ethereum and altcoins. - Despite $1.17B ETF outflows, BlackRock's IBIT retained 89% of Q3 inflows, while corporate treasuries accumulated 3.68M BTC, removing 18% of circulating supply. - On-chain metrics revealed 64% of Bitcoin supply held by 1+ year HODLers, with whale accumulation scores and long-term lockups confirming sustained institutional confidence. - Re

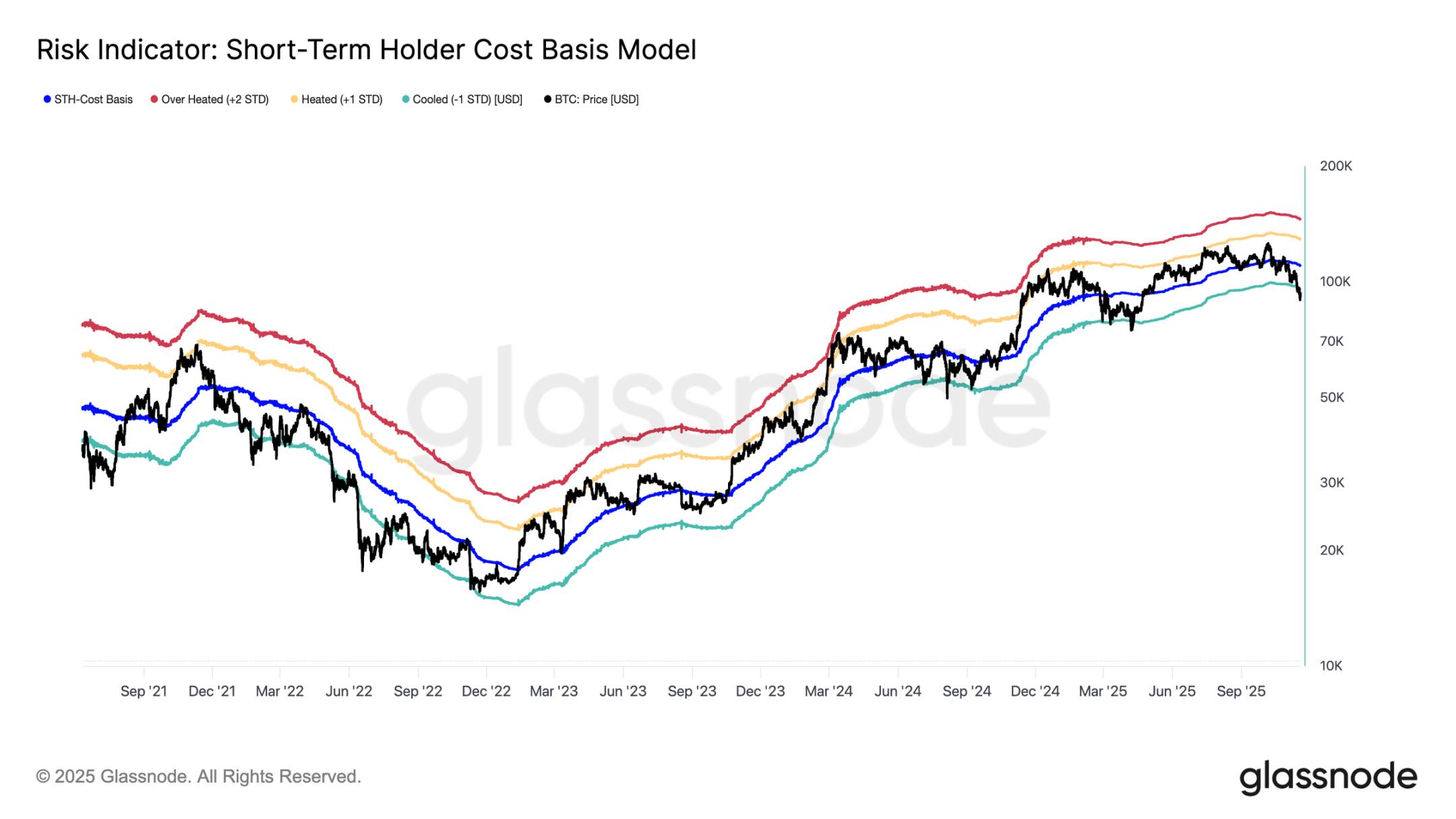

Bitcoin’s recent price correction—a 30% drop to $75,000 in August 2025—has sparked debates about whether institutional investors are signaling an exit or strategically rebalancing their portfolios. The answer lies in a nuanced analysis of market sentiment, search behavior, and on-chain activity, which collectively suggest a shift toward diversification rather than abandonment.

Institutional Activity: ETFs and Corporate Holdings Signal Resilience

Despite a $1.17 billion outflow from U.S. spot Bitcoin ETFs in late August, BlackRock’s IBIT ETF retained zero outflows during the selloff, capturing 89% of the $118 billion in inflows by Q3’s end [1]. This resilience underscores institutional confidence in Bitcoin as a core asset. Corporate treasuries and sovereign entities further reinforced this narrative by accumulating 3.68 million BTC, removing 18% of the circulating supply from active trading [2]. Public companies like Strategy Inc. (628,946 BTC) and Trump Media & Technology Group (15,000 BTC) have adopted Bitcoin as a strategic hedge against fiat devaluation [3].

Institutional investors are also diversifying into Ethereum and altcoins, adopting a “barbell strategy” that pairs Bitcoin’s store-of-value role with Ethereum’s 3.5% staking yields and altcoins like Solana and Chainlink [4]. Ethereum ETFs attracted $2.96 billion in Q3, outpacing Bitcoin’s outflows, while altcoins drew $1.72 billion due to their utility in AI and real-world asset (RWA) integrations [4]. This reallocation reflects a broader trend of yield-seeking capital rather than a wholesale exit from Bitcoin.

On-Chain Metrics: Whale Accumulation and Long-Term Lockup

On-chain data reveals sustained institutional accumulation. The Whale Accumulation Score hit 0.90, with 1+ Year HODLers controlling 64% of Bitcoin’s supply [5]. The Exchange Whale Ratio, a 15-month high, indicates large holders are locking in Bitcoin for long-term value [5]. Meanwhile, the Value Days Destroyed (VDD) Multiple and MVRV Z-Score confirm a robust accumulation phase [5].

Contrarian buying during the August correction further highlights institutional resilience. Despite a 30% price drop, institutions controlled 18% of the Bitcoin supply by Q3, with corporate treasuries holding 3.68 million BTC [6]. On-chain metrics like the Accumulation Trend Score and UTXO Age Distribution point to sustained buying pressure [6].

Market Sentiment: Retail Caution vs. Institutional Optimism

Retail sentiment remains cautious, with the Fear and Greed Index hitting an extreme fear level below 10 in April 2025 despite Bitcoin trading between $80K–$85K [5]. This hesitancy is partly due to volatility concerns and the perception that retail investors “missed the boat” at higher prices [7]. However, institutional confidence is bolstered by regulatory clarity, including the CLARITY Act (reclassifying Ethereum as a CFTC-regulated commodity) and the Trump administration’s 2025 executive order allowing 401(k) accounts to include Bitcoin [1]. These developments unlocked $8.9 trillion in retirement capital, with even a 1% allocation injecting $89 billion into the market [8].

Search Behavior: Divergence Between Retail and Institutional Trends

Google Trends data shows a stark divergence: while Bitcoin search volume remains subdued at a peak of 36 in 2025 (far below the 100-level spikes of 2021), altcoin interest surged mid-August before plunging 55% amid market downturns [7]. This volatility raises questions about whether retail interest is genuine or algorithmically driven by crypto platforms. Meanwhile, institutional ETF inflows—accounting for 85% of price discovery in 2024—have decoupled from retail metrics, signaling a maturing market dominated by institutional capital [9].

Conclusion: Rebalancing, Not Exit

The evidence points to a strategic rebalancing rather than an institutional exit. While Bitcoin’s market dominance fell from 65% in May to 59% by August, this reflects capital rotation into yield-bearing assets like Ethereum and altcoins, not a loss of confidence in Bitcoin itself [4]. Regulatory tailwinds, corporate adoption, and on-chain accumulation suggest Bitcoin remains a core institutional holding. Analysts project a price target of $190,000 by Q3 2025, driven by sustained institutional demand and global liquidity expansion [10]. For investors, the key is to monitor ETF flows, macroeconomic signals, and regulatory developments as they shape the next phase of institutional adoption.

Source:

[1] Bitcoin's Q3 2025: Historic Highs, Volatility, and Institutional Moves

[2] Bitcoin's Institutional Supply Shock: A Catalyst for $192000

[3] Public companies bought more bitcoin than ETFs did for the third quarter in a row

[4] Institutional Capital Reallocates: The 2025 Crypto Diversification Shift

[5] Bitcoin Whale Accumulation and Institutional Confidence

[6] Contrarian Institutional Buying: A Harbinger of Bitcoin's Market Reversal

[7] Bitcoin Retail Traders Scarce as BTC Hits Highs

[8] Q3 2025 Bitcoin Valuation Report

[9] The Bitcoin Spot ETF Approval and Its Implications for ...

[10] 25Q3 Bitcoin Valuation Report

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin plunges 30%. Has it really entered a bear market? A comprehensive assessment using 5 analytical frameworks

Further correction, with a dip to 70,000, has a probability of 15%; continued consolidation with fluctuations, using time to replace space, has a probability of 50%.

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative, Is a Full Bear Market Really Here?

Spot demand remains weak, outflows from US spot ETFs are intensifying, and there has been no new buying from traditional financial allocators.

Why can Bitcoin support a trillion-dollar market cap?

The only way to access the services provided by bitcoin is to purchase the asset itself.

Crypto Has Until 2028 to Avoid a Quantum Collapse, Warns Vitalik Buterin