Ethereum Community Foundation Rolls Out BETH to Make Token Burns Visible

BETH provides a tangible representation that can be used in governance, incentive models, and decentralized applications.

The Ethereum Community Foundation (ECF) has rolled out a new token, BETH, which serves as a verifiable record of Ether permanently removed from circulation.

The launch underscores the foundation’s mission to restore Ethereum’s focus on ETH as a core asset. It also aims to strengthen Ethereum’s monetary design at a time when debates about scarcity remain unresolved

What is the BETH Token?

Unveiled on August 28, the program operates through a smart contract that accepts ETH and forwards it to an irretrievable burn address. It then issues an equal amount of BETH back to the contributor.

The foundation argued that Ethereum’s existing system, introduced with EIP-1559, already eliminates a portion of fees with every transaction. However, those removals remain largely abstract.

BETH, by contrast, offers a tangible representation that can circulate in applications and protocols.

The ECF described the token as a building block for proof-of-burn. It makes the mechanism usable in governance frameworks, incentive models, and new forms of decentralized coordination.

“As Ethereum continues to evolve, BETH highlights the role of scarcity and destruction as equally powerful forces alongside creation and issuance,” the foundation stated.

Ethereum core developer and ECF founder Zak Cole compared the design to wrapped Ether. He explained that just as WETH standardizes ETH for smart contracts, BETH provides a clean layer for tracking burns.

He suggested that the token could enable mechanics such as burn-based voting and auctions where bids are denominated in destruction rather than revenue.

It could also support namespaces that expire unless sustained by continued burning.

At the same time, Cole warned that users should treat BETH strictly as a receipt system, not as a new asset with intrinsic value.

The introduction of BETH comes as Ethereum’s monetary policy continues to attract debate.

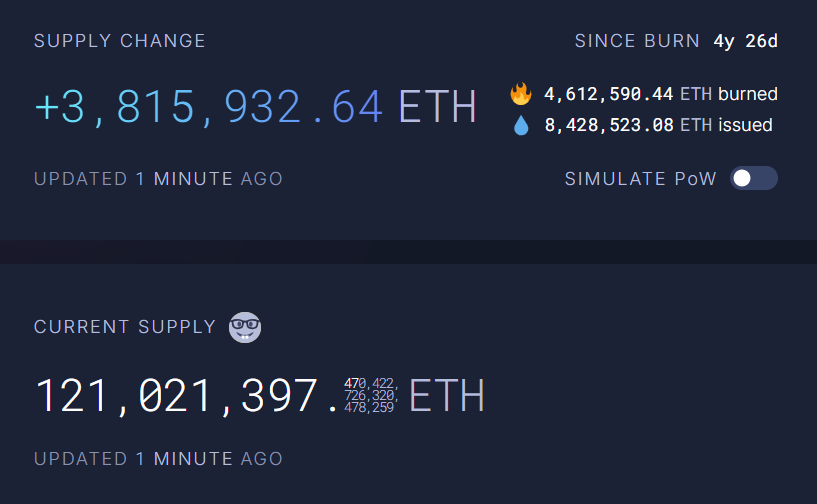

Since the 2021 London upgrade, the network has burned roughly 4.6 million ETH while issuing more than 8 million new tokens over the same period.

Ethereum’s Circulating Supply. Source:

Ethereum’s Circulating Supply. Source:

This mismatch has prompted analysts to question whether Ethereum’s design can consistently enforce scarcity.

However, Ethereum co-founder Joseph Lubin expressed confidence that the community will embrace the new model.

He said developers are already exploring ways to build on BETH, suggesting that proof-of-burn could evolve into industries of its own.

“Burning ETH is going to be a very lucrative thing to do, as it will spawn industries. And a very fun thing to do, as it will become a popular mechanic in Web3 games. This is one way people will get paid to play in Web3,” he added.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SoFiUSD Stablecoin: The Revolutionary First from a US National Bank

VivoPower Plans $300M Ripple Labs Share Vehicle in South Korea

Revealing: Kevin Hassett’s Bold Call for an Interest Rate Cut and What It Means for Crypto

Changpeng Zhao’s Crucial Mission: Talks with 10 Governments on Crypto Regulation