Obita completes over $10 million angel round financing to accelerate the deployment of new infrastructure for stablecoin cross-border payments

This round of funding will focus on core system development, compliance construction, and market expansion, accelerating the layout of a global stablecoin cross-border payment network.

Obita is building a blockchain-native payment network under the Obita Mesh framework, with compliant stablecoins at its core.

Source: Obita

The enterprise-level cross-border payment and digital financial network Obita announced the completion of an angel round financing exceeding 10 million USD, jointly led by Yuanjing Capital and Mirana Ventures, with follow-on investments from well-known institutions and individuals such as Junlian Capital, HashKey Capital, and Web3.com Ventures. This round of funding will be mainly used for core system R&D, compliance construction, and market expansion, accelerating the global layout of the stablecoin cross-border payment network.

Driven by the global wave of stablecoin legislation and compliance, cross-border payments are undergoing a new revolution.

With compliant stablecoins at its core, Obita is building a blockchain-native payment network under the Obita Mesh framework, enabling global enterprises to enjoy low-cost, real-time, and regulatory-compliant settlement experiences. Addressing industry pain points such as high exchange costs, slow settlement, and lack of transparency in fund flows, Obita deeply integrates enterprise-level compliance systems, cross-border clearing networks, and integrated fund management tools, reshaping the flow of funds for cross-border trade, cross-border e-commerce, and supply chain platforms, and taking the lead in high-growth markets such as Southeast Asia, Central Asia, Africa, and Latin America.

The core team of Obita brings together top talents from fintech, cross-border payments, and crypto assets, with deep technical expertise and forward-looking industry insights. They have extensive experience in global payment network construction, compliant operations, and payment financial product design, consistently leading innovation and iteration in the cross-border digital payment industry.

Da Yong Zhang — Co-founder and CEO, has outstanding practical experience and industry influence in fintech products, global payment network construction, and crypto asset ecosystem building. He previously served as Chief Business Officer (CCO) of HashKey Group, CEO of Onchain Business Group, and Executive Director of Yuanbi Technology, where he led the development of fiat products for the HashKey global trading platform, guided HashKey Chain to become the preferred public chain for compliant RWA in Hong Kong, and promoted the RD stablecoin into the HKMA regulatory sandbox. As General Manager for South Asia and Southeast Asia at Ant Financial, he led the creation of leading local wallet super unicorn products in multiple countries and drove Ant’s global payment network expansion.

Vincent YANG — Co-founder and Chief Business Officer (CBO), is a serial entrepreneur who previously founded abComo and anyStarr, and was also a co-founder of Longbridge Securities. As a key member of the AliExpress and Ant Financial international business development teams, he led the implementation of multiple cross-border payment and digital finance projects in Southeast Asia, Europe, and Latin America, with deep understanding and execution capabilities in global market operations, strategic partnerships, and business expansion from 0 to 1.

Obita Co-founder and CEO Da Yong Zhang stated: “Cross-border payments are at a structural transformation point driven by stablecoins. We aim to bring the global payment innovation of blockchain technology into real trade fund flows with enterprise-level performance, end-to-end compliance and security, and high-quality, user-friendly integrated services.”

Liu Yiran, Managing Partner of Yuanjing Capital, stated: “Cross-border B2B payments are a key infrastructure for global trade. Obita’s stablecoin-centric solution significantly improves the cost and efficiency of cross-border payments. We are optimistic about the Obita team’s experience and diverse backgrounds in global fintech. Yuanjing has a broad investment portfolio in cross-border fintech and looks forward to exploring more possibilities for stablecoins in payments together with Obita.”

David Toh, Managing Partner of Mirana Ventures, stated: “Obita takes compliance as its cornerstone, bringing stablecoin settlement into the core of global trade and accelerating industry upgrades.”

Wenlong Wang, Managing Director of Junlian Capital, stated: “Bridging the worlds of Web2 and Web3 is the biggest opportunity in FinTech today. Obita brings together experienced professionals from both sides, making it a very rare team.”

Deng Chao, CEO of HashKey Capital, stated: “Obita’s solution is highly compatible with HashKey’s layout in digital assets, compliance, and infrastructure, and will jointly accelerate industry transformation.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

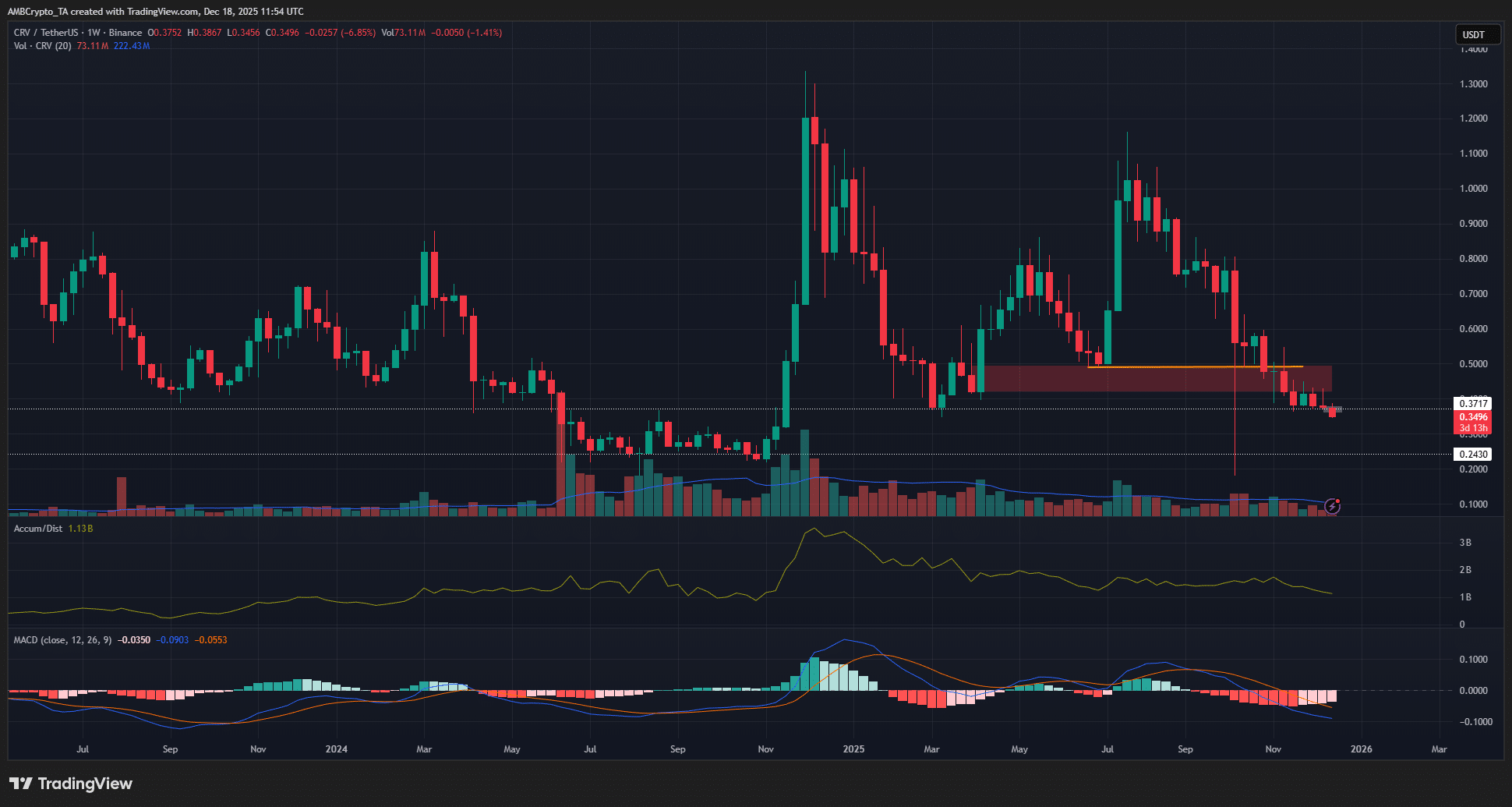

Dissecting Curve DAO’s price action as CRV eyes another support test

Damaging Impact: Cardano Founder Reveals How Trump’s Crypto Moves Hurt the Market

Crucial Alert: CoinMarketCap’s Altcoin Season Index Plummets to a Weak 17