Pre-launch Readiness Checklist: 20 Q&A Exploring Governance Models

WLFI token holders can submit and vote on formal proposals through the Snapshot platform, but World Liberty Financial retains the right to review and reject any proposal.

Original Article Title: "20 Q&A to Help You Understand the Trump Family's WLFI Governance Model for the Cryptocurrency Project"

Original Article Author: Moni, Odaily Planet Daily

Last weekend, World Liberty Financial (WLFI) and Aave's proposal dispute caught the market's attention, with both parties embroiled in a "7% revenue share" dilemma. A week later, WLFI is also about to face its token's first claim and trading on September 1. So, what is the governance model of this cryptocurrency project backed by the Trump family? Below, Odaily will guide you through 20 official questions and answers to deepen your understanding:

General Governance Questions

1. How to Participate in WLF Protocol Governance?

WLFI's sole purpose is to participate in the governance of the World Liberty Financial (referred to as the "WLF Protocol"). Therefore, it hopes that the community will actively participate in proposals, discussions, and voting on WLF Protocol governance matters. If you do not intend to participate, please do not buy this token.

Proposal Questions

2. How to Participate in Discussing Potential Proposals?

Proposals will be discussed on the "forum." Community members must first register an account to participate in the forum. It is important to note that the forum is not limited to WLFI token holders; anyone with an account can participate in the forum. Although the forum is a place for discussing potential WLF Protocol governance initiatives and pre-vote "temperature checks," there will be no actual token voting on the forum, and any actions on the forum will not determine the voting results. Some discussions on the forum may be purely social in nature.

3. How to Propose a Formal Voting Proposal?

Formal proposals are submitted through Snapshot, where any user holding and staking votable WLFI tokens can create a proposal. World Liberty Financial will screen proposals before the Snapshot vote begins and reserve the right to reject any proposal if its implementation would constitute an unreasonable risk or security risk that violates legal requirements (including contractual obligations). The specifics are defined by the WLF Articles, with these decisions made by World Liberty Financial at its sole discretion and as the final decision.

4. What Happens After Submitting a Proposal?

After submission, the proposal will enter the community review phase. During this period, all WLFI holders can review the proposal, provide feedback, and discuss its implementation. There is no minimum required discussion time, but the voting period for a specific proposal is typically two weeks, although World Liberty Financial may adjust this based on the circumstances.

5. How is Spam Proposal Prevention Ensured?

World Liberty Financial will screen proposals and may reject any proposals it deems to be spam. Ultimately, additional screening measures may be created through the governance process, allowing users to directly submit proposals.

Voting Process

6. How is Voting Conducted?

Once a proposal receives voting approval, a "snapshot" of token holders will be taken. Token holders with tokens are eligible to vote. In most cases, proposals will use a simple vote, either for or against. However, in certain situations (e.g., if a proposal may have more than two possible outcomes), ranked-choice voting may apply.

To participate in Snapshot voting, you must hold WLFI tokens and securely hold these tokens in a way that allows your wallet or a similar application to connect to Snapshot. Snapshot voting enables off-chain voting (to avoid voters paying Gas fees), and the voting results will be stored on-chain and verifiable.

7. How Can I Know if a Proposal is Open for Voting?

Proposals are typically announced on the Snapshot forum, and formal proposals can be submitted and viewed in Snapshot, but registration on the forum is required to receive information on voting proposals.

8. How Long is the Voting Period Open?

The voting period for proposals is typically two weeks, but World Liberty Financial may make changes in certain circumstances.

9. Are There Limits on the Token Amount for Participation in Voting?

Yes. In addition to each token holder being limited to a 5,000,000,000 token vote (which is 5% of the total supply), any treasury tokens (i.e., tokens owned by World Liberty Financial) cannot be used for voting.

10. Can the WLFI Token be Transferred?

Currently, WLFI is not transferable or resalable. WLFI holders approved a proposal in July 2025 to allow the transfer of WLFI tokens. It is expected that WLFI will unlock and make tradable a portion of the tokens allocated to early purchasers according to the unlock schedule. The remaining WLFI tokens allocated to early supporters will be subject to a second community vote to determine the unlock and distribution schedule. The unlock schedule for founders, advisors, and other individuals is expected to remain non-transferable, with longer unlock schedules in any case. World Liberty Financial reserves the right to determine the timing and eligibility requirements for unlocking WLFI tokens.

11. What Happens If I Do Not Participate in Voting?

If you do not participate in discussions, proposals, and voting, you will not be able to utilize the functionalities of the WLFI token and will miss out on the opportunity to help shape the future of the WLF protocol and engage with the WLFI community.

12. What is the Approval Threshold for Voting?

Proposal approval requires meeting an initial minimum quorum, which is the voting of 1,000,000,000 WLFI tokens, and a majority of WLFI token votes in favor for the proposal to pass. These thresholds may be subject to adjustment as the governance process evolves.

13. What Happens If a Token Holder Holds Over 5,000,000,000 WLFI Tokens?

World Liberty Financial aims to embody decentralized governance and has decided to limit the voting power of individual token holders. Wallets holding over 5% of the total token supply (i.e., 5,000,000,000 or more WLFI tokens) will have their voting power capped at 5,000,000,000 tokens. Additionally, if it is discovered that an individual holds over 5,000,000,000 WLFI tokens across multiple wallets or addresses, measures will be taken to ensure their voting power is capped at 5,000,000,000 tokens, regardless of how many addresses or wallets the individual uses to control their WLFI token holdings. Early contributors and service providers holding over 5% of the tokens have disclosed their ownership and associated status.

14. What is the Difference Between Total Token Supply, Undistributed Token Supply, and Token Supply Eligible for Voting?

Total token supply refers to the total number of tokens ever issued, fixed at 100 billion tokens.

The Undistributed Token Supply refers to the total token supply minus the number of tokens held by WLF, including tokens sold to purchasers in a token sale and grants provided to advisors, service providers, directors, executives, and employees. The Votable Token Supply refers to the Undistributed Token Supply minus the number of tokens held by individuals and their affiliates known to hold more than x WLFI tokens.

For example, if a holder owns 7,000,000,000 WLFI tokens, the holder can only vote with 5,000,000,000 WLFI tokens, and the Votable Token Total Supply will decrease by 2,000,000,000 WLFI tokens. Since the Votable Token Supply is subject to change based on the actual sales or issuance of WLFI tokens, WLF reserves the right to adjust the token voting program restrictions to the actual Votable Token Supply up to 5%.

15. How do I vote if I hold tokens through a third-party custodian?

You should contact the third-party custodian to understand their voting policy and procedures.

Proposal Implementation Issues

16. How are approved proposals implemented?

Once a proposal is approved on Snapshot, if the approval (or rejection) requires on-chain platform actions, the relevant multi-signature parties should execute that action, which will be completed within a reasonable time frame after the proposal is passed. Some upgrade proposals may require extensive audits and other security checks to be safely implemented on the platform, so the timing of the approved implementation should be reasonably determined by the relevant multi-signature parties.

17. Under what circumstances will approved WLFI governance proposals not be executed?

World Liberty Financial reserves the right to reject any proposed or approved proposal if its implementation, once executed, would unreasonably pose a risk of violating the law (including any contractual obligations) or pose a security risk. These decisions are made solely by World Liberty Financial and are final.

Other Issues

18. Will the WLF Protocol Governance Platform be upgraded?

There are currently no upgrade plans, and the WLF Protocol Governance Platform may upgrade its voting procedures through processes to automatically execute certain proposals or types of proposals, but it should be assumed that there will be no future upgrades. Additionally, all parameters listed currently are initial parameters for the platform and may change during the voting process, but such changes should not cause WLF to violate any legal or contractual obligations.

19. Could WLF Protocol Governance Be Paused in the Event of Major Security Risks or Other Threats?

The WLF Protocol or any related protocol may face a "Major Adverse Event," which is any event that causes the WLF Protocol or any related protocol to be unable to function as expected for an extended period, or a "Security Risk," which is any event that causes the WLF Protocol to cease operation or jeopardize the secure use of the WLF Protocol. During a Major Adverse Event or Security Risk, governance control of the WLF Protocol will be fully exercised by a multi-signature until WLF Protocol governance operations return to normal. Additionally, the "secure multi-signature" responsible for WLF Protocol governance, WLF Protocol upgrades, Major Adverse Events, and Security Risks may be approved by token holders and WLF to respond to such matters.

20. Is World Liberty Financial a Decentralized Autonomous Organization (DAO)?

World Liberty Financial is a Delaware non-stock corporation that oversees the WLF Protocol, which allows token holders to vote on certain WLF Protocol governance decisions. The WLF Protocol is not a Decentralized Autonomous Organization (DAO) or any type of organization but is managed and controlled by one or more multi-signers, the number and specific signatories of which are determined by World Liberty Financial. While WLF Protocol governance may be influenced by changes resulting from proposals approved by voting token holders, World Liberty Financial is not bound by any such proposals or votes. There are no obligations between WLFI token holders or between WLFI token holders and World Liberty Financial as per the relevant articles. As per the articles, if approved by the WLFI token holder community, certain WLF Protocol governance proposals will be implemented.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

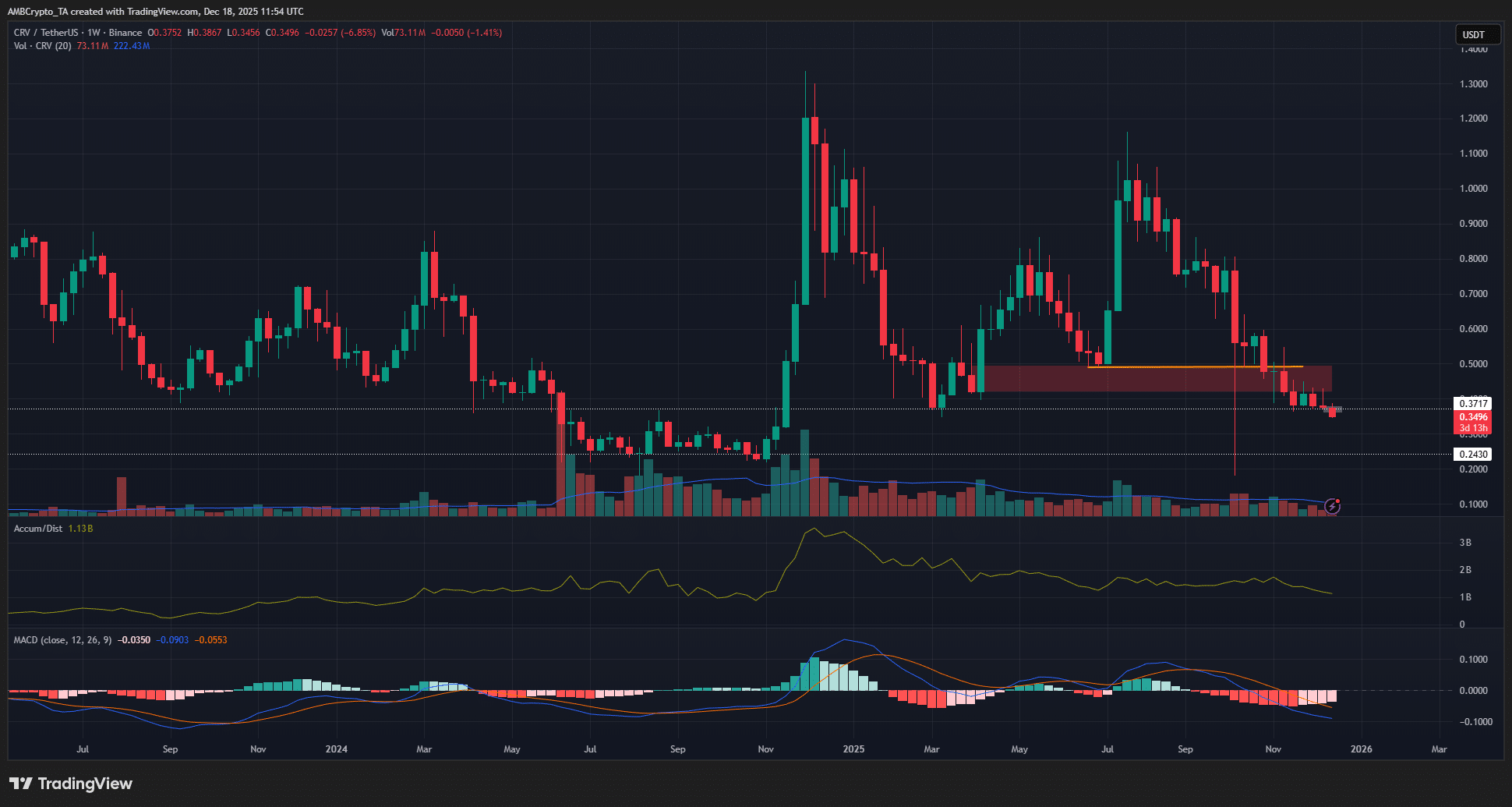

Dissecting Curve DAO’s price action as CRV eyes another support test

Damaging Impact: Cardano Founder Reveals How Trump’s Crypto Moves Hurt the Market

Crucial Alert: CoinMarketCap’s Altcoin Season Index Plummets to a Weak 17