Metaplanet tops 20,000 Bitcoin ahead of key capital-raising vote

Key Takeaways

- Metaplanet now holds 20,000 Bitcoin valued at over $2 billion, making it the seventh-largest public holder globally.

- Proceeds from an upcoming capital-raising vote are planned to further increase Metaplanet's Bitcoin holdings.

Metaplanet acquired 1,009 Bitcoin, bringing its total holdings to 20,000 Bitcoin valued at over $2 billion at current market prices, the Japanese Bitcoin treasury firm announced Monday.

The company will hold a key shareholder vote today on its capital raising plan, with Eric Trump expected to attend, Bloomberg reported earlier this month.

The proposal seeks approval to issue up to 550 million new shares overseas, targeting proceeds of more than 130 billion yen, or about $884 million. The bulk of the proceeds would be used to purchase more Bitcoin.

The company, formerly known as Red Planet Japan, has transformed from a hotel operator into Japan’s leading Bitcoin treasury company. It is now the seventh-largest corporate holder of Bitcoin, according to BitcoinTreasuries.net.

The company recently joined the FTSE Japan Index in the index provider’s September review, moving up from small-cap to mid-cap. President Simon Gerovich called the upgrade a major step in establishing the firm as Japan’s top Bitcoin treasury player.

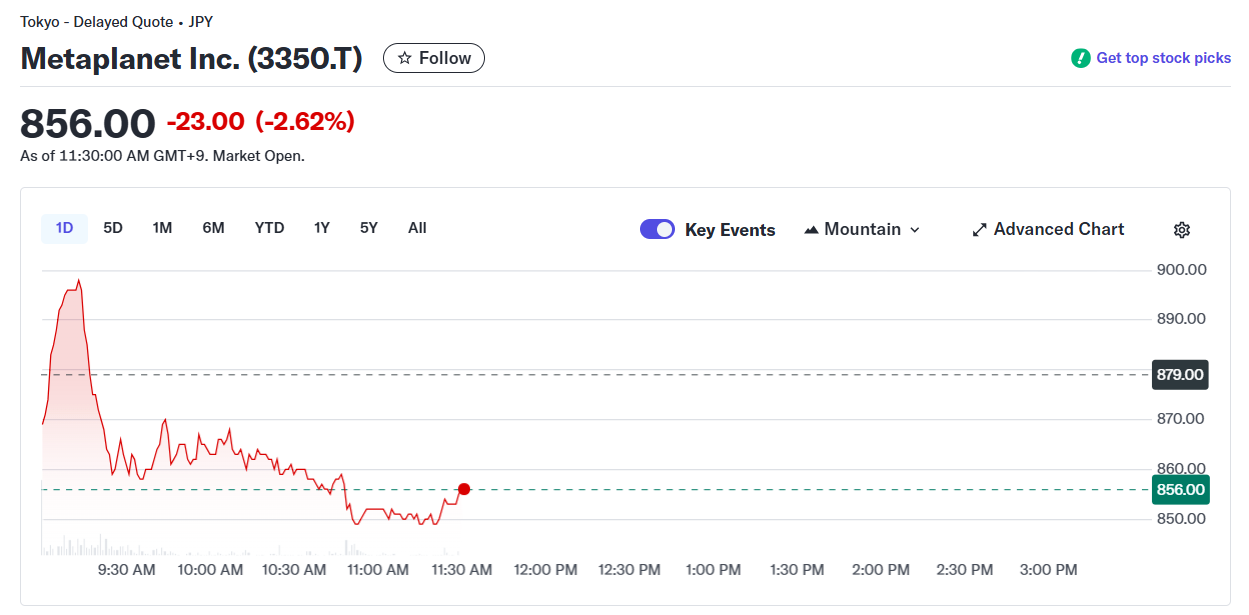

Metaplanet’s shares slipped about 2.6% intraday in Japan. The stock is still up nearly 146% year-to-date.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market Strategist: Everyone Gave Up On XRP. Here’s Why

Best Crypto Presales: New Crypto Coins Set to Lead the Market Recovery

Tezos Art Ecosystem Growth in 2025: Flagship Events, Institutional Programs, and Artist Sales

Urgent Warning: Japan’s Crippling Crypto Tax Reform Risks Global Irrelevance