Thailand’s DV8 Bitcoin treasury push deepens as Jason Fang becomes CEO after 99.9% raise

DV8 today appointed Jason Fang, founding partner of Sora Ventures, as chief executive officer, outlining a shift to a corporate Bitcoin treasury and broader digital asset strategy, the company said.

The move follows a months-long reshaping of DV8’s ownership and balance sheet.

A cross-border group that includes Sora Ventures, UTXO Management, Kliff Capital, AsiaStrategy, Moon Inc., and Mythos Group initiated an acquisition of the Thai-listed firm through a voluntary tender offer in July, positioning DV8 to execute a Bitcoin-centric playbook for public companies in Southeast Asia.

Days later, DV8 named Thai investor Chatchaval Jiaravanon as chairman and expanded its board with a mix of local executives and crypto operators.

DV8 also raised fresh capital through a warrant program completed in mid-July. According to company filings, shareholders exercised 99.9% of available DV8-W2 warrants at 0.80 baht, adding about THB 241 million, roughly 7.4 million dollars, and lifting cash by 38%. The capital raise gives the company room to begin treasury activity and related infrastructure work under the new mandate.

Fang arrives with a record of structuring listed-company Bitcoin programs around Asia. In December 2024 Sora Ventures announced a $150 million fund aimed at helping public companies implement balance-sheet Bitcoin strategies tailored to local market rules.

In February, Fang detailed a “MicroStrategy 2.0” framework in Hong Kong that pairs direct holdings with yield-oriented structured products while removing private key management from end investors.

The Sora ecosystem has since moved onto public markets through Top Win International’s merger and rebrand path to AsiaStrategy on Nasdaq, including a ticker change to SORA and a subsequent push into strategic investments related to corporate Bitcoin adoption.

In August, AsiaStrategy disclosed a $10 million convertible note led by WiseLink and began accepting Bitcoin for luxury watch sales, adding an operational settlement layer that complements the treasury thesis.

Thailand’s policy backdrop has improved for corporates exploring digital assets. The government approved a five-year personal income tax exemption on crypto gains for investors, a move that reduces friction for capital formation and potential secondary-market participation around Bitcoin-treasury equities.

The securities regulator has also authorized the use of USDT and USDC in digital asset transactions, allowing stablecoin pairs on local venues and widening the toolkit for market liquidity. Separate coverage this cycle has pointed to a first local spot Bitcoin ETF approval, indicating a gradual expansion of regulated Bitcoin exposure within the jurisdiction.

For DV8, the immediate roadmap centers on treasury governance, disclosure cadence, and the sequencing of any initial Bitcoin purchases, while the board transition and new cash provide the operating basis.

Prior actions around Sora’s network, including structured yield overlays and cross-listings that connect Hong Kong and U.S. markets, offer a template for how treasury accumulation can interact with corporate finance tools and product initiatives.

DV8’s tender, board changes, and warrant funding provide the backdrop for Fang’s appointment, which now concentrates decision-making for a Thai issuer pursuing a Bitcoin-first model linked to a wider regional network of public companies and investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Revolutionary Move: Forward Industries to Tokenize Its Shares, Unlocking 6.8M SOL Treasury

Digital Euro Breakthrough: ECB Completes Crucial Technical Preparations, Lagarde Reveals

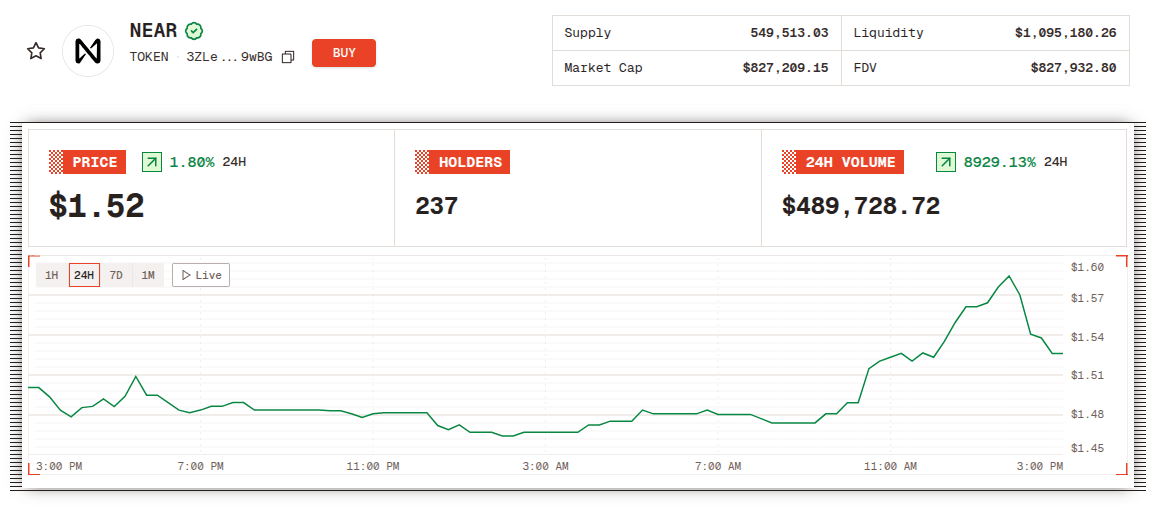

NEAR Is Now Live on Solana as “Attention Is All You Need” Post Goes Viral

Market Strategist: Everyone Gave Up On XRP. Here’s Why