Gaza Residents To Receive Crypto To Relocate Under Trump’s Rumored Plans

Gaza crypto relocation plan with tokenized land under Trump’s rumored GREAT Trust faces civil rights backlash.

The Trump administration is reportedly considering a post-war plan for Gaza that would use cryptocurrency and a tokenized land system to relocate and rehouse Palestinian residents under a potential US takeover.

The tokenized land would then be sold to investors to fund the region’s reconstruction. The news has attracted heavy criticism from civil rights groups.

Controversial GREAT Trust Plan in Gaza Sparks Outrage

The White House is reportedly developing a plan for Gaza that would use tokenized land and digital tokens to rehouse and relocate residents.

On Sunday, The Washington Post published a 38-page document outlining the plan. The document, titled the “Gaza Reconstitution, Economic Acceleration and Transformation (GREAT) Trust,” assumes that the territory will be put under a US trusteeship for at least a decade, which would result in the displacement of Gaza’s two million residents.

The scheme would tokenize Gaza’s land on blockchain…A leaked 38-page proposal called the GREAT Trust reportedly tied to Trump-era circles envisions a US trusteeship over Gaza for at least a decade following the war. The plan would displace Gaza’s 2 million residents…

— Zeus (@ZeusCrypto_) September 1, 2025

The document describes the plan’s relocation as “voluntary” because it would give Gazans a specialized token for their land. These tokens could later be exchanged for an apartment in a new “smart city” or relocation to a different area.

Under the plan, Gazans would receive subsidies for temporary housing and food for up to four years.

The plan would be funded by selling the land to investors interested in the territory’s reconstruction. The proposal itself suggested 10 mega projects, including “The Elon Musk Smart Manufacturing Zone” and the “Gaza Trump Riviera & Islands.”

The Washington Post report also connected the proposal’s creators to the leaders of the controversial Gaza Humanitarian Foundation, an organization supported by the US and Israel.

Though reports also noted that the Boston Consulting Group (BCG) contributed to the financial planning, BCG previously denied these claims.

“Recent media reporting has misrepresented BCG’s role in post-war Gaza reconstruction. Two former partners initiated this work, even though the lead partner was categorically told not to. This work was not a BCG project. It was orchestrated and run secretly outside any BCG scope or approvals,” it said in a July press release.

The proposal has already sparked outrage among civil rights groups. It even prompted a response from Hamas official Basem Naim, who responded that “Gaza is not for sale.”

The regime has a plan to enact a pogrom in Gaza and turn it into the “Riviera of the Middle East” with American management.Palestinians will be offered a “digital token” to be “eventually redeemed” in “AI-powered, smart cities.”Adding a crypto scam to genocide. pic.twitter.com/TbkMOG5chn

— Jim Stewartson, Antifascist

(@jimstewartson) August 31, 2025

Blair, Trump, and Kushner in Post-War Talks

Trump wasn’t the only high-profile politician involved in the Gaza reconstruction proposal.

Reports surfaced in July that the former UK Prime Minister Tony Blair’s think tank was working on a similar project. The plan was reportedly aligned with Trump’s original idea to transform the Palestinian territory into a resort.

Last Wednesday, Blair attended a White House meeting with Trump and his son-in-law, Jared Kushner, to discuss plans for post-war Gaza. The meeting’s contents have not yet been made public.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

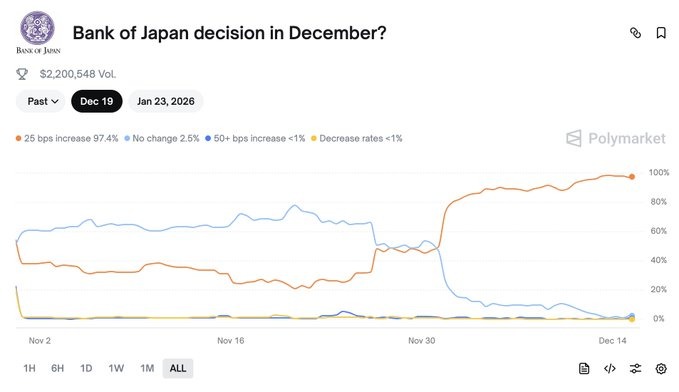

Bitcoin Price To Crash Below $70K as Japan Rate Hike Looms

“Quantum Threat to Bitcoin Is Decades Away”, Says Adam Back

Ethereum Founder Vitalik Buterin Wants Algorithm Transparency on X

“Crypto Cases Were Dropped Under Trump’s Second Term”, NYT Investigation Says