Decentralized exchanges record $1.1 trillion in trading volume as perpetuals drive historic trading month

Decentralized exchanges (DEX) processed a combined $1.15 trillion in spot and perpetual contract volumes during August, marking the first time monthly DEX activity surpassed the $1 trillion threshold.

According to DefiLlama data, spot DEX volumes reached $506.3 billion in August, falling just $1.5 billion short of the all-time high of $507.8 billion recorded in January.

The August figure represents an 18.4% increase from July’s trading activity, demonstrating sustained growth in on-chain spot trading.

Perpetual contract volumes drove the record-breaking performance, reaching $648.6 billion in August, a 31.3% jump from July and an absolute all-time high for the derivative product category.

The perpetuals surge accounted for 56.4% of total DEX volume during the month.

Ethereum reclaims spot leadership

August marked the first time since March that Ethereum overtook Solana and BNB Chain in spot on-chain trading volume.

Ethereum processed $140.4 billion in monthly spot volume, while Solana registered nearly $120 billion. BNB Chain rounded out the top three with approximately $60 billion in spot trading activity.

Uniswap maintained its position as the dominant spot DEX protocol, capturing 28.2% of total volumes with over $143 billion processed in August. PancakeSwap secured second place with $56.6 billion, while Hyperliquid completed the top three with $21.7 billion in spot volume.

The perpetual landscape showed even greater concentration, with Hyperliquid establishing absolute dominance by capturing 62.5% of the market through its $405.8 billion in monthly volume.

Ethereum-based perpetual protocols processed $72.5 billion, securing second place, while BNB Chain platforms generated $55.1 billion.

Among other perpetual protocols, edgeX captured $43.6 billion in trading volume, while Orderly processed $23.7 billion during August.

The spot volume increase drove the DEX-to-CEX trading ratio up by 0.7% to 17.2% in August. Throughout 2025, this ratio has consistently remained above 10%, indicating sustained adoption of on-chain trading infrastructure.

These numbers indicate a growing acceptance of decentralized trading venues, potentially driven by improved user experience across major DEX platforms.

The $1.1 trillion monthly volume achievement positions decentralized exchanges as a permanent fixture in the cryptocurrency market structure, with perpetuals trading finally receiving attention similar to that of their centralized counterparts.

The post Decentralized exchanges record $1.1 trillion in trading volume as perpetuals drive historic trading month appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

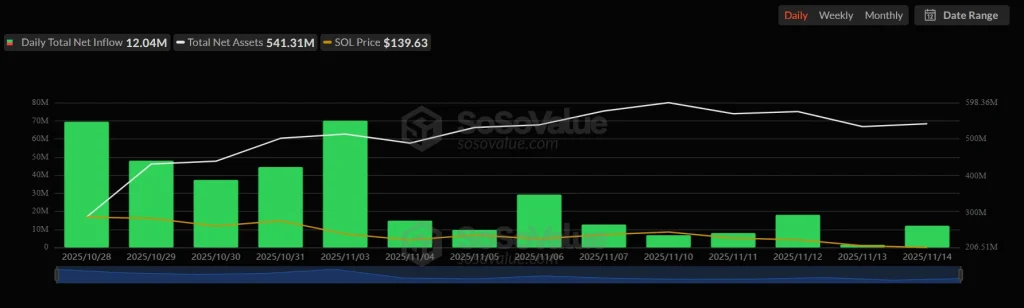

Solana Price Drops to $140, Is a Fall to $134 the Next Move?

Dogecoin Price Sinks to New Lows, Can Bulls Regain $0.171 Soon?

Is Ethereum Starting Its Own Bitcoin-Style Supercycle? Tom Lee Weighs In

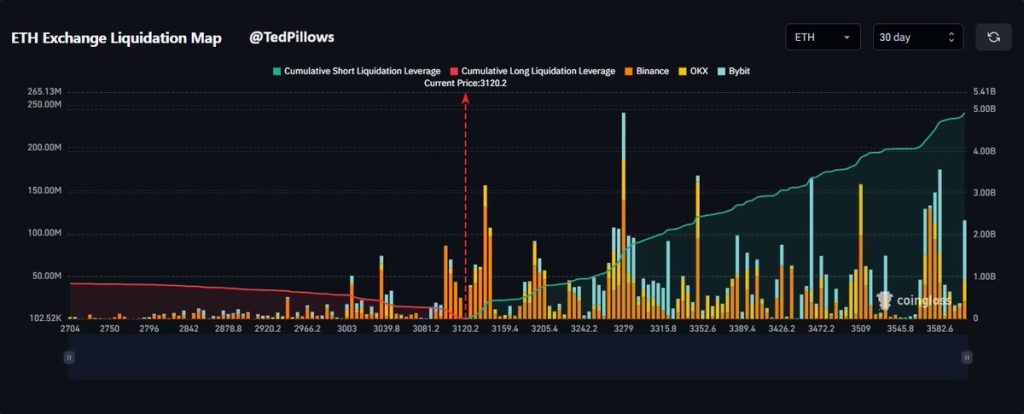

Ethereum Price Analysis: ETH Eyes $3,600 Liquidation Zone as BTC Crashes—Is a 12% Rebound Coming?