ZachXBT says over 100 crypto influencers accepted promo deals without disclosing paid ads

Quick Take ZachXBT published an alleged price sheet covering more than 200 crypto influencers. The security expert claims fewer than five of over 160 paid promoters disclosed their posts as ads.

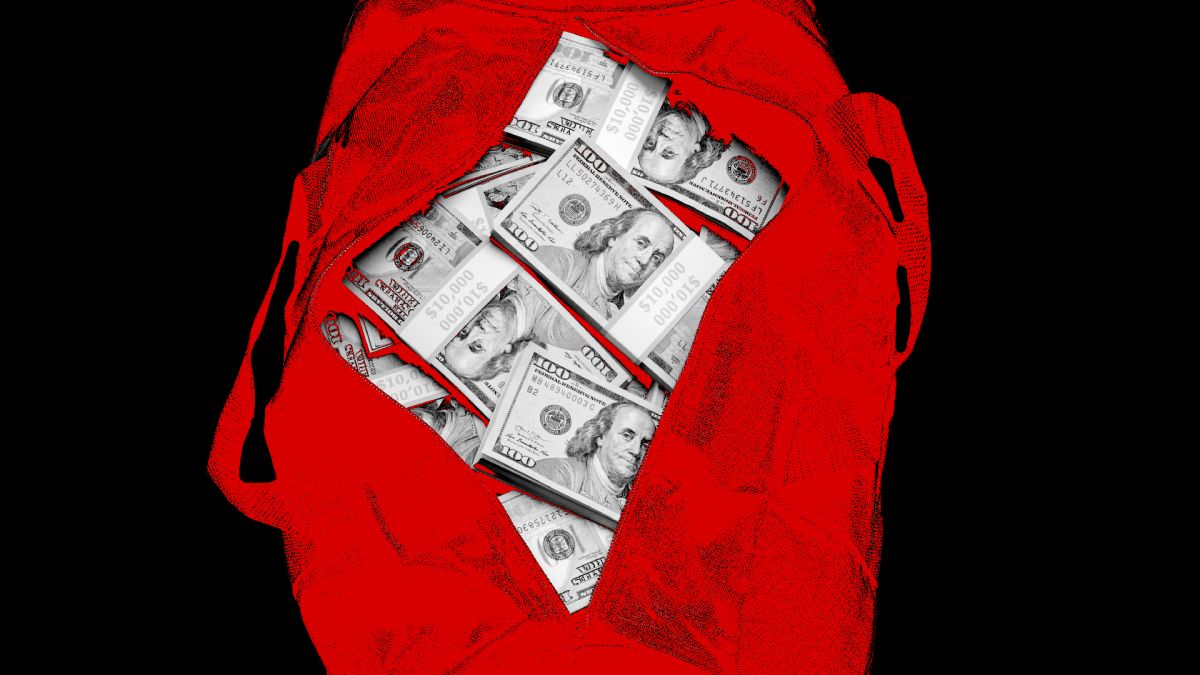

Blockchain sleuth ZachXBT claims he obtained proof that many crypto influencers failed to indicate paid promotions on their social media pages.

On Monday, the web3 investigator published a spreadsheet that lists pricing and wallet addresses for more than 200 crypto influencers contacted to promote a token campaign. He alleged that fewer than five of roughly 160 who accepted the deal labeled their posts as advertisements.

The documents, shared on X , appear to show per-post price quotes ranging from hundreds to five figures, Solana wallet addresses for payment, and links to onchain payment receipts. The Block reached out to several named accounts for comment.

Undisclosed paid endorsements are a recurring flashpoint in the crypto industry, where so-called key opinion leaders, or KOLs, profit from thinly traded tokens. In the U.S., the Federal Trade Commission requires influencers to clearly and conspicuously disclose material connections to brands or projects in social posts. Failure to do so can draw regulatory scrutiny and mislead investors who may mistake sponsored content for impartial analysis.

ZachXBT's latest post adds to broader concerns over market integrity regarding promoted cryptocurrencies and new launches, where coordinated shills, thin liquidity, and limited disclosures spell heavy losses for retail buyers after brief price spikes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Terra Luna Classic Shakes the Crypto Market with Surprising Developments

In Brief LUNC experienced a significant price decline following Do Kwon's sentencing. The court cited over $40 billion losses as a reason for Do Kwon's penalty. Analysts suggest short-term pressure on LUNC may persist, despite long-term community support.

NYDIG: Tokenized Assets Offer Modest Crypto Gains as Growth Depends on Access and Regulation

Cardano Investors Split As Market Fatigue Sets In