Bitcoin OG whale adds another $1B in EthereumBitcoin OG whale stakes ETH

The Bitcoin OG whale, who recently made headlines for dumping billions in BTC for ETH, has added another $1 billion worth of the second-largest cryptocurrency to their stash.

- The Bitcoin OG whale added over $1 billion in ETH to their holdings.

- Since Aug., the whale has sold over 35,000 BTC to buy ETH.

- ETH price has dropped over 11% from its all-time high.

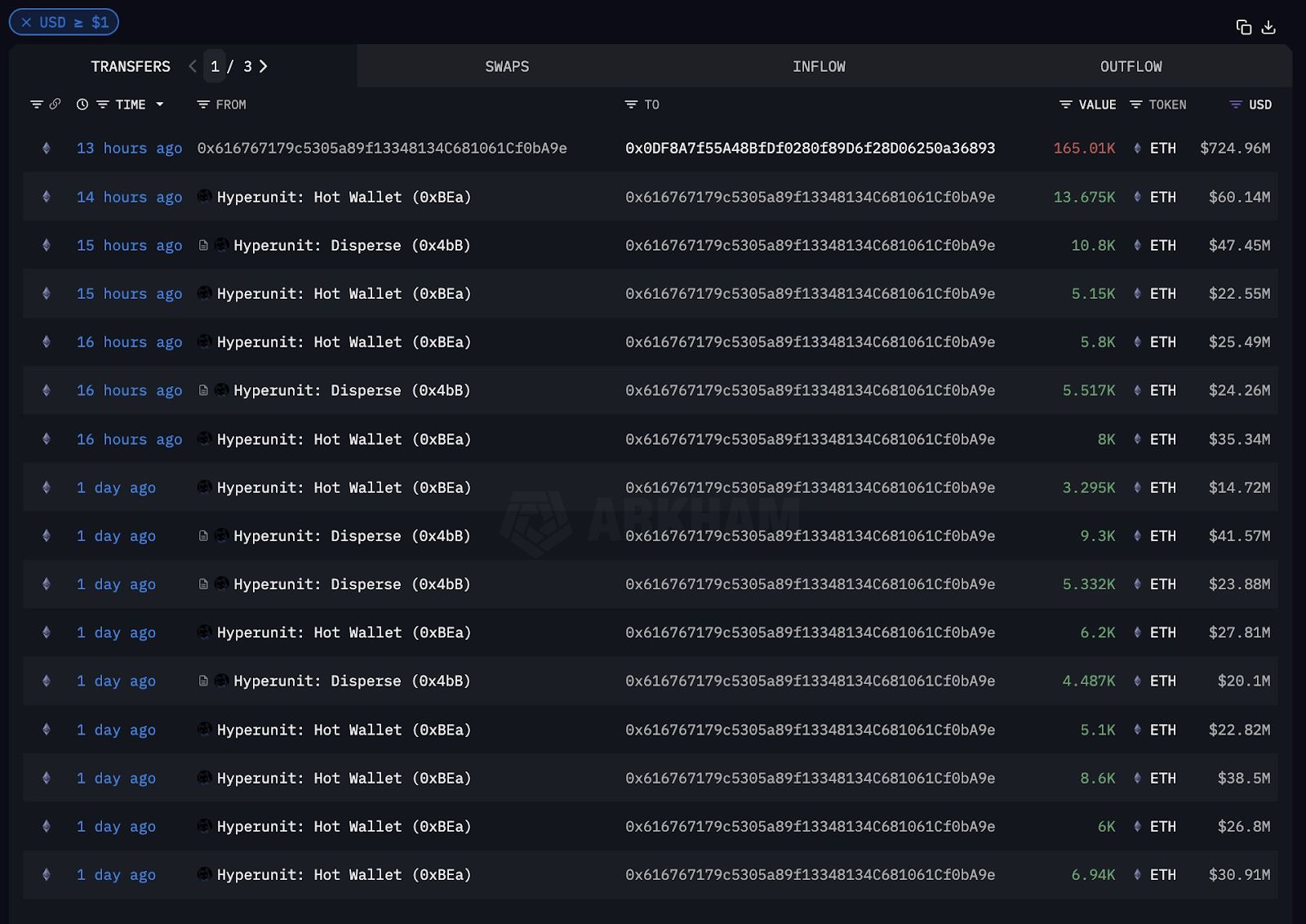

Over the past 24 hours, the Satoshi era Bitcoin whale scooped up roughly $1.08 billion in ETH, according to data from on-chain analytics platform Arkham Intelligence , and subsequently staked a significant portion of it.

A series of ETH purchases by the whale on Hyperunit | Source: Arkham Intelligence

A series of ETH purchases by the whale on Hyperunit | Source: Arkham Intelligence

For the uninitiated, staking involves locking ETH into the Ethereum network to help validate transactions and secure the blockchain, in return for passive yield.

As of press time, the whale’s Ethereum stash held a whopping 886,371 ETH, which is valued at over $4 billion based on current prices.

Bitcoin OG whale stakes ETH

As per data shared by Arkham, the whale has staked roughly $3.5 billion worth of ETH in total, which includes purchases that initially began late in August.

Since Aug. 20, the investor has been rebalancing his portfolio, which originally held over 100,000 BTC. Separate findings from on-chain tracker Lookonchain revealed that the funds were originally deposited almost seven years ago.

At the time, the holdings were valued at roughly $642 million; however, as of writing, it is now worth more than $11 billion.

Starting last month, the whale has been offloading notable chunks of his Bitcoin holdings through Hyperunit, a decentralized exchange that has emerged as the whale’s preferred execution venue.

In the weeks that followed, the whale shed over 35,991 BTC and used the funds to aggressively expand their Ethereum holdings, which now surpass even notable Ethereum treasury companies like SharpLink Gaming , which holds roughly 797,000 ETH according to data from Ethereum Treasuries.

Lookonchain estimates that the investor continues to hold at least 49,634 BTC distributed across four different wallets, which is worth roughly $5.43 billion.

The Ethereum Treasury playbook

The Bitcoin OG whale’s investment strategy is quite similar to what Ethereum treasury companies have been doing in recent months, especially as ETH has emerged as the new favorite among institutional allocators.

Like most treasury companies, much of the whale’s investment activity has been supported by spot ETH purchases, paired with staking, a strategy that can generate passive yield while maintaining long-term exposure to Ethereum’s upside.

That said, the investor did briefly open and close ETH perpetual long positions, including a notable $450 million long that was exited at an average price of $4,735, locking in around $33 million in profit, which was then promptly rolled back into additional spot ETH.

Ethereum price

When writing, Ethereum ( ETH ) was down over 2% in the past 24 hours, and had also wiped all of its past week’s gains. Yet, it is up almost 30% in the past 20 days, supported by the newfound demand , which helped push it to a new all-time high of $4,946 on Aug. 24.

Since then, it has dropped over 11%, although analysts believe the token may be consolidating, and the broader market structure remains largely bullish as long as ETH stays above the $3,900 support. That said, the largest altcoin may look to target the $5000 mark .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know

Revealed: Why Tether’s $1.1 Billion Juventus Acquisition Bid Was Rejected